Date : 12/08/2023

Relevance: GS Paper 1- Geography - Mineral Resource

Keywords: Mineral Security Partnership, Mining Leases, or Composite Licences (CLs), Global Supply Chain Vulnerabilities

Context-

- India's vast geological potential remains largely untapped, with only around 10% explored. To attract private investment and mitigate import dependency for critical minerals, India passed the Mines and Minerals (Development and Regulation) Amendment Bill, of 2023.

- This legislation opens up opportunities for private sector engagement in the exploration of deep-seated and critical minerals. The significance of these minerals for various sectors, including manufacturing, infrastructure, and clean energy transitions, is increasingly evident, driven by global supply chain vulnerabilities and growing demand.

Private Sector Participation and Exploration:

- Private sector involvement in mineral exploration is pivotal for India's resource development. Existing government-led exploration efforts have yielded limited success in uncovering significant mineral deposits.

- The amendment bill seeks to address this by bringing in private expertise and investment. Exploration is a multi-stage process, ranging from reconnaissance to detailed exploration. Private participation can accelerate these stages and increase the likelihood of commercially viable discoveries.

- To attract private sector investment in the exploration of critical and deep-seated minerals in the country. The Bill puts six minerals, including lithium — used in electric vehicle batteries and other energy storage solutions — into a list of “critical and strategic” minerals. The exploration and mining of these six minerals, previously classified as atomic minerals, were restricted to government-owned entities.

- The MMDR Act of 1957, the main law regulating mining in India, has undergone amendments, most recently in 2015, 2020, and 2021. Initially, the FCFS model and private participation facilitated exploration and investment in minerals. However, after 2010, mineral exploration stopped due to allocation concerns. In 2015, amendments allowed private firms to obtain Mining Leases or Composite Licences (CLs) through auctions. Government-conducted early-stage exploration projects were auctioned using the EMT rule, excluding the private sector. Legal interventions resulted from concerns over resource allocation fairness and misuse in sectors like coal blocks and 2G spectrum.

Why is private sector participation needed for the exploration?

- Atomic Minerals Directorate for Exploration and Research and the Centre for Social and Economic Progress (CESP) note that India’s unique geological and tectonic setting is conducive to hosting potential mineral resources and that its geological history similar to the mining-rich regions of Western Australia and Eastern Africa. However, the primary step to discovering mineral resources and eventually finding economically viable reserves is mineral exploration, which comes in various stages before mining.

- Notably, it is estimated that India has explored just 10% of its Obvious Geological Potential (OGP), less than 2% of which is mined and the country spends less than 1% of the global mineral exploration budget. Not many significant mineral discoveries have taken place in the country in the last couple of decades and a majority of exploration projects have been carried out by the government agency Geological Survey of India and other PSUs like Mineral Exploration Corporation Limited (MECL), with very little private sector participation.

- while Indian PSUs were in a relatively better position to explore surficial and bulk minerals like coal and iron ore, they had not fared well when it came to deep-seated and critical minerals owing to the high expenditure and long duration of risky projects while being under pressure to increase the supply of bulk minerals.

Dependence on Imports:

- India's import dependency on critical minerals is pronounced, impacting its economic stability and security. For instance, as per figures quoted by the Ministry, India is 100% import-dependent on countries including China, Russia, Australia, South Africa, and the U.S. for the supply of critical minerals like lithium, cobalt, nickel, niobium, beryllium, and tantalum.

- In the case of lithium, for instance, India’s imports were worth $22.15 million in 2021-2022. As for the finished product lithium-ion batteries used in electric vehicles, a report by Fortune India notes that India imported 5,486.18 lakh units of lithium-ion batteries, spending $1,791.35 million. The lack of domestic supply puts India's industries and clean energy goals at risk.

Global Supply Chain Vulnerabilities:

- Recent events, such as Russia's invasion of Ukraine, have underscored the fragility of global supply chains. Securing critical minerals is crucial for countries striving to achieve net-zero emissions and technological advancement.

