Relevance: GS-3: Indian Economy, Fiscal Policy, Monetary Policy.

Key phrases: Depreciation, Import, Export, Exchange Rate, Foreign investment, forex.

Why in News?

- In December mid, the Indian rupee’s exchange rate slid past the 76-per-U.S.-dollar-mark for the first time since June 2020 and stood at 76.25. It had fallen beyond 76 in March 2020 when COVID-19 cases surged, and economies came to a grinding halt. However, this time its fall was driven by widening trade deficit and foreign investors pulling out funds from equities.

What is Depreciation or falling Rupee?

- Depreciation is used to describe ‘a decrease in a currency's value due to market forces’, not government or central bank policy actions.

- Govt might depreciate it to increase the exports of the country (like China). But in our case, it is depreciating due to various other external and internal factors.

Currency Appreciation

- Currency Appreciation refers to increase in the value of domestic currency in terms of foreign currency. The domestic currency becomes more valuable and less of it is required to buy the foreign currency.

- For example: Indian rupee appreciates when price of $1 falls from Rs. 50 to Rs 45.

- Currencies appreciate against each other for a variety of reasons, including government policy, interest rates, trade balances and business cycles.

Impact of falling Rupee on Indian economy:

- Costlier imports -More Rupees need to buy 1 dollar. Commodity prices will rise.

- As India meets 80% of energy needs through imports, weak rupee will translate into higher inflation.

- The higher inflation will be detrimental to growth of the country. Demands of people will be less.

- Costlier for overseas students as they buy dollar to pay their fees.

- Traveling abroad will be expensive.

- Widening of the Fiscal Deficit - Govt will have to pay a higher amount (in rupees), to repay its debt (in dollars).

- Less foreign investment in the country.

Positive aspects falling Rupee on Indian economy:

- Export industry will bloom - Foreigners will have to pay less dollars for same product. (But the increase in oil prices can will increase the transportation cost. Therefore, improvement in logistics sector to realize the actual bloom in exports.)

- Creation of more jobs in export industry. Less unemployment.

- Growth of tourism sector.

- Rise in exports will give us more foreign money which makes our economy

more stable. These forex reserves act as cushion in perilous economic

conditions.

Rupee's U.S. dollar exchange rate in last decade: - The chart shows the rupee’s U.S. dollar exchange rate between January 2010 and December 2021. The rupee breached the 76-to-a-dollar mark on December 16, an 18-month low. It had first slipped past the 76-mark in March 2020 on account of global restrictions imposed to stop the COVID-19 spread and heightened demand for the safe haven greenback.

Reason for Indian rupee weakening:

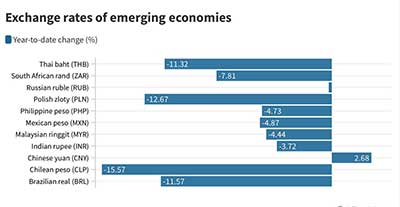

- Modest fall: The chart shows the year-to-date % change in the currency value of select emerging economies as on December 16, 2021. While the rupee tumbled 3.7%, its fall was relatively modest compared to the currencies of other economies.

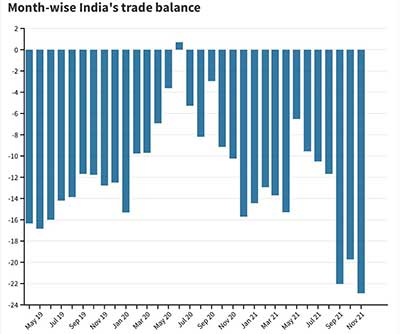

- Widening trade deficit: One of the factors that impacted the Indian unit’s weakness was the record high trade deficit in November. The chart shows India’s trade balance (in $billion) between April 2019 and Nov. 2021. In November, the trade deficit widened to $22.9 billion due to higher imports and slow growth in exports year-on-year.

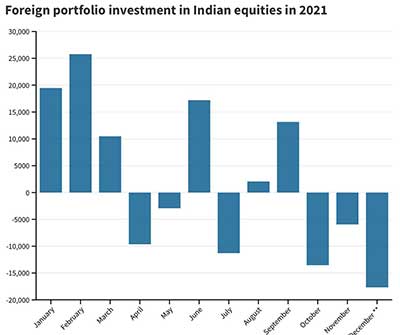

- Stock market exodus: The other reason for the rupee’s fall is that a significant number of foreign investors have withdrawn from Indian equities. December is the third consecutive month that foreign outflows have been higher with equities being hit the hardest. As on December 23, foreign portfolio investors pulled out ₹17,677 crore from Indian stock markets.

- Policy divergence Between RBI and Federal Reserve: The strengthening of USD in line with expectations of better growth in the US economy and favorable interest offered by the Federal Reserve (US’ Central bank

Source: The Hindu

Mains Question:

Q. In December mid, the Indian rupee’s exchange rate slid past the 76-per-U.S.-dollar-mark for the first time since June 2020, In light of the statement what is depreciation of currency? Is it beneficial for developing economy like India?