Context:

According to provisional data released by the Ministry of Commerce, India's foreign trade landscape witnessed unprecedented developments in the financial year 2024–25, with exports to the United States and imports from China reaching all-time highs. These shifts come amid global trade realignments, tariff concerns, and shifting supply chain dependencies.

Key findings of the release:

· India’s exports to the United States reached $86.51 billion in FY25, up sharply from the previous fiscal. March alone saw exports to the US rise by 35.06%, reaching $10.14 billion compared to $7.51 billion in March 2024. This unprecedented monthly jump is being attributed to front-loaded shipments ahead of reciprocal tariffs that kicked in on April 2.

· Overall, India’s total goods and services exports touched a record $820.93 billion, marking a 5.5% growth over FY24’s $778.13 billion.

· On the import front, India’s trade with China hit a new high, with inbound shipments reaching $113.45 billion, a year-on-year increase of 25%. In March alone, imports from China saw a steep rise, contributing to an overall 7% increase in total imports, total import reached $915.19 billion in FY25.

· This has pushed India’s total trade deficit to $94.26 billion, with a $99.2 billion deficit vis-à-vis China alone, highlighting long-standing structural dependencies, particularly in the industrial sector.

· Despite robust performance in specific sectors, goods exports stayed largely flat, rising marginally to $437.42 billion in FY25 from $437.07 billion a year earlier.

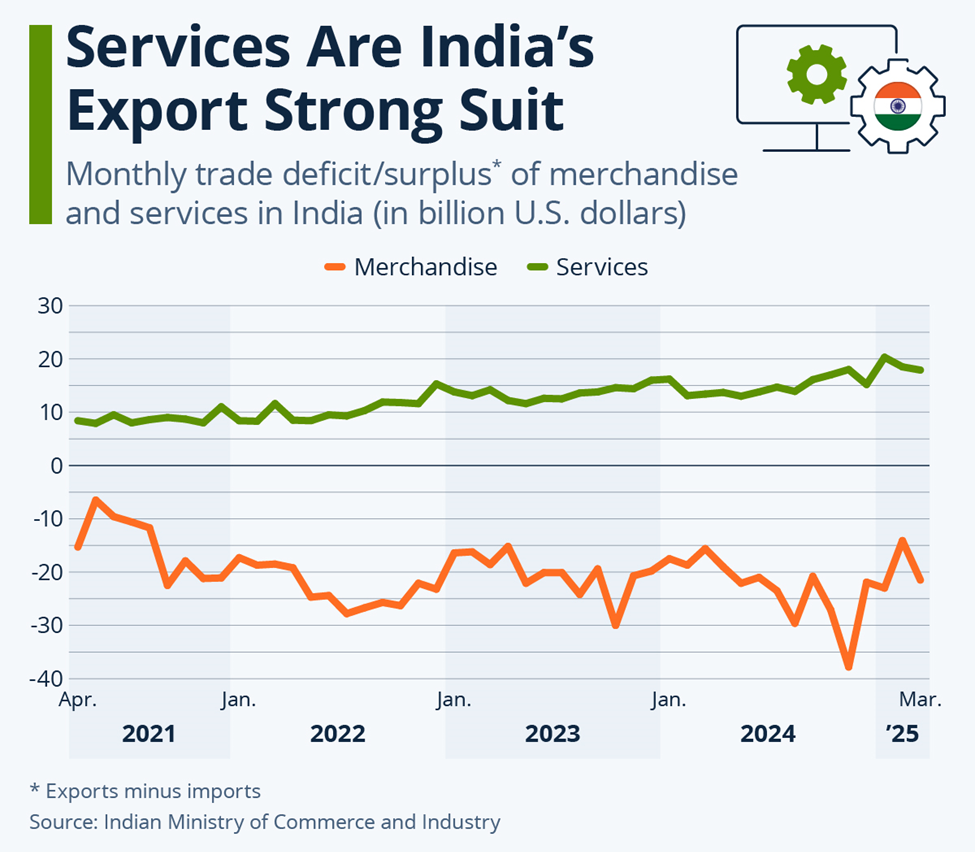

· However, services exports provided strong support, registering a 12.45% growth to reach $383.51 billion, up from $341.06 billion. India retained a healthy services trade surplus, with imports of services at $195.95 billion.

Sector-Wise Highlights:

· Electronics exports surged 32% to hit $38 billion, due to booming iPhone shipments from India.

· Coffee exports reached a record $1.8 billion, a 40% rise, driven by global shortages caused by droughts in Brazil.

· Pharmaceuticals, fruits & vegetables, cereal preparations, and other processed items posted growth between 5–10%.

· Engineering goods saw a 6.74% annual rise, but monthly exports in March dropped nearly 4% to $10.82 billion.

Conclusion:

FY 2024–25 will be remembered as a year of contrasting trends in Indian trade—remarkable gains in some export sectors and markets, but deepening structural challenges in import dependency and trade deficits, especially with China. As global supply chains shift and trade policies evolve, India's exporters and policy-makers must now balance growth ambitions with resilience and competitiveness across industries.