Context:

Celebrating the Maldives' 59th Independence Day on July 26, President Mohamed Muizzu highlighted the importance of “economic sovereignty” and expressed gratitude to India and China for their cooperation in strengthening the nation’s economy. However, the Maldives is currently grappling with a severe economic crisis. Despite inheriting a distressed economy in November 2023, Muizzu has struggled to stabilise the situation, and his actions have further exacerbated the crisis.

Historical Context of the Crisis

The Maldives’ economic crisis has been long in the making, stemming from structural issues inherent to the nation’s economy. With nearly 1,200 islands, the Maldives has limited economic diversification and a narrow production base.

The economy relies heavily on tourism, import taxes, and property taxes. Successive governments have promoted mega-infrastructure projects, social welfare schemes, and state expansion to cater to political needs, leading to a growing budget deficit covered by grants and loans.

Causes Maldives’ Economic Crisis

● Impact of External Shocks

External shocks such as the COVID-19 pandemic and the Russia-Ukraine war have further strained the Maldives' economy. The Ibrahim Solih administration had already borrowed significantly from private lenders and India, resulting in an increase in the nation’s debt from US$ 3 billion in 2018 to US$ 8 billion by 2023. This debt accumulation, including loans from private lenders and China, has burdened the state with excessive financial obligations.

● Deterioration Under President Muizzu

Since taking office, President Muizzu has faced worsening economic conditions, including high inflation, rising imports, and declining tourism revenues. Despite the dire economic situation, Muizzu has maintained a budget deficit and appointed a large number of ministers and political appointees, resulting in high recurring expenditures. As of March 2024, the Maldives has a debt-to-GDP ratio of 110 percent, with total debt amounting to US$ 8.2 billion.

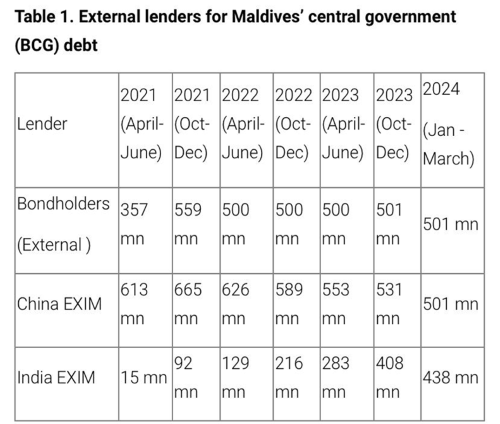

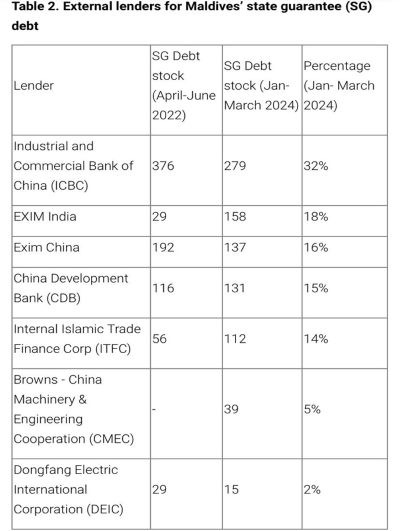

● Debt Structure and Key Lenders

The Maldives' debt structure includes significant domestic and external borrowings. As of early 2024, external debt includes loans from bondholders, China EXIM, and India EXIM, with Chinese debt stocks depleting and Indian debt stocks increasing. Domestic debt consists of high-interest treasury bills and bonds. The debt profile shows a mix of loans from commercial banks, financial corporations, and sovereign guarantees.

Implications to Manage Crisis

● Reforms and Debt Restructuring Efforts

To address the debt crisis, the Maldives has sought assistance from India and China for debt restructuring. China has offered a grant of USD 130 million and a five-year grace period on interest and principal payments. However, the restructuring details regarding sovereign guarantees remain unclear. India has provided over US$ 91 million in assistance and is exploring further support, including currency swap agreements and credit lines. Despite these efforts, the Maldives faces challenges due to its large debt stock and maturing loans.

