Relevance: GS-2: Government policies and interventions for development of various Sector.

Relevance: GS-3: Indian Economy and issues relating to planning, mobilization of resources, growth and development.

Key phrases: GFCF, private investment, bank credit, stressed balance sheets, GDP Growth, budgetary resource allocation, Capacity utilisation.

Why in News?

- The Indian economy is delicately poised. Growth is picking up but a strong, durable and sustainable growth trajectory is missing as capital formation or what is commonly referred to as investment has not picked up, particularly in the private sector.

Context:

- In just under a decade, India’s Gross Capital Formation (investment rate) has fallen about 10.4 percentage points from a high of 40 per cent of GDP in 2010-11 to about 29.6 per cent in 2021-22.

- Investment, as measured by Gross Fixed Capital Formation (GFCF) is expected to see strong growth of 15 per cent in 2021-22 and achieve full recovery of pre-pandemic level. Government’s policy thrust on quickening virtuous cycle of growth via capex and infrastructure spending has increased capital formation in the economy lifting the investment to GDP ratio to about 29.6 per cent in 2021-22, the highest in seven years.

- While private investment recovery is still at a nascent stage, there are many signals which indicate that India is poised for stronger investment.

- Private sector investment relative to GDP has been decelerating and has remained mostly stagnant during the decades of 2010s, for example, at 22 per cent of GDP in the period 2017-2020. This could be attributed to weak business sentiment.

Reasons for low Private Investment:

- There are multiple reasons for the decline in investments – supply chain problems, land acquisition problems, lack of environmental and other clearances, lack of promoter interests, tough labour laws and other regulatory burdens among others.

- However, the biggest reason remains lack of funds, as a CMIE survey reports. The main source of funds, bank credit, has not been very reliable in the recent few years. Credit offtake by key sectors in the economy has been declining.

- In short, banks are unwilling to lend, and the monetary policy transmission mechanism is not working in India. The main reason for declining credit growth is the balance sheet problem – the situation where both banks and private firms have stressed balance sheets.

- Nearly 17 per cent of the entire bank loans in India are stressed, a significant share of which may not be repaid, which explains the reluctance of banks to lend. Nearly 40 per cent of debt is owned by overleveraged corporates who are unable to make interest payments.

- Another problem with large government borrowing is that it does not leave any room for private borrowing and investment.

- Of the three sectors of the economy – government, business, and households – it is only the last that has a positive savings rate. The household sector financial savings is about 7 per cent of GDP, the combined fiscal deficit of the states and union government is well above that figure. PSU borrowings require about 1.5 per cent of GDP in addition to government’s borrowings. This leaves no room for private sector borrowing, which explains the lack of funds and low investment rates.

Private Investment and GDP Growth:

- Conceptually, investment links the present to the future by moving the economy to a higher growth trajectory through higher investment. As evidence suggests, private investment is an important component of aggregate demand that contributed more than 73 per cent to the total investment and accounted for around 22 per cent of the GDP during the period 2017-2020.

- Thus, private investment is the key to sustaining GDP growth momentum. The financial performance of the private corporate sector in Q2-FY-2022 suggests a steady growth in sales but investment indicators reflect subdued activity.

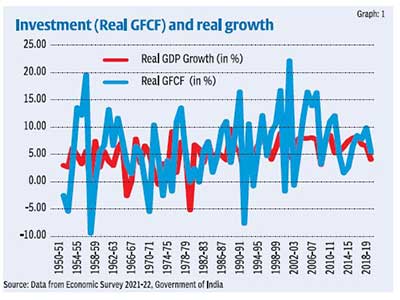

- A historical view of data of real GDP and real investment represented by Gross Fixed Capital Formation (GFCF) for the period 1951-2020, reveals that there is a co-movement between these two.

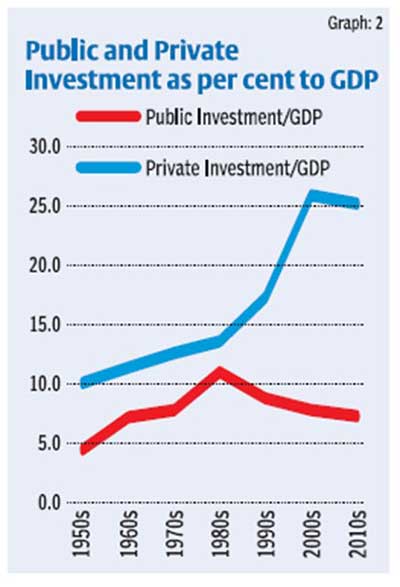

- Further, during the same period, the share of private sector investment in GDP is higher than the share of public sector investment in GDP. This is because public investment is guided by budgetary resource allocation.

- During the pre-pandemic period, due to hard budget constraints and because of its discretionary nature there, has been a lower allocation of investment spending.

However, during the pandemic, the Union Budget has enhanced the capital expenditure allocations substantially to boost public investment at the cost of higher fiscal deficit and debt relative to GDP. These higher allocations could facilitate private investment as it will play a complementary role to private investment.

Capacity utilisation

- A key factor influencing the private investment in the manufacturing sectors is the level of capacity utilisation (CU). Conceptually, CU is ratio of actual output to potential output. Potential output capacity critically depends upon available capital and labour to produce maximum output.

- The order books, inventories and capacity utilisation survey (OBICUS) of RBI presents the level of CU. Higher CU, accompanied by order book growth, signals robust demand conditions in the economy. According to the RBI of February 2022: “at the aggregate level, CU for the manufacturing sector recovered to 68.3 per cent in Q2:2021-22 after the waning of the second wave of Covid-19 pandemic in the country, which had caused plummeting of CU to 60.0 per cent in the previous quarter.”

- Thus, capacity utilisation is at a lower level than the pre-pandemic level of around 75 per cent. CU functioning below the long-term average reflects both demand and supply constraints

Way forward:

- It is true that the private sector makes business decisions for

investment to earn profits. It is important to note that capital goods

have a long gestation lag. Investment decisions critically hinge on

- Level of output produced by new investment,

- Taxation system,

- Cost of credit reflected in lower interest rate regime,

- Timely delivery of credit and

- Business expectations of the domestic and global economy.

- Thus, a positive sentiment is warranted to boost investment which should be guided by “spontaneous optimism rather than mathematical expectation.”

- The government must revise specific schemes, designed to augment production for exports, to suit the changing global environment and ensure proper functioning. Apart from infrastructure development, which reduces trade cost and improves competitiveness, the government must work on trade facilitation that includes logistics.

- There is an urgent need to activate stalled projects and clean up balance sheets of corporate firms and the banking sector to revive the investment cycle. It is important to revive overall investment --- especially in infrastructure ---- for balanced growth.

- The thrust for private investment in the budget continues with the announcement of extending the credit lines by INR 50,000 crore to a total cover of INR 5 lakh crore for the worst-hit sectors during the pandemic- the hospitality and the travel sector.

- Recognising startups as the key drivers of growth, Budget 2022-23 provides an impetus to entrepreneurial ventures by securing an enabling startup ecosystem, with an announcement of extension of the tax exemption to startups by another financial year; in addition to the previously announced three years tax exemption. To ensure an upbeat animal spirit, Budget 2022-23 announced an increase in the outlay for Aatmanirbhar Bharat Yojana by about 28 per cent vis-à-vis Budget 2021-22.

- The need of the hour is increasing private investment in the economy for India to remain on a high growth trajectory.

Source: The Hindu BL

Mains Question:

Q. “India need a boost in private investment in the economy to remain on a high growth trajectory.” Critically analyse the statement.