Relevance: GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment; Inclusive growth and issues arising from it; Government Budgeting.

Key Phrases: Direct and Indirect Taxes, Personal Income tax, Corporate Tax, GST, Widening Tax base, infrastructure development, tax concession, property tax, rationalisation of tax slabs.

Why in News?

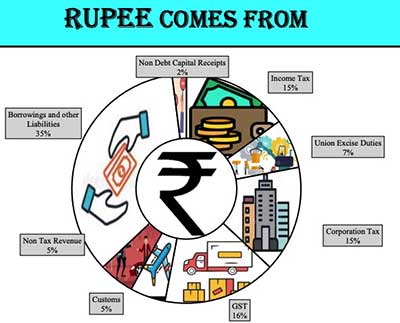

- Despite considerable efforts for widening the tax base, still the number of taxpayers in our country, is about 82.7 million people which is 6.25% of the over 132 crore population. This is unsurprising since agricultural income is not taxed in India and the wealthy have mastered the art of tax avoidance and evasion.

Highlights:

- A direct tax is levied directly on a taxpayer who pays it to the

government and cannot pass it on to someone else. They are again subdivided

as:

- Personal Income Tax: The income-tax paid by the individual taxpayers is the personal income tax. Individuals get taxed on the basis of tax slabs at different rates.

- Corporate Tax: The income-tax paid by domestic companies, and foreign companies on their income in India is corporate income-tax (CIT).

- Indirect tax is the tax imposed by the government on a taxpayer for

goods and services bought.

- Indirect tax is not levied on the income of the taxpayer and can be passed on from one individual to another.

- Examples include GST, customs duty sales tax, entertainment tax, excise duty, etc.

Concerns:

- Despite the small base for income tax, most Indians contribute to tax

revenue because India relies heavily on indirect taxes.

- This includes the poor, who pay all kinds of indirect taxes like GST, excise tax, sales tax while they buy a product.

- Tax collections from indirect taxes are becoming more and more important

relative to tax revenues raised by direct taxes.

- Since the indirect tax rates are the same for everybody irrespective of income level, the Indian tax system is becoming less progressive over time.

- Taxes on consumption tend to be regressive, because poor people spend a greater proportion of their income on consumption—and consumption is taxed at high rates in India.

- Moreover, the Indian version of taxing consumption is not very efficient. Even the relatively incentive-compatible goods and services tax (GST) is fraught with high compliance costs, too many rates and classifications.

- Moreover, all rich people do not necessarily pay income tax. Rich farmers in India do not have to pay any taxes on the so-called ‘agricultural income’.

- By contrast, salaried people for whom taxes are deducted at source have

no way to evade paying income taxes.

- However, even here, an individual, under the current income tax rates and exemptions, can earn around ₹7.5-8 lakh a year without paying any income taxes by making use of various tax deductions.

- Even if the tax exemption limit and the tax rates for different income

tax brackets are not changed (as in the last Budget), the income tax payers

end up being adversely affected in an inflationary situation.

- Suppose prices go up by 10% and everybody’s money income also increases by 10%, real income remains the same. Yet, people would be moving to higher income tax brackets and would have to pay a higher percentage of the unchanged real income as taxes.

Debate over Tax Concession V/s Infra Spending: Government prefer to spend more money on infrastructure development.

- Economic theory tells us that additional government expenditure has

bigger effect on aggregate demand than equal reduction in tax revenue.

- So, with the same level of budget deficit, it makes sense to rely on additional government spending rather than tax cuts to created demand.

- Spending on infrastructure projects (like building roads, ports, bridges, airports, power stations) creates demand through productive job creation instead of doles.

- It is true that more money transferred to the poor by taxing the rich

would increase net aggregate demand as the poor have a higher propensity to

consume.

- In addition, the effect would be more immediate since it takes time for new infrastructure projects to get started. But it would not create new national assets.

- However, better physical infrastructure is expected to attract more private investment which, in turn, would expand the productive capacity of the nation in future.

- The long-term trend growth rate of an economy depends on the growth of production capacity rather than the growth in aggregate demand.

- Moreover, some tax concessions do not bring benefits to the most

intended beneficiaries.

- For example, all buyers of health insurance have to pay GST at a high flat rate of 18%. Under 80D, they can deduct the premium payment including the GST (up to some maximum limit like ₹50,000 for senior citizens) from taxable income and thus get a tax benefit.

- In case of a low-income senior citizen whose taxable annual income falls below ₹5 lakh, though he does not have to pay any income tax but will still have to pay the 18% GST on health insurance premium without getting any tax deduction.

- But a rich person with marginal income tax rate of 30% plus surcharge would enjoy a significant tax benefit.

-

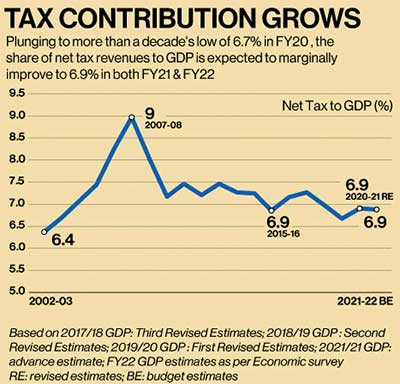

As per Economic Survey’21-22, India’s net tax revenue grew 65% during the April-November 2021 period due to growth in all major direct and indirect taxes in the last one year.

Of the direct taxes, personal income tax has grown at 47.2% over April-November 2020 while corporate income tax registered a growth of 90.4% over April-November 2020 and 22.5% over April-November 2019. -

Among the various factors which may have led to such an increase in corporate tax collection, improved profitability of the corporates, formalization of the economy and improved compliance due to tax reforms are noteworthy.

- Goods and Services Tax has emerged as a buoyant source of revenue for both the Centre and the States.

-

Gross GST collections, Centre and States taken together, were Rs 10.74 lakh crore during April to December 2021, which is an increase of 61.5% over April to December 2020 and 33.7% over April to December 2019.

-

The average monthly gross GST collection for the third quarter of FY21 was Rs 1.30 lakh crore, higher than the average monthly collection of Rs 1.10 lakh crore and Rs 1.15 lakh crore in the first and second quarters respectively.

-

Survey noted that the improvement in GST collections has been due to the combined effect of the rapid economic recovery post pandemic, the nation-wide drive against GST evaders and fake bills along with many systemic changes introduced recently, and various state rationalization measures undertaken by the GST Council to correct inverted duty structure.

Way Forward:

- Over the last few years, the Central and many State Governments have

undertaken various policy reforms and process simplification towards great

predictability, fairness and automation.

- The Goods & Services Tax (GST) reform is one such reform to ease the complex multiple indirect tax regime in India.

- States can explore other revenue sources like property tax.

- India barely relies on property taxes, with a property tax to gross domestic product (GDP) ratio of 0.2%.

- For other developing countries, though data varies greatly, the rough estimate is 0.7%.

- By comparison, the average property tax to GDP ratio for OECD countries is almost 2%.

- On Indirect tax front, focus should be on rationalisation of tax slabs

and address duty inversions, especially for the services sector.

- It is needed to remove ambiguities in the GST laws and simplify the provisions relating to availment and utilisation of tax credits to reduce litigation.

Conclusion:

- Government needs to keep taking steps in developing tax culture and help to create a positive public opinion. We need to shun the apathy of some taxpayers who are averse to payment of the taxes.

Source: The Hindu BL, Times of India

Mains Question:

Q. “Taxes are the price for civilisation”, however, in India, we are lacking tax culture. Discuss. Also suggest steps to improve the tax collection.