Relevance: GS-2: Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

Relevance: GS-3 : Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Key Phrases: Retail prices, Repayment of loans, Current account deficit, Crisil Ratings, Input Cost.

Why in News?

- S&P Global recently forecasted that banks in India would face ‘headwinds’ as a fallout of the Russia-Ukraine conflict. The rating agency flagged rising inflation and borrower ‘stress’ that could affect companies’ ability to fully pay back loans.

How does a war in Eastern Europe affect India?

- Sunflower Import Impacted

- The war has impacted the production and movement of a wide range of raw materials and commodities.

- Ukraine, for instance, is the main source of sunflower oil imported into India. Supplies have naturally been hit and are bound to further push up the retail prices of edible oils.

- Shutting Down of Neon Factories

- The conflict has also forced Ukraine to shut two neon factories that account for about 50% of the global supply needed in the manufacture of semiconductors.

- Chip Shortage

- As semiconductors become scarcer, user industries bear the brunt.

- Already, the global chip shortage has led to the waiting period for the delivery of new premium cars in India being extended to several months. And with major carmakers having reported declines in sales for January and February, the profit outlook for these companies and their component suppliers looks significantly clouded.

- Impair the ability of Businesses

- The domino effect on the automobile and other industries' supply chains could impair the ability of businesses, especially medium and small enterprises, to fully service their loans.

Factors that may undermine a company's ability to repay loans?

- Rising Oil Prices

- Oil has been on the boil ever since Russia invaded Ukraine on February 24. After zooming to $139 a barrel — near historical highs — Brent crude prices were at the $106 a barrel level few days back.

- With India’s state-run oil marketing companies certain to raise the retail prices of petrol and diesel sooner than later, the higher cost of transportation is bound to feed into the prices of goods from agricultural produce to raw materials for factories and to finished products headed to store shelves, thus quickening inflation across the board.

- Higher Input Cost

- Higher input costs for manufacturers and service providers would leave them in a tough spot as they would have to choose between passing on the price increases to consumers - thus risking the already tenuous demand - and hurting their profitability if they opt to absorb the impact. Here again smaller businesses, that are most dependent on bank credit, are bound to be hit the hardest.

- Delays in Repayment of loans

- If the war in Europe is prolonged, Indian banks could end up facing delays in the repayment of loans or possibly even having to write them off as ‘bad’.

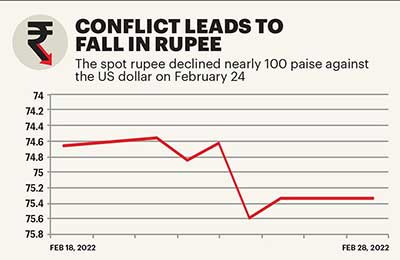

- Weakening of Rupee

- Separately, with the dollar benefitting from a global flight to less risky assets, as well as the start of the U.S. Federal Reserve's calibrated monetary tightening to rein in inflation from a 40-year high in the world's largest economy, the rupee is expected to weaken against the U.S. currency.

- With the exchange rate impacted, importers would have to shell out more rupees for the same dollar value of imports than before.

- Unless demand expands, allowing them to sell more volume, a weaker local currency eats into their profits, leaving them with lesser cash available to service loans.

- Rising Inflation

- Rising inflation, which is already just beyond the RBI’s 6% upper tolerance limit, may nudge the central bank into raising benchmark interest rates.

- This means more interest will have to be paid by companies that would likely face the prospect of lesser profit.

Note:-

- Official data for February show that overall goods imports are growing faster than exports compared with a year earlier, widening the current account deficit (CAD). Widening CAD is likely to cause the rupee to weaken further to 77.5 to a dollar by March 2023, from 75, Crisil Ratings said on March 17.

Why is the situation particularly worrying for Indian banks?

- India’s lenders had already been struggling to cope with an overhang of non-performing assets or bad loans even before the pandemic severely hurt overall economic momentum.

- In its Financial Stability report for December 2021, the RBI warned that from a Gross Non-Performing Asset Ratio of 6.9% in September 2021, commercial banks were likely to see the metric rise to 8.1% in a baseline scenario, and possibly soar to 9.5% under a ‘severe stress’ situation by September 2022.

Conclusion

- Geopolitical developments are impacting India’s import basket, and India may have to rethink of diversifying sources of imports of certain commodities, especially petroleum products and agri commodities.

Source: The Hindu

Mains Question:

Q. Could a distant war have a domino effect on Indian lenders? What are some of the challenges? (Words 250).