Relevance: GS-3: Indian Economy, mobilization of resources, growth, development and employment.

Key phrases: LCR, RBI, HQLA, total asset, Basel III, SLR, schedule commercial bank

Why in News?

- The Reserve Bank of India has upped the threshold limit for Banks to maintain Liquidity Coverage Ratio (LCR) on deposits and other extension of funds received from non-financial small business customers from ₹5 crore to ₹7.5 crore.

What is the Liquidity Coverage Ratio (LCR)?

- The liquidity coverage ratio (LCR) refers to the proportion of highly liquid assets held by financial institutions, to ensure their ongoing ability to meet short-term obligations.

- This ratio is essentially a generic stress test that aims to anticipate market-wide shocks and make sure that financial institutions possess suitable capital preservation, to ride out any short-term liquidity disruptions that may plague the market.

- The LCR was introduced as part of the Basel III reforms following the 2008 global financial crisis and was finalised by the Basel Committee on Banking Supervision in January 2013

- LCR = High-Quality Liquid Asset Amount (HQLA) / Total Net Cash Flow Amount

Basel III reforms

- Basel III is a 2009 international regulatory accord that introduced a set of reforms designed to mitigate risk within the international banking sector, by requiring banks to maintain proper leverage ratios and keep certain levels of reserve capital on hand.

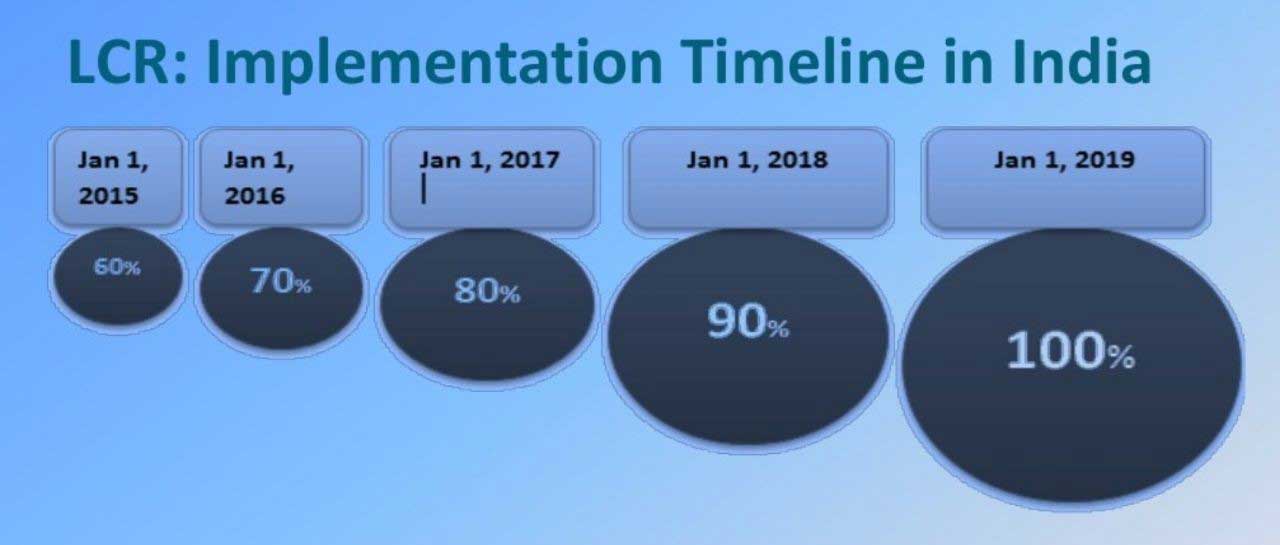

Implementation of Basel III Liquidity Risk Framework in India:

- The Indian framework for LCR requirements was issued on June 9, 2014 through the publication of final Guidelines on the LCR, Liquidity Risk Monitoring Tools and LCR Disclosure Standards, where implementation of the LCR has been phased in from January 1, 2015 with a minimum mandatory requirement at 60 per cent, which will gradually increase to 100 per cent by January 1, 2019.

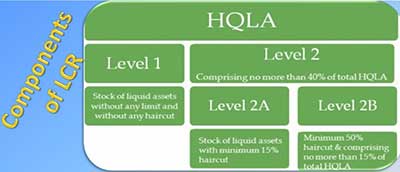

High-Quality Liquid Asset Amount (HQLA)

- HQLA are cash or assets that can be converted into cash quickly through sales (or by being pledged as collateral) with no significant loss of value.

- HQLAs are assets with the potential to be converted into cash quickly and easily. Under the Basel Accord, there are three categories of liquid assets – level 1, level 2A, and level 2B:

- Level 1 – These assets include coins and banknotes, central bank reserves, and marketable securities. Level 1 assets aren’t discounted when you calculate the LCR ratio.

- Level 2A – These assets include securities issued/guaranteed by specific sovereign entities or multilateral development banks, as well as securities issued by US government-sponsored enterprises. Level 2A assets have a 15% discount.

- Level 2B – These assets include investment-grade corporate debt and publicly-traded common stock. Level 2B assets have a 25-50% discount.

Why Liquidity Coverage Ratio is important for banks?

- LCR promotes short-term resilience of banks to potential liquidity disruptions by ensuring that they have sufficient high quality liquid assets (HQLAs) to survive an acute stress scenario lasting for 30 days.

- Banks are required hold a stock of HQLA at least as large as the expected total net cash outflows over the stress period.

- The LCR ratio formula is immensely important because it ensures that banks and financial institutions have a substantial financial cushion in a crisis.

Limitations of the Liquidity Coverage Ratio:

- A limitation of the LCR is that it requires banks to hold more cash and might lead to fewer loans issued to consumers and businesses. One could argue that if banks issue a fewer number of loans, it could lead to slower economic growth since companies that need access to debt to fund their operations and expansion would not have access to capital.

- On the other hand, another limitation is that it increase the cost of the banks. I.e. the banks unable to lend these money to customer.

- It increases the cost of lending because cost of maintaining fund ratio has been cover from other lending.

Way Forward:

- This upward revision in the threshold better aligns RBI guidelines with the Basel Committee on Banking Supervision (BCBS) standard and enable banks to manage liquidity risk more effectively.

- So, to extent of the upward revision in the threshold, Banks may be able to lend instead of parking in HQLAs.

- Further, such assets will also include, within the mandatory SLR requirement, G-Secs to the extent allowed by RBI under Marginal Standing Facility; marketable securities issued or guaranteed by foreign sovereigns.

Source: The Hindu BL

Mains Question:

Q. The Reserve Bank of India has upped the threshold limit for Banks to maintain Liquidity Coverage Ratio (LCR) on deposits and other extension of funds. In light of this statement explain Liquidity Coverage Ratio (LCR)? Does LCR promote short-term resilience of banks to potential liquidity disruptions?