Relevance: GS-3: Indian Economy Investment models.

Key phrases: FDI, FPI, Government route, Automatic Route, DPIIT, Sector.

Why in News?

- India’s FDI inflows may dip by about 20% this year after the all-time high investments of close to $82 billion received in FY21, a UBS Global research report said on Thursday

What is Foreign direct investment (FDI):

- Foreign Direct Investment (FDI) is a category of cross-border investment in which an investor resident in one economy establishes a lasting interest in and a significant degree of influence over an enterprise resident in another economy. Ownership of 10 percent or more of the voting power in an enterprise in one economy by an investor in another economy is evidence of such a relationship.

- Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets, including establishing ownership or controlling interest in a foreign company.

Foreign Direct Investment vs. Foreign Portfolio Investment:

FDI in India:

FDI is an important monetary source for India's economic development. Economic liberalisation started in India in the wake of the 1991 crisis and since then, FDI has steadily increased in the country. India, today is a part of top 100-club on Ease of Doing Business (EoDB) and globally ranks number 1 in the Greenfield FDI ranking.

Routes through which India gets FDI:

- Automatic route: The non-resident or Indian company does not require prior nod of the RBI or government of India for FDI.

- Government route: The government's approval is mandatory. The company will have to file an application through Foreign Investment Facilitation Portal, which facilitates single-window clearance. It is administered by the

Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry.

- FDI prohibition: There are a few industries where FDI is strictly prohibited under any route. These industries are

- Atomic Energy Generation

- Any Gambling or Betting businesses

- Lotteries (online, private, government, etc)

- Investment in Chit Funds

- Nidhi Company

- Agricultural or Plantation Activities (although there are many exceptions like horticulture, fisheries, tea plantations, Pisciculture, animal husbandry, etc)

- Housing and Real Estate (except townships, commercial projects, etc)

- Trading in TDR’s

- Cigars, Cigarettes, or any related tobacco industry

Rising Trend of FDI in India

- India is a developing nation, trying to make its way up the ladder in the world economy. To achieve its goal, it requires influx of investment, both national and international. Foreign nations often keep an eye on fast-growing economies and are keen to invest in markets where they expect great interests in the future.

- The Government of India amended FDI policy in 2014 to increase the inflow of FDI. FDI in 25 sectors was increased to up to 100% along with up to 49% in insurance sector. Following this, India became the top destination for FDI overtaking China and USA.

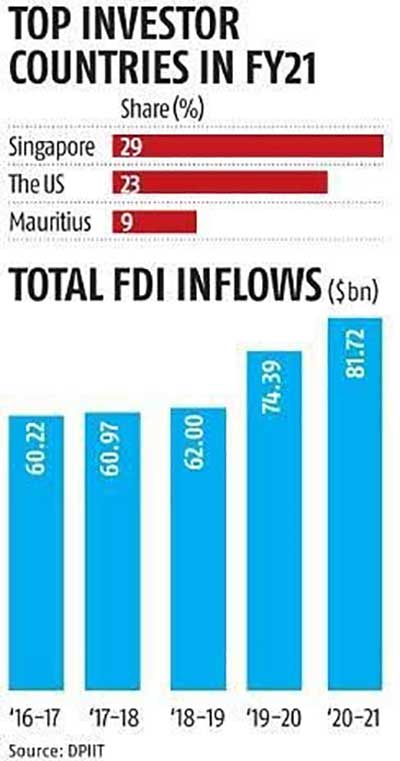

- According to DPIIT data, the main investor in India is Singapore, comprising 29% of the total FDI followed by USA at 23%, Mauritius at 9%, and Netherlands at 6%. Other investors include Japan, UK, Germany,France, UAE and Cyprus.

Does India need FDI for economic growth?

- India is a developing nation, trying to make its way up the ladder in

the world economy. To achieve its goal, it requires influx of investment,

both national and international. The FDI provide various benefit to economy

which are followings:

- Revenue Generation

- Employment Generation

- Getting Latest Technology

- Cultural Exchange

- Infrastructure Development

- Price Reduction

- Healthy Competition

Disadvantages of FDI:

- Foreign Investors are Volatile

- FDI Creates Imbalance

- Tax Evasion

- FDI Causes Money Laundering

- FDI harms Domestic Companies

- Possibility of Inflation

- Increase in Dependency

- Political Involvement

Some data related to FDI

- India has attracted highest ever total FDI inflow of US$ 81.72 billion during the financial year 2020-21 and it is 10% higher as compared to the last financial year 2019-20 (US$ 74.39 billion).

- FDI equity inflow grew by 19% in the F.Y. 2020-21 (US$ 59.64 billion) compared to the previous year F.Y. 2019-20 (US$ 49.98 billion).

- In terms of top investor countries, ‘Singapore’ is at the apex with 29%, followed by the U.S.A (23%) and Mauritius (9%) for the F.Y. 2020-21.

- ‘Computer Software & Hardware’ has emerged as the top sector during F.Y. 2020-21 with around 44% share of the total FDI Equity inflow followed by Construction (Infrastructure) Activities (13%) and Services Sector (8%) respectively.

- Under the sector `Computer Software & Hardware’, the major recipient states are Gujarat (78%), Karnataka (9%) and Delhi (5%) in F.Y. 2020-21.

- Gujarat is the top recipient state during the F.Y. 2020-21 with 37% share of the total FDI Equity inflows followed by Maharashtra (27%) and Karnataka (13%).

- Majority of the equity inflow of Gujarat has been reported in the sectors `Computer Software & Hardware’ (94%) and `Construction (Infrastructure) Activities’ (2%) during the F.Y. 2020-21.

- The major sectors, namely Construction (Infrastructure) Activities, Computer Software & Hardware, Rubber Goods, Retail Trading, Drugs & Pharmaceuticals and Electrical Equipment have recorded more than 100% jump in equity during the F.Y. 2020-21 as compared to the previous year.

- Out of top 10 countries, Saudi Arabia is the top investor in terms of percentage increase during F.Y. 2020-21. It invested US$ 2816.08 million in comparison to US$ 89.93 million reported in the previous financial year.

- 227% and 44% increase recorded in FDI equity inflow from the USA & the UK respectively, during the F.Y. 2020-21 compared to F.Y.2019-20

Way Forward:

- The steps taken in this direction during the last six and a half years have borne fruit, as is evident from the ever-increasing volumes of FDI inflows being received into the country. Continuing on the path of FDI liberalisation and simplification, government has carried out FDI reforms across various sectors. Measures taken by the government on the fronts of FDI policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country

Source: The Hindu

Mains Question:

Q. What do you understand by Foreign direct investment? Is India need FDI for economic Growth? Illustrate.