Context:

India is on its way to achieve its target of blending 20% of petrol with ethanol by 2025-26, going by the milestones on blending percentages crossed so far and the increase in ethanol production capacity.

Growth of India’s Biofuel Sector

Decarbonising India with Bioethanol

Biofuels are integral to India's decarbonization and energy security ambitions, with bioethanol being a major component. The government initially aimed for a 20% ethanol blending rate by 2030 but has since advanced this target to 2025. The blending rate, which remained between 10-12% in 2023, surged to 15% by May 2024. India’s biofuel sector has experienced notable growth due to the strong policy push, particularly with bioethanol. However, to sustain this growth, diversifying beyond first-generation biofuels and improving the supply chain for second-generation (2G) biofuels is critical.

India's Biofuel Policy Evolution

India’s biofuel policy has evolved significantly since its inception. In 2001, the country launched a pilot programme for 5% ethanol blending, followed by the National Mission on Biodiesel in 2003, which aimed for 20% biodiesel blending in diesel by 2011–12. This led to the introduction of the National Policy on Biofuel (NPB) in 2009, which set a voluntary blending target of 20% for both ethanol and biodiesel by 2017. The 2009 policy aimed to foster domestic biomass feedstock development through a framework of financial, institutional, and technological interventions.

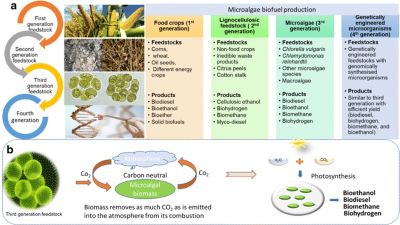

In 2018, the revised NPB came into effect, advancing the goal of achieving 20% ethanol blending in petrol and 5% biodiesel blending in diesel by 2030. This policy focuses on reducing crude oil imports, increasing farmers’ incomes, generating employment, and enhancing sustainability. It provides financial incentives based on biofuel types, categorized into first-generation (1G) ethanol and biodiesel, second-generation (2G) biofuels from agricultural waste, and third-generation (3G) biofuels such as compressed biogas (BioCNG). The Sustainable Alternative Towards Affordable Transportation (SATAT) initiative, for instance, aims to establish compressed biogas production units and promote CBG as a green fuel.

Emerging Feedstock Challenges in 1G Biofuels

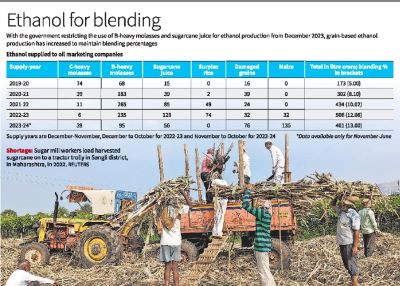

Ethanol production in India predominantly relies on edible feedstocks, classified as first-generation (1G) biofuels. Despite recent policy shifts that have expanded the list of permitted feedstocks, including sugarcane by-products and food grains, challenges remain in balancing their use for both fuel and food production. Sugarcane juice and syrup have traditionally been key sources of biofuel. However, during periods of reduced sugar output, such as in the past year, the central government temporarily halted their use for ethanol to prioritize domestic sugar availability. This unpredictability in policy has led to caution among investors and sugar mill owners, pushing the sector to explore other feedstock options.

Shifting Focus to Food Grains and B-Heavy Molasses

With the uncertainty surrounding sugarcane-based ethanol, the industry has increasingly turned to food grains and B-heavy molasses to sustain ethanol production. These alternative sources have helped maintain the sector's growth, but they are not without limitations. The reliance on food grains highlights the need for a more diversified and sustainable approach to ethanol production. Expanding beyond food-based feedstocks will be crucial for ensuring the long-term viability of the biofuel industry and reducing the dependency on agricultural outputs that are vital for both energy and food security.

