Context:

Karnataka introduced a new Bill, called the draft Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill, 2024, seeking to provide social security and welfare measures for platform-based gig workers in the State. The government shared the draft on July 9. In the recent past, a similar law was also enacted by Rajasthan called the Rajasthan Platform Based Gig Workers (Registration and Welfare) Act, 2023.

What Does Bill Seek to Do?

Objective of the Bill

The Bill seeks to regulate the social security and welfare of platform-based gig workers in the State and is expected to be placed in the monsoon session of the Assembly. It aims to protect the rights of platform-based gig workers and place obligations on aggregators concerning social security, occupational health, and worker safety.

Definition of a Gig Worker

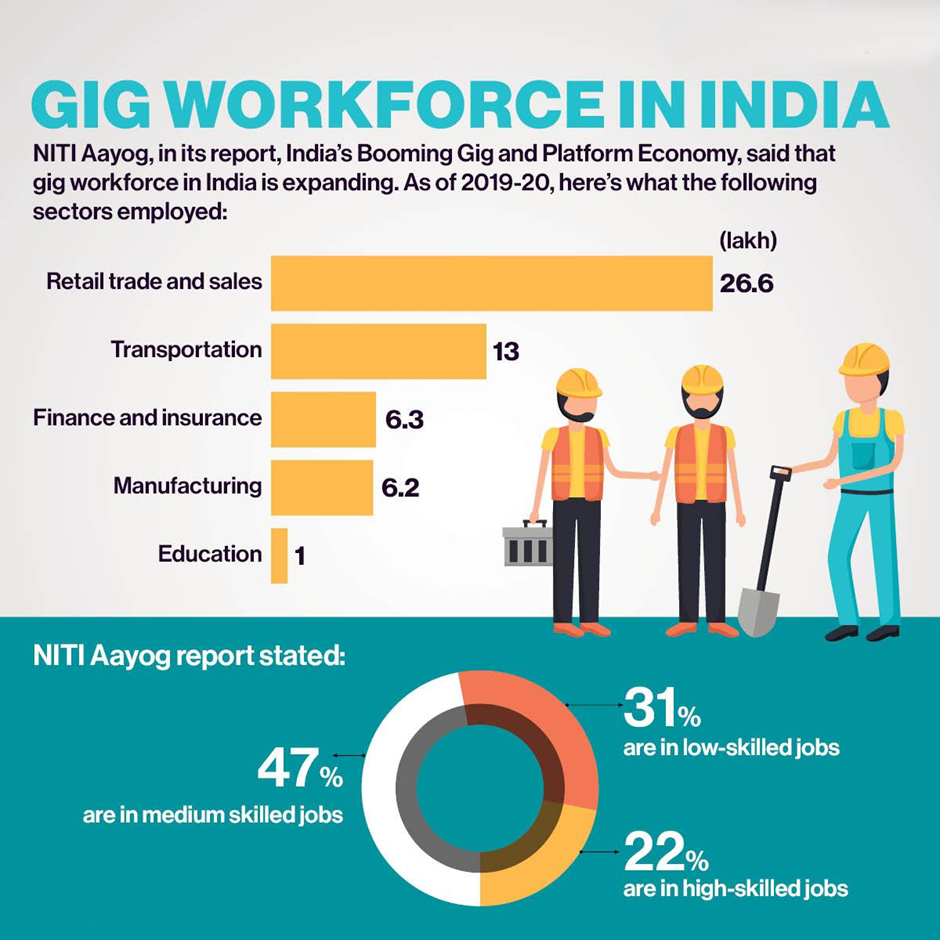

The draft defines a gig worker as “a person who performs a work or participates in a work arrangement that results in a given rate of payment, based on terms and conditions laid down in such a contract and includes all piece-rate work, and whose work is sourced through a platform, in the services specified in Schedule-1.” A 2022 NITI Aayog report estimates that India will have 23.5 million gig workers by 2029-30. Around 2 lakh gig workers work with platforms such as Swiggy, Zomato, Uber, Ola, Urban Company, Porter, Dunzo, Amazon, and Flipkart in Bengaluru alone.

