Context:

Just before Nirmala Sitharaman presented her seventh consecutive Budget as Union Finance Minister of the coalition led by the Bharatiya Janata Party (BJP), expectations were high. The BJP, having secured a third term on a less-than-stellar mandate, was anticipated to address pressing economic and political concerns. The Economic Survey 2023-24 indicated that while India’s business elite were experiencing "excess profits," the government’s priority was not to tax these profits for developmental purposes. Instead, the focus was on easing regulations for businesses and encouraging private sector leadership in achieving the vision of Viksit Bharat 2047.

Employment

The Economic Survey underscores that employment is the critical link between economic growth and prosperity. It asserts that the quantity and quality of employment determine how effectively economic output translates into improved quality of life. However, this link has become increasingly tenuous. The Survey reveals a troubling trend: between 2013-14 and 2021-22, factory jobs in manufacturing grew by only 32 lakh, with three states—Tamil Nadu, Gujarat, and Maharashtra—accounting for 40% of total factory sector employment.

As of 2022-23, India’s total workforce was estimated at 56.5 crore, with over 57% self-employed and earning an average monthly income of ₹13,347. More than 18% worked as “unpaid workers in household enterprises.” The proportion of the workforce engaged in agriculture increased from 44% in 2017-18 to nearly 46% in 2022-23. The Survey estimates that to accommodate the rising workforce, the economy must generate approximately 78.5 lakh non-farm jobs annually until 2030.

Addressing Unemployment

Employment Subsidies

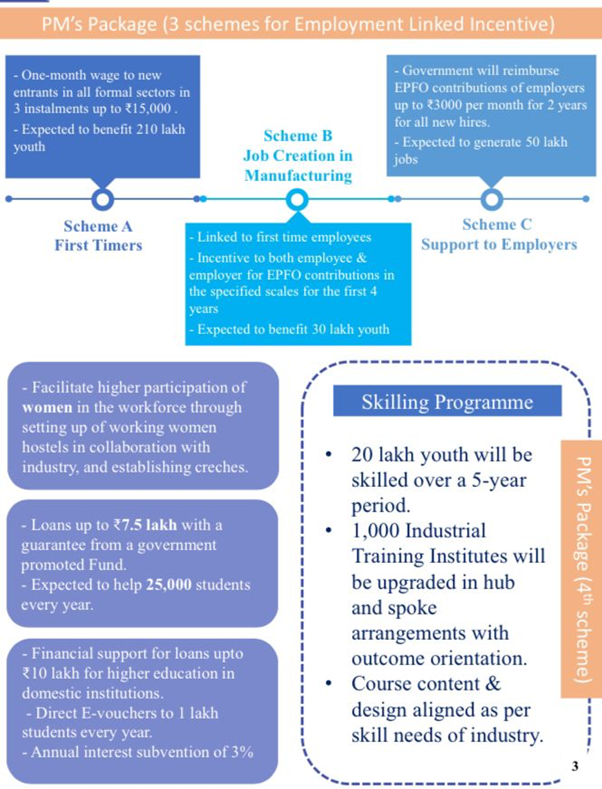

The Budget introduced several initiatives to address unemployment, especially among the educated youth. Two main types of schemes emerged:

● Direct Employment Subsidies: This includes providing ₹15,000 in three instalments to new employees earning up to ₹1 lakh a month. While aimed at the formal sector, this subsidy might influence compensation packages offered by companies. Another subsidy involves the government contributing ₹3,000 a month for two years towards provident fund subscriptions.

● Skill Development and Subsidised Internships: Various schemes were proposed to enhance employability through subsidised internships and interest subvention for educational loans. The assumption behind these measures is that unemployment results from a mismatch between job seekers' skills and industry needs, rather than inadequate economic growth.

Prime Minister’s Package for Employment and Skilling

● The ‘Prime Minister’s Package for Employment and Skilling’ includes government-sponsored internships, incentives for Employees' Provident Fund Organisation (EPFO) enrollments, and skill-development programs. However, this package, with an allocation of ₹2 lakh crore over five years, largely depends on industry response and requires private sector contributions from Corporate Social Responsibility (CSR) funds.

● This approach forces companies to use CSR funds to subsidise their own wage costs, rather than addressing broader employment issues like dampened demand and stagnant wages. Previous attempts at similar schemes have not yielded significant results, and it remains to be seen whether this new package will differ.

Discrepancies and Limitations

Mismatch Between Budget Measures and Economic Reality

The Budget’s approach reflects a fundamental disconnect between the actual problems of unemployment and the solutions offered:

● Employment Challenges: The reliance on subsidies and skill development does not adequately address why high growth does not translate into significant job creation. The belief that businesses would hire more if workers were cheaper or better skilled overlooks deeper issues with economic growth and job creation.

● Agricultural Sector: Farmers facing economic hardships due to unviable crop production were promised long-term productivity and production improvements. However, the lack of immediate support and legal guarantees for minimum support prices is unlikely to address their urgent needs.

Political Implications and Alliances

Allocation and Support to Political Allies

The Budget’s provisions for key political allies, such as the Telugu Desam Party (TDP) and the Janata Dal (United) (JD(U)), were seen as underwhelming. The TDP received support for the development of Amravati, but this was not accompanied by substantial central financial backing, relying instead on borrowing from multilateral development banks (MDBs). Similarly, the JD(U) in Bihar was promised infrastructure development but without significant financial support.

Stagnation in Welfare Scheme Allocations

The Budget allocated the same amount for several welfare schemes as in the previous year’s revised estimates:

● National Social Assistance Programme: The allocation remained unchanged at ₹9,652 crore.

● National Rural Employment Guarantee Programme: Allocation matched the revised estimate from the previous year.

