Context-

The 2024-25 Budget is not merely a financial document accounting for the government's receipts and expenditures for the year; it also sets a strategic direction for the upcoming years. Building on the insights from the Economic Survey, the Budget outlines government intervention priorities, particularly focusing on employability, employment, productivity, and resilience in agriculture and infrastructure. While the expenditure side of the Budget addresses many of these priorities, tax proposals play a limited but significant role.

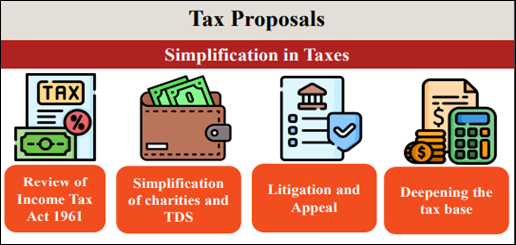

Categories of Tax Proposals

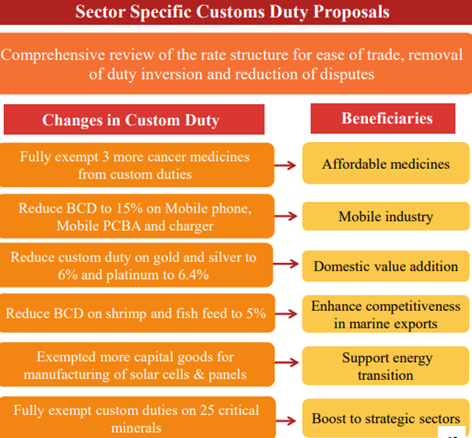

Tax announcements in the Budget can be classified into two broad categories: sector-specific incentives and general proposals. Sector-specific incentives are predominantly changes in customs duties, aimed at protecting domestic industries or fostering competition. The underlying objective appears to be the creation of “national champions.” A predictable policy environment can be established through a clear policy framework for determining which sectors and activities receive support. The Finance Minister's announcement to conduct a comprehensive review of the rate structure provides reassurance in this regard.

General proposals, on the other hand, can be divided into those affecting capital markets and those differentiating between the old and new tax regimes. These general proposals address broader economic concerns and aim to influence taxpayer behavior and market dynamics.

Incentives for Specific Sectors

The Budget includes several announcements on changes in customs duties, designed to either protect domestic industries or enhance competition within them. This approach is part of a broader strategy to cultivate “national champions.” A consistent and predictable policy framework for selecting sectors and activities for such support would benefit the industry by providing a stable environment for long-term planning and investment. The Finance Minister’s commitment to a comprehensive review of the rate structure is a step towards achieving this stability.

General Tax Proposals

Capital Markets

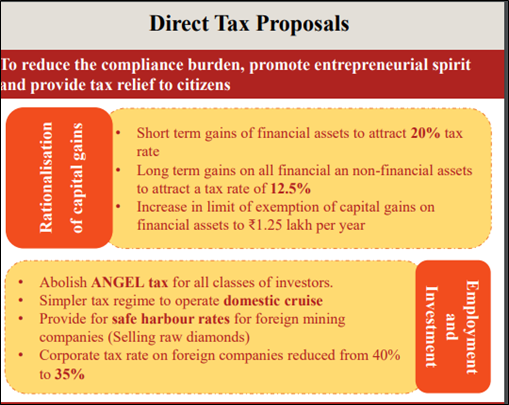

A significant focus of the Budget's general tax proposals is on capital markets. High returns in capital markets, particularly in the Futures and Options segments, have been flagged as a concern by the Reserve Bank of India (RBI) and the Economic Survey. These high returns create uncertainty for retail investors and may induce a shift of resources from banking to capital markets.

The Budget proposes an increase in securities transaction tax on derivatives transactions. Additionally, changes in the taxation of capital gains are proposed to address income inequality and the differential taxation of capital and labor income. Both short-term and long-term capital gains taxes are set to increase. Furthermore, receipts from share buybacks will now be taxed as dividends in the hands of the recipient.

