Context:

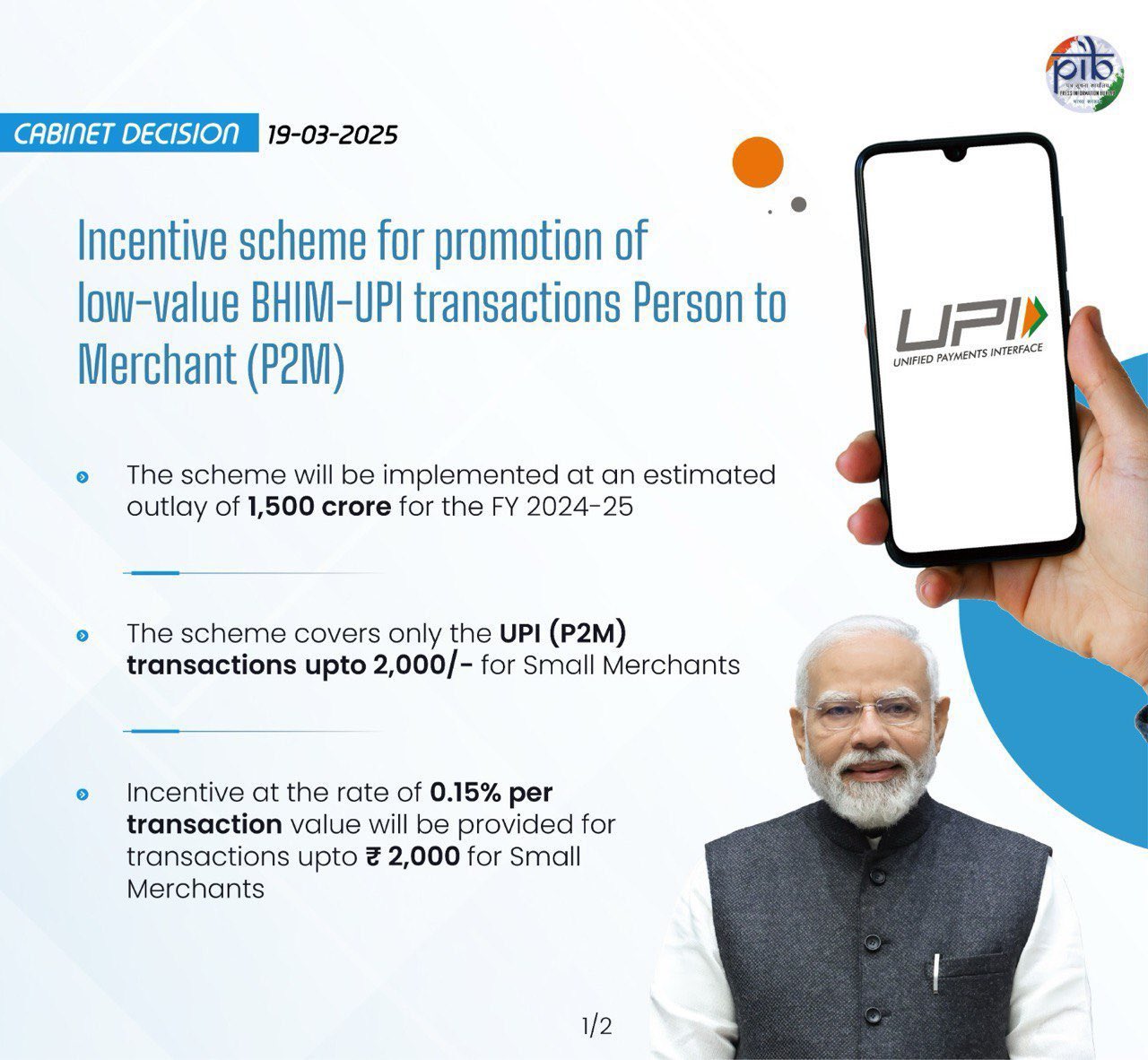

Recently, the Union Cabinet has approved a Rs 1,500 crore incentive scheme for low-value BHIM-UPI transactions for the financial year 2024-25. This scheme aims to encourage digital payments and further the government's vision of a less-cash economy.

Key Highlights of the Scheme

· Incentive Rate: The Centre has set an incentive rate of 0.15 per cent for transactions up to Rs 2,000 made to small merchants.

· Eligibility: Only small merchants are eligible for incentives, while large merchants will not receive any incentives for transactions up to Rs 2,000.

· Zero MDR: There will be zero Merchant Discount Rate (MDR) for transactions across all categories, ensuring cost-free digital transactions.

· Disbursement: 80 per cent of the admitted claims by acquiring banks will be disbursed unconditionally, while the remaining 20 per cent will depend on meeting conditions such as technical decline and system uptime.

Objectives of the Scheme

· Promoting BHIM-UPI: The scheme aims to promote the BHIM-UPI platform and achieve a target volume of Rs 20,000 crore in FY25.

· Supporting Payment Ecosystem: The scheme supports payment system participants in building a robust and secure digital payments infrastructure.

· Encouraging Digital Payments: The scheme encourages small merchants to adopt digital payments, promoting a less-cash economy.

About BHIM UPI:

- BHIM is designed to facilitate simple, quick, and secure transactions using the Unified Payments Interface (UPI), allowing users to transfer money directly to others by either using their UPI ID or scanning their QR code.

- It was launched by Prime Minister Narendra Modi on December 30, 2016, with the goal of promoting financial inclusion and creating a digitally empowered society.

- Core Features:

- Direct Bank Payments: Send money directly to others using their UPI ID.

- Money Requests: Users can request money through their UPI ID.

- QR Code Scanning: Facilitates easy payments by scanning QR codes, which is convenient for merchants.

National Payments Corporation of India (NPCI):

- NPCI is a key organization that operates various payment and settlement systems in India. It was set up by the Reserve Bank of India (RBI) and the Indian Banks' Association (IBA) to ensure the development of a robust and efficient payment infrastructure for both physical and electronic transactions across the country.

- NPCI is incorporated as a "Not for Profit" company under Section 8 of the Companies Act, 2013 (formerly Section 25 of Companies Act 1956).

- Key Objective: To provide essential infrastructure for India's entire banking system, ensuring smoother, more secure, and efficient retail payment and settlement systems.

- Innovation: NPCI focuses on bringing innovative solutions to the retail payment sector, leveraging technology to make payments more accessible and streamlined.

Conclusion:

This initiative could be a game-changer in driving more digital payments, especially for small-scale vendors who may have previously been hesitant due to transaction fees or the perceived complexity of adopting digital systems. By eliminating MDR and offering incentives, the government is making it more feasible for small businesses to make the transition to a fully digital payment environment.