Relevance: GS-3: Conservation, environmental pollution and degradation, environmental impact assessment

Key Phrases: COP-26 Summit, Paris Agreement, Nationally determined contributions (NDCs), Kyoto Protocol, Clean Development Mechanism (CDM), Article 6.4 mechanism, Article 6.2 mechanism

Context:

- The COP-26 Summit at Glasgow in November last finally agreed on a “rule-book” for two new carbon market mechanisms that were created in the 2015 Paris Agreement.

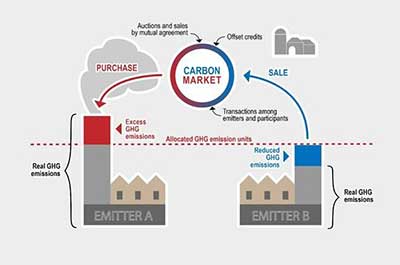

- Carbon market mechanisms are expected to enable countries to accomplish their promises — “nationally determined contributions” (NDCs) to reduce their carbon emissions more cheaply than without them.

- Win-Win situation: Negative carbon would be generated in countries where it is cheap to reduce their carbon emissions and bought by countries where the same is expensive. Both sides would gain, as in international trade for any good.

Background

- Carbon markets under international law were first set up under the Kyoto Protocol (1996) and became operational in 2000.

- The protocol mandated binding reductions in emissions by developed

countries, but not in developing ones, and set up three carbon market

instruments:

- Emissions Trading:- under which developed countries could trade abatements exceeding their mandates with others which fell short,

- Joint Implementation (JI):- covering negative carbon generated from individual projects which could be traded between corporations in developed COUNTRIES.

- Clean Development Mechanism (CDM):- by which such credits could be generated from projects in developing countries and traded to corporations in developed countries.

- Favourable Outcomes from Kyoto Protocol (1996) :

- The CDM was a huge success from the perspective of developing countries, especially India, China, and Brazil.

- Several thousands of projects were approved, and billions of tonnes of negative carbon sold to corporations in developed countries, enabling the latter to avoid mitigating emissions at home.

- Mechanism was, however, perceived less favorably by developed countries.

Why despite a win-win situation of the carbon market, the market failed to achieve its objectives?

- Developed countries sell patented technologies for carbon mitigation at high license fees to developing countries for CDM projects which would more than offset what they would pay for the carbon credits.

- Indigenisation of Technology tilt the trade in favour of Developing Nations: India, China, Brazil and others proved adept and started developing their own mitigation technologies. This has curtailed the profit margin of western corporations.

- Motivated campaign by western activists with vested interests:

- 1. Well-heeled activists, nurtured with hidden agendas, denounced the CDM as the “China Development Mechanism”, and claimed that many CDM projects actually subverted, rather than promoted sustainable development.

- 2. The EU abruptly announced that in future it would no longer buy carbon credits from CDM projects other than from Africa and “small island developing states” (SIDS). Prices of carbon credits crashed, and investors in developing countries cried foul. A crisis was at hand.

Do you know Valli Moosa “Dialogue”??

- The UNFCCC convened a “High-Level Policy Dialogue” on the CDM, chaired by the respected former South African Environment Minister, Mohammed Valli Moosa.

- The Valli Moosa “Dialogue” commissioned a number of studies, including one to carefully examine specific allegations made by Western NGOs against 12 CDM projects that they claimed infringed sustainable development norms.

- The study, entrusted to The Energy and Resources Institute (TERI), found that in 11 cases the allegations were baseless.

- In the twelfth, the complainant NGO did not respond to the request to give evidence.

- The Valli Moosa “Dialogue” also made a number of recommendations to prevent collapse of CDM prices, and to enhance mitigation ambitions in developed countries.

What is the New Carbon Market Mechanism under the Paris Agreement ?

- The carbon market instruments under the Paris Agreement are

first, a project based mechanism, akin to the CDM, called the “Article

6.4 mechanism” (A6.4).

- What is the Article 6.4 mechanism?

- Under this mechanism, the claims regarding sustainable development benefits of the projects would be scrutinised by the international Supervisory Body (SB), and there would be mandatory “haircuts” in the carbon credits generated — for contributions to the “Adaptation Fund”, administrative expenses of the SB, and for OMGE (“Overall Mitigation in Global Emissions”).

- The second mechanism is for large-scale country, region, or sector-wide

programmes or policies, implemented cooperatively by the host and another

country termed the Article 6.2 (A6.2) mechanism.

- What is the Article 6.2 mechanism?

- The A6.2 mechanism does not involve the “haircuts” of A6.4. While both mechanisms involve sharing of the carbon credits generated, there are intricate requirements of “corresponding adjustments” (CAs) to ensure that there is no double counting of carbon credits.

- The mechanisms of Article 6 were a major theme of deliberations at the recently concluded World Sustainable Development Summit, 2022.

What are the issues in the New Carbon Market Mechanisms?

- Despite the Valli Moosa findings, responds categorically to the assertions made by activists regarding the CDM, A6.4 mechanism, does not address the apprehensions of developing countries regarding possible collapse of carbon credit prices, or possible future refusal by some developed countries to purchase credits from specified countries.

- Immense paperwork is involved in both mechanisms, which will add to their operating costs.

- Comparing developing countries' past experience, it is often questionable whether many developing countries or their corporations would readily step into these mechanisms, as in the case of the CDM.

Conclusion

- Carbon Market has proven its effectiveness in many developing countries through various projects, where it quickly and effectively reduced emissions levels at a far lower cost than expected.

- The EU Emissions Trading System has shown that the cap and trade system when extended to carbon, creates a price on carbon that drives emissions reductions.

- Reductions in pollution that industry feared would be excessively costly were achieved at a fraction of the original estimates.

- A developed and matured Carbon Market can provide a good response to a climate change challenge — the need is to provide a way of establishing rigour around emissions monitoring, reporting and verification – essential for any policy to preserve integrity.

Source: The Hindu BL

Mains Question:

Q. UNFCCC's emission and trading reforms started on a good note, but now seem to have evaporated into thin air. Identify various issues faced in effective implementation of Carbon Trading Market Mechanisms. How can the newly created Carbon Market principles under the Paris Agreement can help in overcoming the problems of Carbon Market Mechanisms under Kyoto Protocol?