● Food Subsidy: The allocation decreased from ₹2,12,332 crore in the revised estimates to ₹2,05,250 crore.

In contrast, the Pradhan Mantri Awas Yojana (PMAY) saw a notable increase in funding, reflecting a higher commitment to housing compared to other welfare areas.

Fiscal Discipline and Capital Expenditure

Fiscal Consolidation and Capital Spending

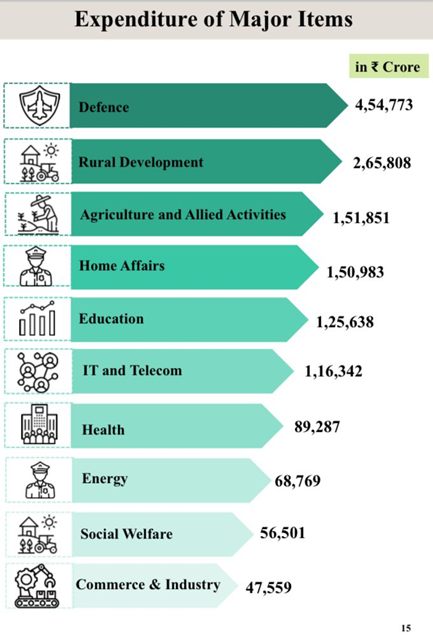

The Budget emphasises fiscal consolidation, with the fiscal deficit targeted to decrease from 4.9% of GDP in 2023-24 to 4.5% in 2024-25. A significant increase in capital expenditure is planned, rising from ₹9,48,506 crore in 2023-24 to ₹11,11,111 crore in 2024-25. This ambitious target is expected to be supported by dividends and surpluses from the Reserve Bank of India and public financial institutions, which are budgeted to rise significantly.

Implications of Funding Sources

The reliance on internal transfers and surplus funds from financial institutions suggests a potential mismatch between fiscal discipline and actual welfare and political needs. Despite the government's focus on infrastructure and capital expenditure, the lack of meaningful support for welfare and political allies indicates a possible disconnect between budgetary allocations and pressing social and economic issues.

A Balancing Act Between Growth and Welfare

Focus on Growth and Job Creation:

- ● Employment Generation: The Budget acknowledges the crucial link between job creation and economic well-being. Initiatives like direct employment subsidies and skill development programs aim to address the challenge of youth unemployment and equip them with industry-relevant skills.

- ● Private Sector Participation: The vision of "Viksit Bharat 2047" (Developed India by 2047) emphasises the role of the private sector in driving economic growth. The Budget aims to create a conducive environment for businesses by relaxing regulations.

Addressing Discrepancies:

- ● Matching Skills to Industry Needs: The Economic Survey highlights the disconnect between job seekers' skills and industry requirements. While skill development programs address this issue, their effectiveness depends on robust implementation and industry collaboration.

- ● Addressing Challenges in Agriculture:

- ○ Natural Farming Initiatives: Over the next two years, 1 crore farmers nationwide will be introduced to natural farming practices, with support for certification and branding. Additionally, 10,000 bio-input resource centers, tailored to specific needs, will be set up to support these farmers.

- ○ Shrimp Production & Export: Financing for shrimp farming, processing, and export will be facilitated through NABARD.

- ○ Digital Public Infrastructure (DPI): Digital Public Infrastructure will be developed to cover farmers and their lands within three years. A digital crop survey will be conducted in 400 districts, and Jan Samarth-based Kisan Credit Cards will be issued.

- ○ Natural Farming Initiatives: Over the next two years, 1 crore farmers nationwide will be introduced to natural farming practices, with support for certification and branding. Additionally, 10,000 bio-input resource centers, tailored to specific needs, will be set up to support these farmers.

Fiscal Consolidation and Resource Allocation:

- ● Fiscal Discipline: The Budget targets a reduction in the fiscal deficit, reflecting a commitment to responsible financial management. A significant rise in capital expenditure signifies an investment in infrastructure development, crucial for long-term economic growth.

- ● Welfare Programs: The allocation for some key welfare schemes remained unchanged, raising concerns about addressing immediate social needs. The increased funding for Pradhan Mantri Awas Yojana (PMAY) demonstrates a focus on housing, but broader welfare considerations need to be addressed.

- ● Direct Tax Proposals: To ease compliance, encourage entrepreneurship, and offer tax relief to citizens, the new tax regime has been simplified. Additionally, the deduction on family pension for pensioners has been increased from ₹15,000 to ₹25,000. Other changes include the abolition of the ANGEL tax for all investors, a simplified tax regime for domestic cruises, the introduction of safe harbour rates for foreign mining companies dealing in raw diamonds, and a reduction in the corporate tax rate for foreign companies from 40% to 35%.

Conclusion

The Budget 2024-25 demonstrates a continued focus on fiscal discipline and capital expenditure but reveals a significant disconnect between the identified economic challenges and the proposed solutions. The persistence of inadequate support for welfare schemes and political allies highlights the government’s failure to address underlying economic and social issues effectively. Balancing fiscal consolidation with investments in social welfare programs and delivering meaningful support to political allies will be crucial in the coming years. The success of this budget hinges on its ability to bridge the gap between stated goals and tangible outcomes for all sections of Indian society.

|

Probable Questions for UPSC Mains 1. Analyse the effectiveness of the Union Budget 2024-25 in addressing the employment challenges in India. Consider the measures introduced for employment subsidies and skill development, and evaluate their potential impact on the quality and quantity of employment. (10 Marks, 150 Words) 2. Critically assess the Union Budget 2024-25's approach to balancing fiscal discipline with social welfare and political support. Discuss the implications of the budget’s allocation for welfare programs, infrastructure development, and support for political allies, and suggest improvements to ensure a more effective and equitable budget implementation. (12 Marks, 250 Words) |

Source: The Hindu