GS-2: Statutory, regulatory and various quasi-judicial bodies;

Gs-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Key Phrases: Monetary Policy Committee, Accommodative Stance, Instruments of Monetary Policy, Broad-based recovery, Excess liquidity, Inflationary Pressure, variable rate reverse repos, supply bottlenecks.

Why in News?

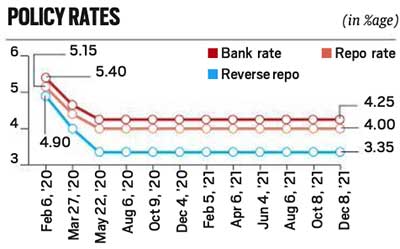

- The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) in December meet, kept the policy rate unchanged for the ninth time in a row and retained its ‘accommodative stance’ to support the recovery in the economy.

Keypoints:

- The central bank also retained the reverse repo rate (the rate at which the RBI borrows from banks) at 3.35 per cent.

- The central bank has retained its real gross domestic product (GDP)

growth projection for FY22 at 9.5 per cent.

- The recovery in domestic economic activity was turning increasingly broad-based. Rural demand is expected to remain resilient while the spurt in contact-intensive activities and pent-up demand will continue to bolster urban demand.

- Major indicators such as agriculture and allied activities, spending on travel and tourism, GST receipts and air passenger traffic indicated a more robust and broad-based recovery.

- The central bank also announced measures to reduce the excess liquidity

in the banking system. It increased the amount of money it will absorb

through so-called variable rate reverse repos (VRRR) to Rs 7.5 lakh

crore by the end of December.

- VRRR is interest rate above reverse repo rate, incentivised by RBI to suck out excess liquidity.

Challenges:

- Downside risks to the outlook have risen with the emergence of Omicron and renewed surges of COVID-19 infections in a number of countries.

- There is widening divergences in policy actions and stances across the world as inflationary pressures persist.

- Headwinds from continuing supply bottlenecks cast a shadow on the outlook

- Monetary policy refers to the use of monetary instruments under the control of the central bank to regulate magnitudes such as interest rates, money supply and availability of credit with a view to achieving the ultimate objective of economic policy.

- In May 2016, the Reserve Bank of India (RBI) Act, 1934 was

amended to provide a statutory basis for the implementation of the

flexible inflation targeting framework.

- It also provides for the inflation target to be set by the Government of India, in consultation with the Reserve Bank, once in every five years.

- For the next 5-year period – April 1, 2021 to March 31, 2026, Consumer Price Index (CPI) inflation with the upper tolerance limit of 6 per cent and the lower tolerance limit of 2 per cent, is set as the target.

- Central Government notified that the following constitute failure to

achieve the inflation target:

- The average inflation is more than the upper tolerance level of the inflation target for any three consecutive quarters; or

- The average inflation is less than the lower tolerance level for any three consecutive quarters.

- An accommodative stance means the MPC is willing to either lower rates or keep them unchanged.

Key Instruments of Monetary Policy:

- Repo Rate: The (fixed) interest rate at which the Reserve Bank provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

- Reverse Repo Rate: The (fixed) interest rate at which the Reserve Bank absorbs liquidity, on an overnight basis, from banks against the collateral of eligible government securities under the LAF.

- Liquidity Adjustment Facility (LAF): The LAF consists of overnight as well as term repo auctions. Progressively, the Reserve Bank has increased the proportion of liquidity injected under fine-tuning variable rate repo auctions of range of tenors.

- Marginal Standing Facility (MSF): A facility under which scheduled commercial banks can borrow additional amount of overnight money from the Reserve Bank by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit at a penal rate of interest. This provides a safety valve against unanticipated liquidity shocks to the banking system.

- Corridor: The MSF rate and reverse repo rate determine the corridor for the daily movement in the weighted average call money rate.

- Bank Rate: It is the rate at which the Reserve Bank is ready to buy or rediscount bills of exchange or other commercial papers. The Bank Rate is published under Section 49 of the Reserve Bank of India Act, 1934. This rate has been aligned to the MSF rate and, therefore, changes automatically as and when the MSF rate changes alongside policy repo rate changes.

- Cash Reserve Ratio (CRR): The average daily balance that a bank is required to maintain with the Reserve Bank as a share of such per cent of its Net demand and time liabilities (NDTL) that the Reserve Bank may notify from time to time in the Gazette of India.

- Statutory Liquidity Ratio (SLR): The share of NDTL that a bank is required to maintain in safe and liquid assets, such as, unencumbered government securities, cash and gold. Changes in SLR often influence the availability of resources in the banking system for lending to the private sector.

- Open Market Operations (OMOs): These include both, outright purchase and sale of government securities, for injection and absorption of durable liquidity, respectively.

- Market Stabilisation Scheme (MSS): This instrument for monetary management was introduced in 2004. Surplus liquidity of a more enduring nature arising from large capital inflows is absorbed through sale of short-dated government securities and treasury bills. The cash so mobilised is held in a separate government account with the Reserve Bank.

Conclusion:

- The slack in the economy and the ongoing catching-up of activity, especially of private consumption, which is still below its pre-pandemic levels, continued policy support is warranted for a durable and broad-based recovery in the economy.

Source: Indian Express

Mains:

Q. The persistently high core inflation remains a key cause of concern for economic recovery. Comment.