- The reliance on a few geographical locations for extraction and processing poses supply chain vulnerabilities, which can lead to shortages and price spikes. For instance, China has majority ownership of cobalt mines in the Democratic Republic of Congo, where 70% of the world’s cobalt is mined.

- China also has by far the largest amount of reserves of Rare Earth Elements (REEs) of any country in the world, followed by Vietnam, Brazil, and Russia; it produces 65% of the world’s REEs, which are crucial in making wind turbines, solar panels, etc. India, meanwhile, has 6% of the world’s rare earth reserves but it only produces 1% of global output.

Challenges and Incentives:

- Exploration is capital-intensive, time-consuming, and risk-laden. Few projects transition from exploration to viable mines, making private investment essential. India's previous policies restricted private participation, limiting the industry's growth.

- The Mines and Minerals Bill 2023 addresses this by allowing private entities to engage in reconnaissance and prospecting. The introduction of exploration licenses encourages private sector involvement, modeled after successful practices in countries like Australia.

Proposed Changes and Concerns:

- The Mines and Minerals Bill 2023 introduces key changes to stimulate private participation. It excludes certain minerals from the atomic minerals list, enabling private exploration. Provisions for exploration licenses and competitive bidding empower private players.

- However, challenges remain. The revenue model for exploration license holders is tied to future mining auctions, leading to uncertainty. The delay between exploration and mining can discourage private investment. Moreover, the auction method for unexplored minerals lacks clarity compared to global practices.

Comparative Analysis:

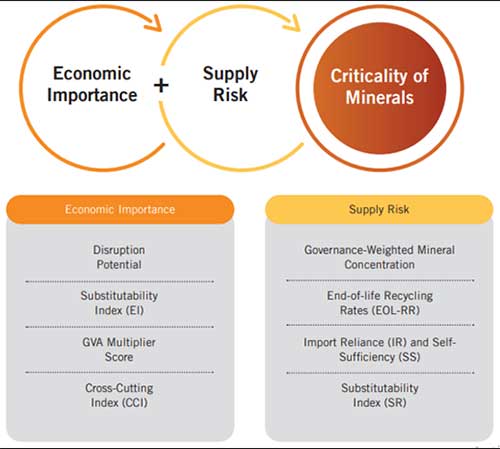

- Countries like the United States, Australia, and the European Union have adopted measures to secure critical mineral supply chains. This has been done by way of the Mineral Security Partnership (MSP). Countries like the U.S., Australia, Japan, and the EU bloc have also created lists of critical minerals based on their specific economic needs and the supply risk of the minerals. The Ministry of Mines, in June this year, came out with a list of 30 minerals critical to the country’s economic development and national security.

- India's participation in the Mineral Security Partnership reflects its commitment to enhancing supply chain resilience. The amendment bill aligns India's approach with developed nations, promoting private exploration and bolstering mineral security.

Conclusion:

The Mines and Minerals (Development and Regulation) Amendment Bill, 2023, marks a significant step toward enhancing India's mineral exploration efforts. Private sector participation is crucial for unlocking the nation's geological potential, reducing import dependency, and supporting clean energy and technological advancements. By learning from global practices and addressing challenges, India can establish a thriving mineral exploration sector, driving economic growth and ensuring long-term resource security.

Probable Questions for UPSC Main Exam-

- Explain the role of private sector involvement in India's mineral exploration, focusing on the recent Mines and Minerals (Development and Regulation) Amendment Bill, 2023. Assess the challenges and benefits of attracting private investment in mineral exploration, drawing comparisons with global practices. (10 Marks,150 words)

- Analyze the reasons behind India's reliance on imported critical minerals and its impact on economic stability. Discuss global supply chain vulnerabilities related to these minerals and their significance for achieving net-zero emissions. Evaluate how the Mines and Minerals (Development and Regulation) Amendment Bill, 2023, aims to enhance resource security through private exploration. (15 Marks,250 Words)

Source - Critical Mineral for India Report 2023 - PIB