Context-

Corporate tax cuts are frequently implemented with the goal of stimulating economic growth, increasing investment, and enhancing employment. However, the effectiveness of these tax cuts in benefiting wage-earners is a topic of debate. Reductions in profit taxes can immediately impact income distribution by boosting profits on existing capital without necessarily leading to increased future investments. This situation predominantly benefits private capital while offering limited advantages to wage-earners, who would only gain if increased investment sufficiently raised employment, productivity, and wages.

Corporate Tax Cuts in the U.S.

● Overview of the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act, signed into law by former President Donald Trump on December 22, 2017, represented a significant overhaul of the U.S. tax system. Effective from January 1, 2018, the act included a variety of provisions impacting both personal and corporate taxes. One of the most significant changes was the reduction of the top tax rate on corporate income from 35% to 21%. Proponents of the act argued that lowering the corporate tax rate would encourage companies to increase investment, leading to economic growth, job creation, technological advancements, and higher wages for workers.

● Impact on Investment

A recent study titled “Lessons from the Biggest Business Tax Cut in U.S. History,” examines the effects of the U.S. tax cuts. The study found a positive impact on investment, with various analyses estimating an increase in investment between 8% and 14%. This indicates that, absent the tax cuts, investment levels would likely have declined, highlighting the stimulative effect of the policy on capital expenditures.

● Impact on Wages

Despite the increase in investment, the benefits to wage-earners have been modest. The rise in annual wages has been less than $1,000 per worker, significantly below the projected $4,000 to $9,000 increase claimed by the Council of Economic Advisors at the time of the tax cuts’ implementation. Moreover, the long-term GDP growth resulting from the tax cuts is estimated at only 0.9%, reflecting the limited overall economic impact. While corporate profits have grown due to the reduced tax rates, the broader benefits for wage-earners have been minimal, and the reduction in tax revenue, estimated at 41% over the long run, has strained the fiscal health of the U.S. economy.

Corporate Tax Cuts in India

● Overview of Tax Rate Reductions

In September 2019, India introduced substantial corporate tax reductions, cutting the rate for existing companies from 30% to 22% and for new companies from 25% to 15%. These measures were intended to boost investment and job creation in the Indian economy. However, the immediate effect was a significant tax revenue loss of approximately 1 lakh crore in the fiscal year 2020-21. While the tax cuts aimed to deliver net benefits through increased economic activity, the outcomes have been mixed, especially in the context of the COVID-19 pandemic, which caused severe disruptions in the economy.

● Impact on Employment

The pandemic led to a dramatic rise in unemployment as economic activity stalled. Although unemployment rates have since declined, with increasing labour force participation, especially among women, the corporate sector has not been the primary driver of this recovery. Much of the employment increase has come from insecure and informal work, including unpaid family labour in rural areas. According to the Periodic Labour Force Survey (PLFS), the share of regular wage employment across India decreased from 22.8% in 2017-18 to 20.9% in 2022-23. This shift towards more precarious forms of employment indicates that the corporate tax cuts did not translate into significant job creation in the formal sector.

● Impact on Wages

The impact of corporate tax cuts on wages has also been limited. Comparing average nominal monthly earnings for rural and urban regular wage workers from July-September 2017 to July-September 2022 reveals a compounded annual growth rate (CAGR) of 4.53% for rural workers and 5.75% for urban workers. These increases barely outpace inflation, suggesting that real wage growth has been stagnant or even negative in rural areas. Despite the recovery in corporate tax collections since the pandemic, there has been little positive effect on wages or employment levels. Additionally, high-profile layoffs in the Indian tech sector further underscore the limited impact of tax cuts on the broader job market.

Shift in Tax Burden

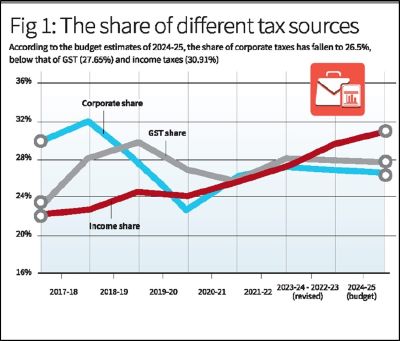

● A significant consequence of corporate tax cuts in India has been a shift in the tax burden from corporations to individuals. Data from Figure1 shows that in 2017-18, corporate taxes constituted nearly 32% of the Centre’s gross tax revenues. This share has since declined, while the proportion of revenue from income taxes and GST has increased. As per the 2024-25 budget estimates, corporate taxes now represent only 26.5% of gross tax revenues, compared to 30.91% from income taxes and 27.65% from GST. This shift has led the government to explore new revenue sources, such as removing indexation benefits and taxing long-term capital gains, to offset the declining contribution from corporate taxes.

Policy Implications and Future Directions

● Challenges in Stimulating Investment

The evidence suggests that tax cuts alone are insufficient to drive substantial increases in investment, especially in uncertain economic environments. For investments to increase meaningfully, businesses must have confidence in the prospects for future profits. In economies recovering from the pandemic and dealing with ongoing supply-side disruptions, corporate tax cuts have had only marginal effects on private investment.

● Rethinking Tax Policy

Economists like Chodorow-Reich and his colleagues propose that a more effective approach would involve maintaining higher taxes on existing profits while providing stronger incentives for future investments. This strategy could help align tax policy more closely with the goals of stimulating long-term economic growth, improving employment prospects, and raising wages. The experiences of the U.S. and India highlight the complexities of policy-making in uncertain times, illustrating that while corporate tax cuts can increase profits, their broader economic impacts are often limited.

Conclusion

Corporate tax cuts in the U.S. and India have largely benefited private capital with only marginal gains for wage-earners. The expected boosts in investment, employment, and wages have not materialized to the extent predicted by proponents of these measures. As such, future tax policies should consider more targeted approaches that balance the need for fiscal health with the goal of broadly shared economic gains.

|

Probable Questions for UPSC Mains Exam- 1. What were the primary goals of the corporate tax cuts in the U.S. and India, and how did the actual outcomes compare to these expectations? (10 Marks,150 Words) 2. How did corporate tax cuts in India affect the distribution of tax burdens among corporations, individuals, and other sources of revenue? (15 Marks, 250 Words) |

Source- The Hindu