GS 3- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment; Inclusive growth and issues arising from it.

Keywords- Neo-banks, Fintech, Artificial intelligence, cloud Computing, Traditional banks, NBFC

Why in News ?

Recently, many experts raised the issue of sustainability in traditional banks, with the increasing penetration of Neo-banks.

What are Neo-banks?

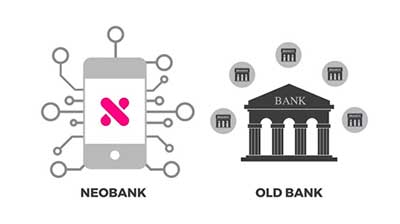

Neo-banks are online-only financial technology (fintech) companies that operate solely digitally or via mobile apps. Simply put, neo-banks are digital banks without any physical branches.

Neo-banks vs Traditional banks

- Neo-banks are disrupting the traditional banking system by leveraging technology and artificial intelligence (AI) to offer a range of personalised services to customers.

- On the other hand, traditional banks follow an Omni-channel approach i.e. having both physical (through branches and ATMs) and digital banking presence to offer a multitude of products and services.

- Right from customer acquisition to traditional banking services such as remittances, money transfers, utility payments and personal finance, neo-banks offer a wide range of offerings to customers across retail and small-to-medium enterprise (SME) categories.

- Basically, neo-banks apply a demand based approach to a particular banking area and tailor their products and services in a manner that makes banking simpler and convenient to the end consumers.

Evolution of Neo-banks

- The term ‘Neo-bank’ started gaining prominence globally in 2017 as they emerged as a new challenger to the traditional banks.

- Neo-banks are also called ‘challenger banks’. The market potential for neo-banks is driven by the rising penetration of the internet and smartphones across the globe.

- According to a report by KBV Research, the global neo-banking market size is expected to reach $333.4 billion by 2026, rising at a compounded annual growth rate (CAGR) of 47.1 per cent.

Neo-banks Market Strategies

- Neo-banks run on target customer based approach that main conventional banks do not do. SMEs, tech savvy people and low wage classes are their targets.

- They have lowered the fee or charges so that customers are retained well and fast.

- The Neo-banks use the technologies from the cloud, AI and Data Mining to provide customized services to users.

- The customer service of neo banks is based on digital chatting.

For example chatbots and other such support provide automated online support, while conventional banks use telephonic or email services or contact face to face with the customers, which is not very user friendly.

Benefits of Neo-banks

- They provide trouble free banking on easier basis

- They provide a smooth user interface. Customers don’t have to work through a glitchy netbanking site anymore.

- They are highly responsive and well-designed to suit the needs of a customer.

- They provide creative and innovative services to users and come with an advanced security level to protect data breach.

Neo-banks in India:

- There are around a dozen neo-banks in India including Razorpay X, EpiFi, Open, NiYo, Jupiter among others.

- Neo Banks in India are divided into two types: licensed and non-

licensed.

Non licensed banks tie up with a traditional bank and provide their products while the licensed banks obtain their licenses and work on their own. - Currently in India Neo banks are not allowed to hold customer deposits and they are not even being granted virtual license by the RBI since it maintains the stand on the need of physical availability as per its 2014 guidelines.

- In recent times, some of Neo-banks raised funding from marquee global investors, who are investing in India’s hugely underbanked market potential.

Can Neo-banks replace traditional banks?

- This not possible entirely because Neo-banks offer only a small range of products and services as compared to a whole gamut of services that traditional banks offer.

- Since neo-banks are highly digital focused, they may not be able to cater to the banking needs of non-tech savvy consumers or people from the rural parts of the country.

- As of 2020, India had a smartphone penetration rate of just about 54 per cent.

Challenge of Neo-banks

- Foremost challenge is gaining user trust. Unlike traditional banks, neo-banks don’t have a physical presence, so customers cannot literally ‘bank upon’ them in case of any issues/challenges.

- Neo-banks are yet to be recognised by the Reserve Bank of India (RBI) specifically in customer deposit and lending services.

Conclusion

Thus, currently, Neo-banks have to engage with regulated banks and financial institutions to offer financial products and services. Due to the absence of enabling regulations, neo-banks cannot accept deposits or offer lending products on their own books. That is why some fintechs have a non-banking financial company (NBFC) as their parent to engage in lending activities while most others partner with banks and financial institutions.

Prelims Question

Q. Consider the following statement:

- Neo-banks in India are existing independently.

- Neo-banks market share is greater than traditional banks market share in India.

- Neo-banks regulated by RBI.

Choose the correct option

A. 1 only

B. 2 , 3 only

C. 3 only

D. 1, 2, 3

Answer: C

Mains Question

Q. In India, 100% financial inclusion is still long distance dream. In this regard, examine the significance and benefits of Neo-banks to help India to achieve the objectives of SDG 17. (10 marks)

Source: The Hindu BL