Context-

Vertical Fiscal Imbalance (VFI) is a key issue in federal fiscal systems, including India's, where the financial relationship between the Union government and the States is asymmetrical. This imbalance arises when different government levels' revenue-raising powers and expenditure responsibilities need to align, leading to financial dependency and inefficiencies. In India, the States are responsible for a significant share of public spending but have limited revenue-raising powers, making them reliant on transfers from the Union government.

The Extent of Vertical Fiscal Imbalance in India

According to the 15th Finance Commission, the States in India incur 61% of the revenue expenditure but collect only 38% of the revenue receipts. This indicates a significant VFI where the States' ability to incur expenditures highly depends on transfers from the Union government. This fiscal decentralisation is overwhelmed by the States' limited revenue-raising capacity, highlighting the need to address VFI to achieve a balanced and effective fiscal federalism.

Reducing VFI is important for several reasons:

1. Efficiency in Tax Collection and Public Spending:

● The Constitution of India divides the financial duties of the Union government and the States to maximize efficiency. While the Union government is best suited to collect major taxes like Personal Income Tax, Corporation Tax, and certain indirect taxes, the States are better positioned to provide public goods and services closer to the citizens. Reducing VFI can help balance this arrangement, ensuring that resources are adequately available to the States, where most of the spending responsibilities lie.

● VFI in India has been observed to be larger and rising compared to other federations. The problem is further magnified during crises, such as the COVID-19 pandemic, which widened the gap between the States' revenue and expenditure responsibilities. A balanced fiscal arrangement would ensure that the States have sufficient funds to respond effectively to such crises.

Role of the Finance Commission in Addressing VFI

The Finance Commission plays a crucial role in addressing VFI through the following mechanisms:

● One of the primary functions of the Finance Commission is to decide how the taxes collected by the Union government are distributed to the States. This is done as a share of the "Net Proceeds," which is defined as the Gross Tax Revenue of the Union minus surcharges, cesses, and costs of collection. The degree of VFI directly relates to how these net proceeds are shared.

● The Finance Commission also recommends grants to States needing assistance under Article 275 of the Constitution. However, these grants are generally for specific purposes and short durations. There are also other transfers made under Article 282 of the Constitution, where the Union government funds State and Concurrent List subjects through centrally sponsored and central sector schemes. These grants, however, often come with conditions, limiting the States' autonomy.

Measuring Vertical Fiscal Imbalance in India

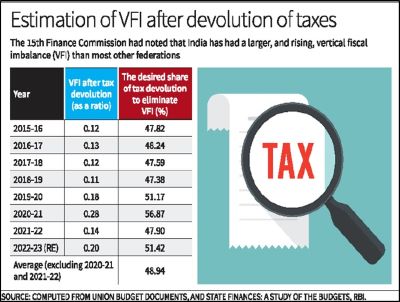

To measure VFI in India, a widely accepted method is used, which involves calculating a ratio where:

● Numerator: The sum of Own Revenue Receipts (ORR) and the tax devolution from the Union government for all States.

● Denominator: The Own Revenue Expenditure (ORE) for all States.

If this ratio is less than 1, it implies that the States' combined revenue receipts and tax devolution are insufficient to meet their expenditure needs. The deficit in receipts, represented by subtracting this ratio from 1, is used as a proxy for VFI after-tax devolution.

For instance, data from 2015-16 to 2022-23 suggests that to eliminate VFI, the average share of net proceeds devolved to the States should have been 48.94%. However, the 14th and 15th Finance Commissions recommended only 42% and 41% respectively, indicating a persistent gap.

Recommendations for the 16th Finance Commission

1. Increase in Tax Devolution:

● Many States have called for fixing the share of tax devolution from the net proceeds at 50% by the 16th Finance Commission. This demand gains additional support considering that substantial amounts of cesses and surcharges are excluded from the net proceeds, reducing the pool of funds shared with the States.

● Our analysis supports this demand. Assuming the current levels of State expenditures, which adhere to and often underutilise borrowing limits specified in fiscal responsibility legislations, an increase in tax devolution to about 49% of the net proceeds would be necessary to eliminate VFI. This would allow States more untied resources to spend on their citizens and ensure that their expenditures better reflect jurisdictional needs and priorities.

2. Enhancing Cooperative Fiscal Federalism:

● By increasing the share of untied resources, the efficiency of expenditures at the State level can be enhanced. It would enable a more responsive governance system, aligned with the local needs of citizens, thus promoting a healthier system of cooperative fiscal federalism.

The 16th Finance Commission has a critical role in addressing the issue of Vertical Fiscal Imbalance in India’s federal fiscal system. By increasing the share of tax devolution to around 49%, the Commission can help align the expenditure responsibilities and revenue capabilities of the States. This adjustment is essential not only for the financial autonomy of the States but also for the overall efficiency and effectiveness of public service delivery in India. Addressing VFI will contribute to a balanced and cooperative fiscal federalism, benefiting both the Union and the States and, ultimately, the citizens.

|

Probable Questions for UPSC Mains Exam- 1. What are the key factors contributing to Vertical Fiscal Imbalance (VFI) in India, and why is it important for the Finance Commission to address this issue? (10 Marks, 150 words) 2. How does the current share of tax devolution to the States compare to the levels needed to eliminate VFI, and what are the potential benefits of increasing this share to around 49% as suggested by the analysis? (15 marks, 250 words) |

Source- The Hindu