The Gig Economy Landscape

Over the last two decades, several platforms have shaped the gig economy in India, impacting the labour market significantly. Aggregators do not onboard gig workers as employees but as ‘partners,’ leaving them outside the security net of labour protection laws. Workers have faced reduced payments, arbitrary dismissals, and exploitation in the absence of regulatory laws. The number of gig and platform workers has surged, particularly with growth in app-cab and retail delivery sectors. NITI Aayog projects the gig workforce will expand to 23.5 million by 2030. Amid a generally low employment generation scenario, gig work provides livelihoods to many job-seekers, a trend seen globally.

What is The Significance of the Bill?

The Karnataka draft Bill seeks to introduce safeguards against unfair dismissals, establish a two-level grievance redressal mechanism, and ensure transparency regarding automated monitoring and decision-making systems. The contract between the aggregator and the worker should list grounds for termination, require valid reasons in writing, and provide a 14-day prior notice.

- Importance of Addressing Arbitrary Terminations: Arbitrary terminations have been a significant issue for gig workers. Platforms often enact these through automated systems tracking work and earnings, heavily skewed in favour of customers, leaving no room for grievance redressal for workers.

- Payment and Work Refusal Provisions: The draft mandates weekly payments and requires aggregators to inform workers of any payment deductions. Workers have the right to refuse a specified number of gigs per week with ‘reasonable cause’ without adverse consequences.

- Establishment of a Welfare Board: The draft seeks to establish a welfare board and a social security and welfare fund for gig workers. A welfare fee would be levied on transactions or the company's overall turnover, with contributions from Union and State governments. Contracts must be written in simple language, and any changes notified 14 days in advance, allowing workers to terminate contracts without adverse consequences. Aggregators must provide reasonable and safe working conditions, though the draft does not define ‘reasonable.’

Shortcomings of the Karnataka Bill

- Employment Relations in Gig Work: The Karnataka Bill, like the Rajasthan Act, avoids defining employment relations in gig work, preferring the term 'aggregator' over 'employer'. Without recognizing employment relations, crucial protective labour laws cannot be applied, leaving issues like minimum wage, occupational safety, working hours, and the right to collective bargaining unresolved.

- Minimum Wages and Working Hours: The Karnataka Bill does not address minimum wages or working hours for gig workers. Section 16 discusses income security but does not guarantee a minimum income or revenue sharing. Weekly payments are mandated, but no minimum amount is specified.

|

The Work Issues of Gig Workers

|

Have There Been Initiatives in Other States?

Initiatives in Other States

Rajasthan introduced the Rajasthan Platform Based Gig Workers (Registration and Welfare) Bill, making it the first State to do so. The Haryana government is set to establish a State-level board for gig workers' social and economic security. Telangana is also drafting a similar bill. The Karnataka Bill closely mirrors the Rajasthan legislation, as both are based on a welfare board model. This model, suitable for self-employed informal workers, fails to address employment relations—crucial for gig work.

Union Government Initiatives

In 2020, the Code on Social Security recognized gig workers and mandated employers to provide benefits similar to regular employees. However, the Karnataka Bill, like its counterparts, does not address employment relations in gig work, leaving crucial protective labour laws inapplicable and workers' rights unprotected.

Way Forward

- Defining Employment Relations: A crucial step involves clearly defining the nature of employment relations within the gig economy. This clarity will determine the applicability of existing labor laws and ensure better protection for workers' rights.

- Addressing Minimum Wages and Working Hours: Establishing minimum wage standards and regulating working hours are essential for ensuring fair treatment and preventing exploitation.

- Strengthening Grievance Redressal Mechanisms: Creating robust grievance redressal mechanisms, with streamlined processes and clear timelines, will empower workers to address issues related to payments, terminations, or unfair work practices.

- Collaboration between Stakeholders: Effective dialogue and collaboration between aggregator platforms, government agencies, and worker representatives are crucial for crafting sustainable solutions that benefit both parties.

Conclusion

The proposed Karnataka Bill, like the Code on Social Security 2020 and the Rajasthan Act 2023, fails to address employment relationships in the gig economy. This oversight absolves employers of legal obligations, making it difficult to fully protect workers’ rights. Crucial labour laws remain inapplicable without recognizing employment relations in gig work. As the gig economy evolves, a nuanced approach that balances flexibility and workers' rights is essential. The success of the Karnataka Bill and similar initiatives will depend on achieving this balance. Policymakers must create a comprehensive regulatory framework to ensure fairness and security for the gig workforce while fostering a thriving gig economy.

|

Probable Questions for UPSC Mains

|

Source: The Hindu