These measures are likely to curb excessive speculation and stabilize capital markets, making them a more reliable source of funds for real investments. By addressing irrational exuberance in the short term, the revised tax regime (Introduction of 20 % tax on short term gain while long term capital gain would continue with 12.5 % tax rate)aims to create a more balanced and stable market environment.

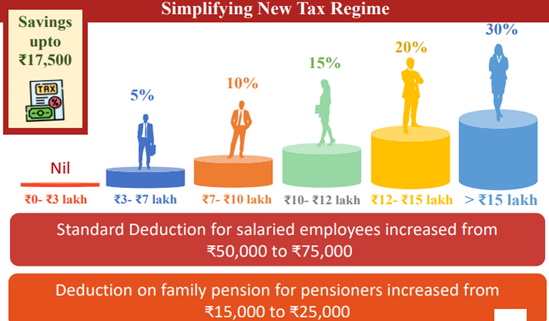

Personal Income Tax: Old vs. New Regimes

Reforming tax regimes typically involves broadening the tax base, eliminating or reducing tax incentives, and rationalizing rate structures. The government introduced a simplified tax regime where taxpayers could opt out of various exemptions and concessions in exchange for a lower tax rate. This dual system allows taxpayers to choose between the old regime, with its numerous deductions and exemptions, and the new, simplified regime.

To encourage taxpayers to shift to the new regime, the Budget introduces several changes. For individual taxpayers, the standard deduction in the new regime has been increased from ₹50,000 to ₹75,000. This increase is not available in the old regime. Additionally, the income slabs in the new regime have been expanded.

For corporate income tax, there is a proposal to allow higher deductions for Provident Fund contributions by employers opting for the new regime, provided they also adopt the National Pension System (NPS).

The Finance Minister noted that 58% of corporate tax returns and over 66% of personal income tax returns came from the new regime. These figures are impressive. However, the share of the old regime in total reported income for corporate tax rose from 38% in 2021-22 to 43% in 2022-23. Moreover, in personal income tax, the ratio of revenue foregone to total revenue collected was 24% in 2021-22 and only slightly decreased to 23.33% in 2022-23.

These numbers suggest that taxpayers are selecting the regime that minimizes their tax liabilities. While providing options is beneficial, it could become fiscally burdensome if continuous incentives are required to nudge taxpayers towards the new regime. A prospective terminal date for the old regime could be announced, with limited grandfathering of existing incentives, to streamline the transition and simplify the tax system for both taxpayers and the government.

Wealth Tax Proposal

The debate on personal income tax in India often focuses on the low number of taxpayers. Another emerging issue is the impact of growing income inequality on tax collections. At the G20 summit in Brazil, a proposal for a wealth tax of 2% on billionaires was discussed. The Economic Survey addresses this concern by highlighting the differential taxation of capital and labor income.

Conclusion

The 2024-25 Budget’s tax proposals reflect a strategic approach to addressing sector-specific needs and broader economic concerns. Sector-specific incentives, primarily through changes in customs duties, aim to protect and promote domestic industries. General tax proposals, particularly those affecting capital markets and personal income tax regimes, seek to stabilize markets, encourage investment, and ensure a more equitable tax system.

The shift towards the new simplified tax regime is being incentivized through increased standard deductions and expanded income slabs. However, the coexistence of the old and new regimes poses challenges in terms of fiscal cost and taxpayer decision-making. A prospective terminal date for the old regime could simplify the tax system and encourage a smoother transition.

By addressing concerns related to income inequality and high returns in capital markets, the Budget’s tax proposals aim to create a more balanced and resilient economic environment. The comprehensive review of the rate structure and the focus on creating a predictable policy framework further reinforce the government’s commitment to long-term economic stability and growth.

|

Probable questions for UPSC Mains Exam- 1. How do the proposed changes in capital gains taxes and the increase in securities transaction tax on derivatives transactions aim to stabilize capital markets and address concerns highlighted by the Reserve Bank of India and the Economic Survey? (10 Marks, 150 words) 2. What are the potential fiscal implications of maintaining both the old and new personal income tax regimes, and how might the government's proposal to incentivize the transition to the new regime affect taxpayer behavior and revenue collections in the long term? (15 Marks, 250 words) |

Source - The Hindu