Relevance: GS-3: Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.

Key Phrases: Digital transactions, Merchant transaction, Banking Cards, Unified Payments Interface, Internet Banking, Mobile Banking, NPCI’s, Transparency, Security of Payments, Improved technology, Connectivity issues, Rural adoption, Payment system.

Context:

- India’s digital payment system has transformed drastically over the past few years. Currently, 40 per cent of payments are digital.

- The share of digital transactions has been consistently rising in merchant transactions, especially in the retail, entertainment, travel and healthcare segments. Merchant payments are expected to be the drivers of digital payments and by 2026 it is expected that digital merchant payments may account for 65 per cent of total payments.

What are Digital Payments?

- Digital payments are transactions that take place via digital or online modes, with no physical exchange of money involved. This means that both parties, the payer and the payee, use electronic mediums to exchange money.

- The Government of India has been undertaking several measures to

promote and encourage digital payments in the country. As part of

the ‘Digital India’ campaign, the government has an aim to create a

‘digitally empowered’ economy that is ‘Faceless, Paperless, and

Cashless’. There are various types and methods of digital payments.

like

- Banking Cards

- Unstructured Supplementary Service Data(USSD)

- Aadhaar Enabled Payment System (AEPS)

- Unified Payments Interface (UPI)

- Mobile Wallets

- Bank Prepaid Cards

- PoS Terminals

- Internet Banking

- Mobile Banking

- Micro ATMs

Do you know?

- National Payments Corporation of India (NPCI) is an umbrella organisation for operating retail payments and settlement systems in India.

- It is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment & Settlement Infrastructure in India.

- The NPCI is a not-for-profit organisation registered under Section 8 of the Companies Act 2013. It is an initiative of Reserve Bank of India and Indian Banks’ Association.

- Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI is built over the IMPS infrastructure and allows the transfer of money between any two parties' bank accounts.

- IMPS stands for Immediate Payment Service. It is an instant transfer service that enables immediate payment between two bank accounts.

- Bharat Interface for Money (BHIM) is a mobile payments application based on NPCI’s Unified Payments Interface (UPI). It allows direct bank payments to any bank account on UPI with the help of UPI ID, QR code and PIN.

- Financial technology, also known as FinTech, is an economic industry composed of companies that use technology to make financial services more efficient.

Digital Payments in India:

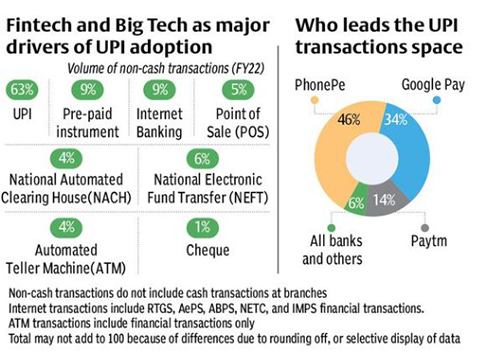

- The volume of digital payments in India has increased by 33% year-on-year (YoY) during the financial year (FY) 2021-2022. NPCI’s unified payment interface (UPI) was the most used platform for digital transactions during the period, accounting for 452.75 crore transactions with a value of ₹8.27 lakh crore, until the end of February.

- According to NPCI, the total volume of UPI transactions during the month of February, 2022 was almost twice the transactions seen a year ago. In February 2021, 229.2 crore UPI transactions worth ₹4.25 lakh crore were made.

- The use of digital payment apps in India has grown considerably, especially after the pandemic, which forced people to stay indoors and order food and other items through online platforms. To avoid contact with delivery agents, many of the online stores and aggregator platforms had blocked cash payments.

- PhonePe with 212 crore transactions was the leading UPI app during February,2022 with Google Pay right behind it with 152.4 crore transactions.

- India has been the leading market in terms of digital payments since 2019. India was the leading market for real-time payments transactions with 2550 crore payments, followed by China (1570 crore) and South Korea (600 crores). The US with 120 crore transactions was ranked 9th.

Factors Responsible For The Rising Digital Payments in India:

Some of the key factors responsible for the rising adoption of digital payments in India is given below:

- Increased awareness: Consumer acceptance of digital modes of payments has shot up in recent times, especially after demonetisation in November 2016. Millennials and Gen Z consumers are comfortable with digital payments and use them more than often. By not accepting digital payments, merchants are going to lose out on a sizeable chunk of business.

