Relevance: GS-3: Issues related to Direct and Indirect Farm Subsidies and Minimum Support Prices; Public Distribution System - Objectives, Functioning, Limitations, Revamping; Issues of Buffer Stocks and Food Security; Technology Missions; Economics of Animal-Rearing.

Key Phrases: Pradhan Mantri Fasal Bima Yojana, Central-state scheme, Windfall gains, Public exchequer, Low claim ratio.

Why in News?

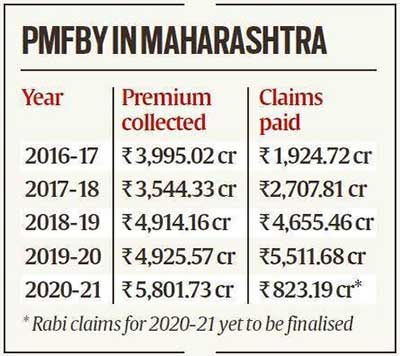

- Maharashtra is the latest state to threaten to withdraw from the Pradhan Mantri Fasal Bima Yojana (PMFBY) if changes to it are not carried out. Many other states have already opted out of the Prime Minister’s crop insurance scheme. Gujarat, Andhra Pradesh, Telangana, Bihar, Jharkhand, and West Bengal have already left the Central plan and established their own.

- Maharashtra has consistently seen a large number of farmers opting for the scheme, even when it was non-mandatory for non-loanee farmers. Till 2019-20, over 357 lakh farmers had opted for the scheme and over 162 lakh farmers had received a total compensation of Rs 10,048.67 crore.

What is PMFBY?

-

Introduced in the 2016-17 kharif season, PMFBY is a central-state scheme which aims to cushion farmers against crop loss. The central and state governments pay more than 95 per cent of the premium amount while the farmer bears 1.5-5 percent of the premium.

- Use of technology: As extensive usage of technology is used to settle the claims of farmers within a stipulated time period,

- Claims of insurance: farmers are required to fill loss reports online which are validated by insurance companies before the compensation amount is paid directly in their accounts.

- Implementing agency: The Scheme shall be implemented through a multi-agency framework by selected insurance companies under the overall guidance & control of the Department of Agriculture, Cooperation & Farmers Welfare (DAC&FW), Ministry of Agriculture & Farmers Welfare (MoA&FW)

- Scheme coverage: Prior to 2020, the scheme was mandatory for farmers who availed institutional finance, but that was changed and made voluntary for all farmers.

OBJECTIVES OF PMFBY:

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crops as a result of natural calamities, pests & diseases.

- To stabilise the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector.

Why is PMFBY criticised?

Since the beginning, farm leaders across the state have criticised the scheme for various reasons.

- Benefiting insurance companies rather than farmers: One of the main arguments against it is that it helps insurance companies more than the farmers. Farm leaders claim insurance companies have made windfall gains at the behest of the public exchequer and farmers.

- Non-performance and unreliability of insurance companies: Delayed payouts and denial of claims are other common complaints against insurance companies.

- Moving away from responsibility: Insurance companies had hoodwinked farmers by not establishing taluka-level offices or call centres, and also failed to educate farmers on the correct methodology for reporting claims.

- Inappropriate methods employed: The insurance companies were also blamed for not conducting enough crop cutting experiments (CCE), which measure the total loss experienced by the farmers.

The Lok Sabha’s Standing Committee on Agriculture had noted in its report of August 2021 that these states decided to opt out because of low claim ratio and financial constraints. “Financial constraints of the state government and low claim ratio during the normal season are the major reasons for non-implementation of the scheme by these states. However, they have implemented the schemes with lower benefits than PMFBY from their own resources and without contribution from the central government,” the report stated.

The Beed model: Proposed by Maharashtra government

- One of the major changes the state government has proposed is

a share in premium collected from insurance companies during a

non-payout or normal year.

- Called the Beed model, after the district where it was first experimented during kharif 2020, under this model, insurance companies provide cover to an extent of 110 per cent of the premium collected.

- In case the compensation amount exceeds this, the state government will bridge the amount.

- In case the compensation amount is less than the premium collected, the company will refund 80 per cent of the funds to the state government and keep 20 per cent for its administrative expenses.

The model was implemented by the government-run Agricultural Insurance Company.

Way ahead:

- Need for a safety net for vulnerable farmers: Most tribal farmers

are small farmers, own farm plots with steep slopes and are dependent on the

monsoon for their only season of farming.

- One way out of this could be a simpler version of crop insurance, based only on rainfall data. The number of recording locations can be increased and all farmers with less than 10 acres of rain-fed farmland can be included.

- Crop losses should be determined based on rainfall distribution (rather than average rainfall levels) using a specific formula for each crop, and claims, if applicable, should be paid within one month after harvest period.

Sources : Indian Express

Mains Question:

Q. Explain why states are opting out of Pradhan Mantri Fasal Bima Yojna PMFBY. How can this be resolved? [250 words].