GS-2: Functions and responsibilities of the Union and the States; issues and challenges pertaining to the federal structure, devolution of powers and finances and challenges;

GS-3:Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Key Phrases: Gross Fiscal deficit of States, fiscal crisis, development and welfare expenditures, deficit financed spending, revenue receipts, transfer of shareable taxes, Goods and Services Tax, tax concessions,

Why in News?

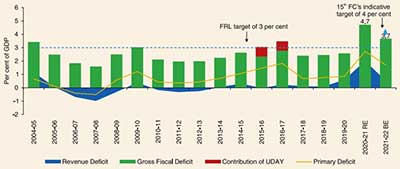

- As per the recent estimates for 2020-21 collated by the Reserve Bank of India, the gross fiscal deficit of the States rose sharply to 4.7 per cent of GDP in pandemic year 2020-21.

Key points:

- The study by RBI suggests that states are experiencing a fiscal crisis

that would adversely impact their development and welfare expenditures

in the coming years.

- The crisis is a direct impact of the pandemic, which reduced revenues and increased expenditures, resulting in a significant increase in the extent of deficit financed spending at the State level.

- With recovery from the pandemic proving to be anaemic, its effects on revenues are likely to be felt in 2021-22 as well.

- This effect of the pandemic is of even greater concern because even in the pre-pandemic year 2019-20, the gross fiscal deficit was kept under control only through a reduction in expenditures, since revenue growth at the level of the states had turned sluggish.

- Moreover enhancing deficit financed spending may not be an option.

- The combined debt to GDP ratio of States already stands at 31 per cent at end-March 2021 and is expected to remain at that level by end-March 2022, is worryingly higher than the target of 20 per cent to be achieved by 2022-23 (As per NK Singh Chaired FRBM Review Committee).

Reasons for the crisis:

- Total revenue of 31 States and Union Territories rose from 23.21

lakh crore in 2017-18 to 26.20 lakh crore in 2018-19 and was projected to

rise to 31.54 lakh crore in the State budgets for 2019-20.

- In practice revenue receipts in 2019-20 stagnated and stood at 26.70 lakh crore, largely because the transfer of shareable taxes from the Centre to the States fell from 7.47 lakh crore to 6.51 lakh crore.

- In addition, poor collections from the Goods and Services Taxes (GST)

regime, made matters much worse in 2020-21.

- According to the Revised Estimates for 2020-21, the tax revenues accruing to the States fell from 18.7 lakh crore to 18.3 lakh crore, even though states’ own tax revenues rose marginally.

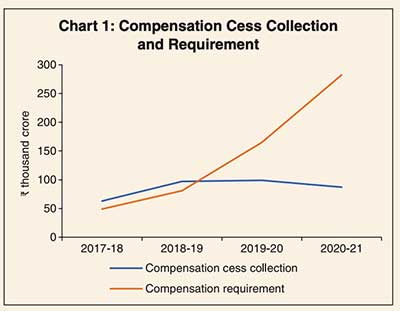

- Centre in light of its own revenue shortfall and tepid GST collections,

was not able to cover the shortfall in GST revenues relative to a 14

per cent growth trajectory starting 2015-16 with grants, as originally

promised.

- Part of it was covered with borrowing, transferred as back-to-back loans to the States, which would be serviced in future by revenues derived from an extension of the compensation cess.

- Compensation through back-to-back loans amounted to 1.1 lakh crore in 2020-21, whereas compensation with grants financed by the cess was a lower 91,000 crore. This contributed to the spike in the revenue deficit of the States.

- Deceleration in growth in receipts and spending prior to the pandemic

was the result of a slowdown in growth, which prompted the Finance

Minister to offer large tax concessions to the corporate sector in

September 2019 to revive investment.

- That had little effect since the deceleration in growth was the consequence of a demand recession that called for enhanced spending.

- Investment did not revive, but net direct tax collections, or gross direct taxes adjusted for tax refunds, declined in nominal terms from 11.36 lakh crore in 2018-19 to 10.49 lakh crore in 2019-20, or by close to 8 per cent.

- That adversely impacted the volume of taxes transferred to States.

- The devastating effect of the pandemic and the brutal lockdowns imposed

by the government was superimposed on this decelerating trend.

- Since most State budgets were prepared before the full effects of the pandemic were felt, State governments had optimistically projected revenues at 33.31 lakh crore in 2020-21.

- Provisional accounts show that as a result of the economic contraction in that year, revenue receipts touched only 26.25 lakh crore.

- Given the pandemic induced pressure to ramp up spending, State

governments needed much more than what they received as compensation from

the Centre for GST revenue shortfalls and had to increase their borrowing

levels, exploiting the relaxation of the ceiling on borrowing set by the

Centre.

- Instead, temporary five-year protection of revenue growth at 14 per cent a year which States had been provided to persuade them to cede their taxing powers to the GST Council would be no more operative, starting July 2022.

States are in substantial measure responsible for a range of social sector and welfare expenditures. Those expenditures would have to be trimmed in order to address the fiscal crisis.

Way Forward:

- As the impact of the second wave wanes, State governments need to take credible steps to address debt sustainability concerns.

- States should prefer to borrow from financial accommodation provided by the RBI through short-term borrowing via the special drawing facility (SDF) and ways and means advances (WMA).

- In the medium term, improvements in the fiscal position of State governments will be contingent upon reforms in the power sector as recommended by 15th Finance Commission and specified by the Centre.

- Undertaking power sector reforms will not only facilitate additional borrowings of 0.25 per cent of GSDP by the States but also reduce their contingent liabilities due to improvement in financial health of the DISCOMs.

- On the third-tier front, increasing the functional autonomy of the civic bodies, strengthening their governance structure and financially empowering them via higher resource availability through self-resource generation and transfers are critical for building resilience and effective interventions at the grass-root level.

Concludingly, we can say that sub-national fiscal positions are at an inflection point. Empowerment of the third-tier government presents an opportunity that can result in better and more effective pandemic crusaders in the future.

Source: The Hindu

Mains Question:

Q. Reduced revenues and increased expenditures in light of pandemic, have put states in a fiscal crisis that would adversely impact their development and welfare expenditures. Comment.