- Government policies: The incumbent government's focus on achieving a cashless economy in India has led to the introduction of several policies favouring merchants who are integrating digital payments.Example: government offer low-cost digital modes of payment, such as BHIM UPI, Aadhaar Pay, UPI-QR Code, debit cards, NEFT and RTGS, to customers and no charges or Merchant Discount Rate (MDR) shall be imposed either on customers or merchants.

- Transparency: The transparency of advanced digital payments is another reason for its increasing appeal to consumers. Even when these payment facilities are supported by credit, the charges and rewards are all transparent. For example, LazyPay’s LazyCard facility has no hidden charges or is interest-free.

- Security of Payments: Today’s digital payment facilities go a step higher to ensure the safety and security of transactions via these modes.

- Highly Rewarding Experience: Digital payments aided by credit stand out by offering a great rewarding experience. This is mainly facilitated through cashback offered by top digital lenders.

- Improved technology: The influx of new and emerging technologies will only strengthen the fintech ecosystem in India. Through our own experience of integrating fast, secure, reliable and scalable technology we have been able to demonstrate improved ROI for our merchant customers.

Challenges Faced By Digital Payment In India:

- Connectivity Issues: Regardless of the wide internet and mobile penetration across India, not everyone is able to get seamless and uninterrupted connectivity. Digital payments are highly dependent on connectivity, but to date, secure and seamless internet connectivity across India is still a big challenge.There is also a network connectivity problem in remote locations and not all telecoms work in all locations.

- Rural adoption: Around 70% of the total population resides in rural India. Unfortunately, issues like digital illiteracy, underdevelopment, lack of infrastructure, etc. pose huge challenges. Despite the growth in the post-demonetization period and during the pandemic, the rural population is unable to access the basic facilities due to a lack of proper infrastructure. Digital empowerment of rural areas is essential to bridge the digital gap.

- Lack of awareness among small merchants: Lack of awareness about how digital payments work is common among small merchants. And the cumbersome dispute management process encourages them to not opt for digital payments.

- The language barrier is also one of the important points that need to be considered as most of the time payment confirmation, invoices, and charge slips are in the English language.

- In some the cases understanding the legal implications of the content that is more or less technical in nature can be difficult to comprehend for small and local merchants. These reasons can reduce their trust in digital payments.

- Cyber fraud: One of the most important and fatal issues. According to a report, around 52% of people don’t know how to protect themselves from cyber fraud and crime.With the lack of public awareness and inadequate investments into security technology, people fell for cybercrimes, thus it reduces their trust in digital payments.

India’s UPI Payment System Adopted By Many Countries:

- Nepal will be the first country to adopt India’s UPI system, which will play a pivotal role in transforming the digital economy of the neighbouring country, the National Payments Corporation of India (NPCI). NPCI International Payments Ltd (NIPL), the international arm of NPCI, has joined hands with Gateway Payments Service (GPS) & Manam Infotech to provide the services.

- GPS is the authorised payment system operator in Nepal and Manam Infotech will deploy Unified Payments Interface (UPI) in that country.

- Bhutan is the first country to adopt UPI standards for its Quick Response (QR) code, and the first country in our immediate neighbourhood to accept mobile based payments through the BHIM App.

- It is also the second country after Singapore to have BHIM-UPI acceptance at merchant locations.

- Bhutan will also become the only country to both issue and accept RuPay cards as well as accept BHIM-UPI.

Conclusion:

- Digital payments has taken off in India as is showing little to no sign of slowing down. With the Indian government demonetising the 500 and 1000 Rupee notes and government agencies companies incentivising adoption by lowering fees and waiving taxes, Indian consumers are embracing cashlessness wholeheartedly.

- Nevertheless, as demand for digital payments grows, so will concerns for security. It is ultimately up to the companies promoting digital alternatives to cash to provide adequate security for their services, as well as consumers to maintain good security habits.

Source: The Hindu BL

Mains Question:

Q. Discuss the factor responsible for the rising digital payments in India and what are the challenges being faced by it in India.