India's National Biofuel Policy, since its inception, has emphasized the need for second-generation biofuels, derived from waste biomass. The 2018 Biofuel Policy prioritized research and development for 2G technologies. However, the ethanol blending roadmap proposed by NITI Aayog in 2021-22 shifted focus to sugarcane and food grain feedstocks, sidelining the initial 2G objectives. The technology for producing waste-based biofuels is already available in India. For instance, in 2022, the Indian Oil Corporation Limited (IOCL) launched Asia's first 2G Ethanol Biorefinery in Panipat, Haryana, utilizing technology from Praj Industries to convert rice straw into ethanol.

Feedstock Availability for 2G Biofuels

India generates 754 million tonnes of agricultural waste annually, of which 228 million tonnes are surplus and can be used for fuel production. This surplus could potentially yield around 42.75 billion litres of ethanol, far exceeding the 12 billion litres needed to meet the 20% blending target. India, now the third-largest global producer and consumer of ethanol, has significantly expanded its ethanol production, nearly tripling output in the past five years. This growth has positioned the country to further increase production with supportive policies that focus on cost management and sustainable feedstock supply.

Resolving the Feedstock Supply Problem

Despite abundant feedstock, establishing a reliable and cost-effective supply chain for waste-based biofuels presents significant challenges.

● Incentive Challenges: Farmers often lack motivation to collect and sort agricultural waste for biofuel production due to the absence of guaranteed economic incentives. As a result, much of the potential biomass is burned or wasted, as farmers remain unaware of the financial benefits of utilizing agricultural residue.

● Quality Challenges: Ensuring standardized biomass quality is crucial for producing ethanol that meets required standards. However, the lack of standardization in the collection process leads to inconsistent quality in the biomass that reaches refineries, causing production delays and raising costs.

● Infrastructure Challenges: The absence of decentralized storage facilities forces direct transportation of collected waste to refineries, leading to higher costs and longer collection times.

● Setting Clear National Targets: Policymakers must set specific national targets for 2G biofuels within the 2025 blending goal. This can catalyze positive action across the sector. Targets should also be set for other biofuels, such as compressed biogas and sustainable aviation fuel, to leverage technological developments in the country.

● Increasing Awareness Among Farmers: Farmers must be made aware of the value of agricultural waste for biofuel production, and how they can benefit economically from it. Organizations like Krishi Vikas Kendra and farming-focused NGOs can be mobilized to help farmers become active contributors to the 2G biofuel supply chain. Agricultural universities should also introduce courses to train educators who can support this initiative.

● Creating Decentralized Biomass Collection and Storage Systems: State governments should collaborate with oil marketing companies to establish decentralized storage depots. Identifying ideal locations for these facilities and procuring land are essential first steps. In 2023, the central government introduced Crop Residue Management Guidelines, proposing a 65% subsidy for collection equipment. However, these guidelines need to be fast-tracked and implemented effectively.

● Offering Greater Incentives for Farmers: States could consider direct incentives for farmers who collect agricultural waste. For example, Haryana has introduced a subsidy of INR 1,000 per tonne of collected biomass. The Green Credit Programme, announced by the central government, can also offer financial support through access to the carbon credit market.

India’s biofuel potential is significant, but unlocking it requires addressing feedstock challenges. A strong focus on 2G biofuels, backed by effective policy implementation and increased awareness among farmers, is essential for the long-term sustainability of India’s biofuel sector. India has already demonstrated how to quickly accelerate biofuel use. It now has an opportunity to extend those lessons learned to other biofuel types.

|

Probable Questions for UPSC Mains 1. Discuss the evolution of India's biofuel policy and its impact on the country's energy security and environmental sustainability. What challenges does the sector face in transitioning from first-generation to second-generation biofuels? (10 Marks, 150 Words) 2. Evaluate the role of second-generation biofuels in India's decarbonization efforts. What policy measures are needed to overcome the supply chain challenges associated with agricultural waste and ensure the sustainable growth of the biofuel sector? (15 Marks, 250 Words) |

Source: ORF India