Relevance: GS-2 : Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora

Relevance: GS-3 : Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

Key Phrases: Impact of War on Economy, Inflation Risk, Hiked Prices, Current Account Deficit, FPI, DII, Equity Investors, Gold Outlook, Economic Recovery

Why in News ?

- Recently, News of Russia’s invasion of Ukraine triggered panic among investors everywhere.

Key Highlights

- The Sensex at the BSE fell 2,702 points or 4.7% to close at a six-month low of 54,529.

- Markets will likely remain volatile in the near term in line with geopolitical developments.

- Experts feel that since India is not party to this external event and is not impacted directly, its medium- to long-term economic prospects are not altered — and investors should not sell in panic.

Concerns

- Inflation Risks

- Fuel Prices

- Russia is the world’s second largest oil producer.

- Brent crude shot past the $100 per barrel mark for the first time in eight years on concerns over supply.

- Rising oil prices could speed up already rising inflation.

- India imports more than 80% of its oil requirement, but the share of oil imports in its total imports is around 25%.

- While increases in domestic fuel prices have been put on hold as five states vote in Assembly elections, the recent surge in global crude could intensify the pressure on the state-owned oil retailers.

- Calibrating price hikes is now more complex, given the cascading inflation impact that could follow the increase.

- Current Account Deficit

- Rising oil prices will also impact the current account deficit, which is the difference between the values of goods and services imported and exported.

- Other Commodity Prices

- Sanctions on Russia by the West could impact its trade with the world — and result in a rise in the prices of other commodities and products, including wheat, edible oil, and metals.

- India imports most of its requirement of sunflower oil from Ukraine, and the two countries now at war are also two of the world’s biggest producers of wheat.

- Fuel Prices

Inflation

- Inflation refers to the rise in the prices of most goods and services of daily or common use, such as food, clothing, housing etc.

- Inflation measures the average price change in a basket of commodities and services over time.

- Inflation is indicative of the decrease in the purchasing power of a unit of a country’s currency.

- This is measured in percentage.

- In India, the Ministry of Statistics and Programme Implementation measures inflation.

- Deflation

- The opposite and rare fall in the price index of this basket of items is called ‘deflation’.

- In India, inflation is primarily measured by two main indices —

WPI (Wholesale Price Index) and CPI (Consumer Price Index).

- WPI measures wholesale and CPI measures retail-level price changes.

Economic Recovery

- The rise in crude prices poses inflationary, fiscal, and external sector risks.

- Oil-related products have a share of over 9% in the WPI basket.

- According to Madan Sabnavis, chief economist at Bank of Baroda, a

10% increase in crude would lead to an increase of around 0.9% in WPI

inflation.

- A larger oil import bill will impact India’s external position.

- It is also likely to increase subsidies on LPG and kerosene, pushing up the overall subsidy bill.

- Some experts, however, argue that India’s economic fundamentals remain strong, and the war will not have a significant impact on the economy.

- There is a view that with the third wave of Covid close to its end and most restrictions having been withdrawn, there will be an uptick in consumption and domestic growth, quickening the pace of recovery.

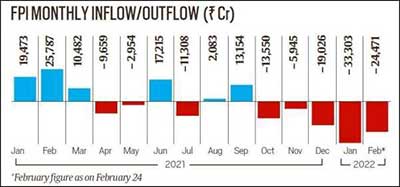

FPI Sentiment

- Foreign portfolio investors have been selling their holdings in Indian equities over the last four months after the US Federal Reserve announced an increase in the pace of withdrawal of stimulus followed by a hike in interest rates beginning March 2022.

- Investors started pulling out funds from emerging economies to park them in US treasuries and benefit from the expected rise in bond yields.

- Geopolitical concerns have intensified the outflow of funds over the last two months.

- Out of the total FPI pullout of Rs 82,745 crore beginning November 2021, Rs 57,774 crore was withdrawn between January and February 2022.

- This outflow is likely to continue over the coming days.

- On 24 Feb, FPIs pulled out a net of Rs 6,448 crore from Indian equities, leading to the fall in the markets.

Foreign Portfolio Investors (FPI)

- Foreign portfolio investment (FPI) consists of securities and other financial assets held by investors in another country.

- It does not provide the investor with direct ownership of a company's assets and is relatively liquid depending on the volatility of the market.

- Along with foreign direct investment (FDI), FPI is one of the common ways to invest in an overseas economy.

- FDI and FPI are both important sources of funding for most economies.

DII Behavior

- As FPIs pulled out on Thursday, domestic institutions emerged as net investors.

- According to provisional data released by the stock exchanges, DIIs ( Domestic Institutional Investors ) invested a net of Rs 7,667 crore on Thursday, which is more than what the FPIs pulled out.

- Over the last two months, DIIs have invested a net of Rs 55,551 crore in equities.

- Experts say that the current geopolitical concerns will not impact long-term fundamentals and prospects of businesses, and investors should take the fall in markets as an opportunity to invest in mutual funds and high-quality blue chip companies.

Domestic Institutional Investors (DIIs)

- Domestic Institutional Investors are institutions like insurance companies, mutual fund houses, pension funds, or provident funds.

- DIIs generally pool money from the small investors of the country and then trade in different securities and assets of the country.

- Like the FIIs, over the years, DIIs have also emerged to become an essential source of domestic funds for the companies and play a significant role in the economy’s net investment flow.

Equity Investors

- While markets may remain volatile, retail investors should look at the DII investment pattern, investment advisors say.

- If DIIs are investing amid the sharp fall in markets, retail investors too should not panic - and should increase their investments if they are underweight in equities.

- With the fundamentals strong and concerns restricted mostly to external factors, experts say the markets will likely bounce back once the situation eases.

- However, investors should not take unnecessary risks.

Gold Outlook

- In times of uncertainty and inflation, gold emerges as the asset class of choice for investors.

- It is important to note that at a time when equities have been falling, gold has risen sharply.

- Gold prices are likely to rise further from current levels, as investors will move towards the safe haven following inflation-related concerns on higher crude prices and geopolitical tensions.

- If the current situation further escalates, investors will cling on to safe haven asset or sit on cash, i.e. dollar.

- Along with geopolitical tensions, rising inflationary concerns has also been supporting precious metal prices on lower levels, hence supporting our view of buying on dips.

Conclusion

- The pandemic has left the global economy with two key points of

vulnerability — high inflation and jittery financial markets.

- Aftershocks from the invasion could easily worsen both.

- Households spending an ever-larger chunk of their incomes on fuel and heating will have less cash for other goods and services.

- Plunging markets would add another drag, hitting wealth and confidence, and making it harder for firms to tap funds for investment.

Source: Indian Express

Mains Question:

Q “Russia’s invasion of Ukraine carries huge risks for a world economy that’s yet to fully recover from the pandemic shock. “ Evaluate.