● Short-Sighted Approach and Great Power Politics

Muizzu’s approach to managing the crisis appears short-sighted, focusing on short-term solutions and mega-infrastructure projects. The administration’s preference for a five-year grace period with China and heavy investments in infrastructure may lead to further debt accumulation and exacerbate structural issues. Projects such as expanding airports and building new bridges may not sufficiently address the underlying economic problems.

● Regional Competition and Strategic Implications

The Maldives’ need for investment and funding makes it increasingly vulnerable to regional competition between India and China. China has expanded its presence by offering infrastructure projects and countering India’s strategic initiatives. On the other hand, India, as a major external lender, is likely to increase its influence in the Maldives and leverage the economic crisis to secure new collaborations and projects.

Way Forward

● Government's Optimism: In response to the Fitch rating, the government has expressed optimism that the strong economic outlook and successful fiscal reforms will positively influence future ratings.

● Protecting Vulnerable Populations: To mitigate negative effects, the World Bank supports implementing a targeting mechanism to protect vulnerable populations from undue hardship. Effective targeting could help prevent increased income inequality and reduce disparities between rural islands and the urban capital.

● Shifts in Policy: Despite previous campaign pledges, welfare reforms and higher taxes now seem likely. The government, which had promised to eliminate the foreign transaction limit and provide support to fishermen, including a guaranteed floor price and timely payments, will need to navigate these changes. The introduction of a co-payment model for health insurance, previously ruled out, might also become a reality.

● Recommendations for Economic Diversification: The report suggests that the Maldives should diversify its economy to lessen its reliance on tourism. Key recommendations include reducing the role of state-owned enterprises, promoting private sector involvement, and encouraging job creation within the private sector.

|

Significance of the India-Maldives Relationship Strategic Significance: ● Central to India's Neighbourhood First Policy: The Maldives' strategic location near India and its position at a key Indian Ocean crossroads make it vital to India's policy priorities. India as a First Responder: ● Timely Assistance in Crises: India has consistently responded swiftly to crises, including Operation Cactus in 1988, vaccine aid in 2020, and extensive Covid-19 support. India as a Net Security Provider: ● Defence Partnership: India is a key security partner for the Maldives, with a comprehensive defence plan and joint exercises like “Ekuverin” and “Dosti,” aligning with the SAGAR vision. Economic and Trade Engagements: ● Tourism Economy: India is the top source of tourists for the Maldives, contributing 11.8% of the market in 2023. ● Trade Agreements: India is the Maldives' second-largest trade partner, with bilateral trade exceeding USD 300 million in 2021. A currency swap agreement was signed in July 2019. Development and Capacity Building: ● Infrastructure Projects: Major Indian-funded projects include the Greater Male Connectivity Project and Hanimaadhoo International Airport development. ● Healthcare Sector: India has invested in developing the Indira Gandhi Memorial Hospital and a new cancer facility. ● Educational Programs: India supports Maldivian education through vocational training, technical education, and defence training programs. Cultural Connectivity: ● Shared Heritage: India and the Maldives share deep cultural and linguistic ties, with the Indian expatriate community in the Maldives numbering around 27,000. |

Conclusion

The economic crisis in the Maldives represents a significant challenge for President Muizzu. With no long-term strategy for economic resilience and ongoing structural issues, the country remains at risk of exacerbating its debt situation. The ongoing competition between India and China will likely continue to shape the Maldives' economic landscape, with the nation’s vulnerability to regional dynamics and external pressures remaining a critical concern.

|

Probable Questions for UPSC Mains 1. Discuss the implications of the Maldives' economic crisis on its relationship with major regional powers like India and China. Evaluate how the crisis impacts India's strategic interests in the Indian Ocean region. (10 Marks, 150 Words) 2. Examine the structural causes of the Maldives’ economic crisis and assess the effectiveness of current reform measures and international assistance in addressing these issues. What strategies should the Maldivian government adopt to ensure long-term economic stability and resilience? (15 Marks, 250 Words) |

Source: ORF India