Relevance: GS-2: Effect of policies and politics of developed and developing countries on India’s interests

Relevance: GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development.

Key Phrases: Organization of the Petroleum Exporting Countries, import bill, natural gas, foreign investments, crude oil, net zero future, international energy agency.

Why in News?

- The US announced a complete ban on Russian oil, liquefied natural gas and coal imports in a bid to deprive Russia of the economic resources it uses to fund its wars.

Key features

- The ban blocked any new purchases of Russian crude oil and certain petroleum products, liquefied natural gas and coal.

- It also banned new US investment in Russia’s energy sector, which it said will ensure that American companies and investors are not underwriting Putin’s efforts to expand energy production inside of Russia.

- It prohibited Americans from participating in foreign investments that flow into Russia’s energy sector.

- Russia is the third biggest producer of oil in the world, behind the US and Saudi Arabia. And if Russian gas stopped flowing into Western Europe, already heated prices would increase even more.

- Russian gas accounts for about 40 per cent of the EU’s natural gas imports.

- The text book definition of ‘oil shock’ is a sudden rise in the price of oil that is often accompanied by decreased supply.

- Oil provides the main source of energy for advanced industrial economies in most places, a crisis can endanger economic and political stability throughout the global economy which is struggling to come out of a pandemic.

Some of the earlier Oil shocks

In the post-World War II era, there have been two major oil crises.

- In 1973, Arab members of Organization of the Petroleum Exporting Countries (OPEC) imposed an embargo on supply to the US, Japan and Western Europe, for supporting Israel in the Yom Kippur war. These nations consumed more than half the world’s energy. Oil prices quadrupled to almost $12 a barrel. Although the embargo was lifted in 1974, oil prices remained high.

- The Iranian revolution triggered the second oil shock in 1979 and the situation hit a nadir with the outbreak of the Iran-Iraq war (1980-88). In 1981, the price of oil stabilised at $32 per barrel.

How has the present crisis impacted the oil prices?

- The current geo-political crisis involving Russia — the second largest exporter of oil and the largest exporter of gas — resulted in Brent hitting $140/barrel (14-year high) recently before settling down to $110 a barrel level.

- Though there may not be supply constraints in the long-term with incremental productions coming from other producing countries like Iran, Venezuela, OPEC members and the US, energy prices will remain volatile in the near term.

Is the world better prepared to tackle this crisis?

- To an extent, yes. Many countries now also take bilateral commercial decisions based on their demand for fossil fuel.

- Today, the basket of oil and gas producers has expanded beyond a handful and therefore supply is no longer an issue.

- But what becomes an issue is logistics — transporting oil and gas — including financing it in an event of sanctions.

How has it affected India?

- The Indian government has been taking up bilaterally with crude oil producing countries, OPEC and heads of other international fora to convey India’s serious concerns over crude oil price volatility. Since India’s import dependence from Russia for oil and gas has been very minor, no major supply-side impact is expected but what has adversely affected India is the price implications arising due to the ongoing conflict.

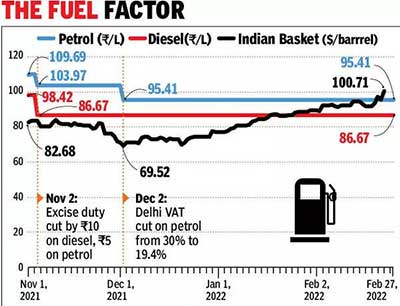

-

The price impact is two-fold for India — on its import bill, thus distorting the country’s fiscal math, and on the retail prices of auto and cooking fuel, making a dent in the consumer pocket.

Government is taking several steps to mitigate this issue.

- Release more oil from Reserve

- In a written reply to the Parliament, MoS petroleum and natural gas indicated that India could release from the Strategic Petroleum Reserves for mitigating market volatility and calming the rise in crude oil prices.

- Resumption of crude supplies from Iran,Venezuela

- According to reports, India is also looking forward to resumption of crude oil supplies from Venezuela and Iran to safeguard itself against global high prices.

- Discounted Russian oil

- The government is also considering taking up Russia’s offer to buy its crude oil and other commodities at discounted prices with payment via a rupee-rouble transaction.

- IEA members moved to build cushion

- Earlier this month ,members of International Energy Agency (IEA),including India,had agreed to release 60 million barrels of oil from their emergency stockpiles.

- Net Zero Future

- The Indian government has been taking significant policy decisions for energy transition towards a net zero future. With the government taking all measures to ensure that alternate resources of energy and green energy become part of the basket, India may be better off in the long term in handling any geo-political strains. But the short-term implications of the ongoing geo-political conflict will be felt in India.

Way Forward

- The key players that can help curtail this price shock are OPEC — mainly, Saudi Arabia and the US. For these entities, holding back oil supply is a choice. However, there’s no evidence yet that they are likely to change their positions.

- Restoring the Iran nuclear deal and lifting sanctions on Iranian oil would add oil to the market, though not enough to greatly reduce prices. More output from smaller producers, such as Guyana, Norway, Brazil and Venezuela, would also help. But even combined, these countries can’t match what the Saudis or the US could do to increase supply.

- All of these uncertainties make history only a partial guide to this oil shock. Currently there is no way to know how long the factors driving it will last, or whether prices will go higher. This isn’t much comfort to consumers facing higher fuel costs around the world.

Sources: The Hindu BL

Mains Questions:

Q. Oil plays an important role in the economic growth of a country .Critically examine the impact of ongoing oil crisis on India?(words 250 ).