Relevance: GS-3: Indian Economy, mobilization of resources, growth, development and employment.

Key phrases: NARCL, ARCs, Bad bank, NPAs, SARFAESI Act, 2002, GNPAs

Why in News?

In a bid to clean up their books, Banks will be transferring 15 stressed assets aggregating about ₹50,000 crore by March-end 2022 to the National Asset Reconstruction Company Ltd (NARCL), according to State Bank of India (SBI) Chairman Dinesh Kumar Khara.

National Asset Reconstruction Company Ltd:

- NARCL has been incorporated under the Companies Act and has applied to Reserve Bank of India for license as an Asset Reconstruction Company (ARC).

- NARCL has been set up by banks to aggregate and consolidate stressed assets for their subsequent resolution. PSBs will maintain 51% ownership in NARCL.

- NARCL will house bad loan accounts of Rs.500 crores and above.

- Establishing NARCL is part of the government’s efforts to clean up the financial system, which is sitting on one of the biggest piles of bad assets in the world.

- It is expected that the warehousing of bad loans by NARCL will allow banks to cut losses and renew lending.

Asset Reconstruction Company

- An Asset Reconstruction Company (ARC) is a special type of financial institution that buys the debtors of the bank at a mutually agreed value and attempts to recover the debts or associated securities by itself.

- The asset reconstruction companies or ARCs are registered under the RBI and regulated under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act, 2002).

- The ARCs take over a portion of the debts of the bank that qualify to be recognised as Non-Performing Assets.

- Thus ARCs are engaged in the business of asset reconstruction or securitisation or both.

NPA in India:

- As of March 2021, the total bad loans in the banking system amounted to Rs 8.35 lakh crore.

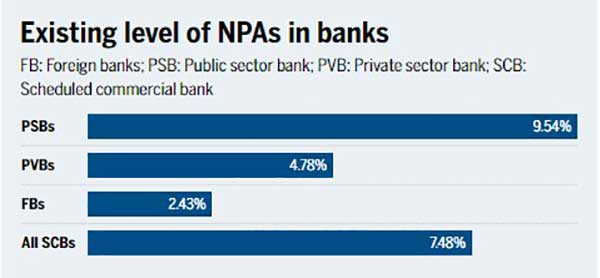

- According to Reserve Bank's financial stability report, the gross non-performing assets (GNPA) and net NPA (NNPA) ratios remained stable during the second half of 2020-21, amounting to 7.5 per cent and 2.4 per cent respectively in March 2021.

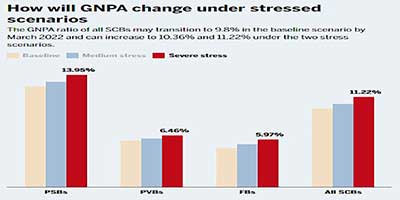

- A stress test conducted by RBI showed that GNPA ratio for scheduled commercial banks (SCBs) may jump from 7.48 per cent in March 2021 to 9.8 per cent by March 2022 under severe stressed condition.

How concept of Bad bank helps banks?

- It will incentivize quicker action on resolving stressed assets thereby helping in better value realization.

- This approach will also permit freeing up of personnel in banks to focus on increasing business and credit growth.

- As the holders of these stressed assets and SRs, banks will receive the gains. Further, it will bring about improvement in bank’s valuation and enhance their ability to raise market capital.

- It can lead to faster aggregation of distressed assets that lie scattered across several lenders.

- Its securitized receipts (SRs) carry sovereign assurance. This is of particular comfort to PSU banks as price discovery would not be subject to later investigations.

- It is also expected to free the banks from the tortuous recovery process and afford them more space to focus on much-needed credit expansion.

Way forward:

- This is a positive move for the banking sector. The success of the bad bank however will depend on the implementation and management of the transferred NPAs.

- With the passing of COVID 19 pandemic, consumer demand is picking up. There will be increasing number of brownfield projects which makes this move perfectly timed.

Bad Bank

- A bad bank is a corporate structure that isolates risky assets held

by banks in a separate entity. It is established to buy

non-performing assets (NPAs) from a bank at a price that is

determined by the bad bank itself.

The first idea to establish a Bad Bank in India was given in the Economic Survey 2017 and it was suggested to name it 'PARA' (Public Sector asset Rehabilitation Agency) - In Budget 2021-22, finance minister Nirmala Sitharaman had announced setting up of a bad bank as part of resolution of bad loans worth about Rs. 2 lakh crore.

Source: The Hindu BL

Mains Question:

Q. In the growing scenario of NPAs and slowdown in the economy, discuss the relevance of National Asset Reconstruction Company Limited or 'Bad Bank' to absorb the non-performing assets of lenders and to Boosts investment in the economy. Critically Analyse. (250 words)