Context-

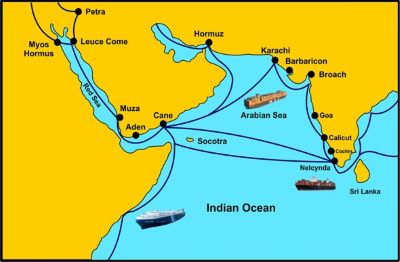

The Red Sea, a crucial maritime corridor spanning over 2,000 kilometers, connects the Mediterranean Sea with the Indian Ocean. It is responsible for handling 12 percent of global trade and 8 percent of the world’s liquefied natural gas (LNG) shipments. In November 2023, the geopolitical situation in the region deteriorated when the Houthis began attacking vessels in the Red Sea, following the October 2023 escalation of the Israel-Hamas conflict. By mid-December 2023, major global shipping companies like A.P. Moller – Maersk started rerouting ships around the Cape of Good Hope, avoiding the Red Sea entirely. This shift resulted in longer transit times, increased insurance costs, and higher container shipping rates, with significant repercussions for global trade.

● Suez Canal : The Suez Canal is the backbone of Egypt’s economy, contributing approximately 14 percent to its GDP. The canal, along with the Sumed pipeline, has the capacity to transport 2.5 million barrels of oil per day. However, the Houthi attacks have reduced ship traffic through the canal, drastically cutting Egypt’s revenue.

● Impact on Neighboring Countries: Countries such as Djibouti, Sudan, and Eritrea have also been affected. Djibouti relies on the canal for 31 percent of its foreign trade, while Sudan depends on the Suez Canal for 34 percent of its trade. The shortage of vessels and rising freight and insurance costs have further complicated maritime trade for these nations, pushing them into an economic crisis.

Saudi Arabia and the Red Sea Ports

● Impact on Ports: Saudi Arabia, with its long Red Sea coastline, has seen significant disruptions in port activities. In March 2024, King Abdullah and Jeddah Ports reported a 90 percent and 70 percent drop in activity, respectively, compared to their normal capacity. The disruption has severely impacted Saudi Arabia’s trade, particularly its oil exports.

● Saudi Oil Exports: By July 2024, Saudi Arabia halted its oil shipments through the Red Sea after two vessels were targeted by the Houthis. This decision further disrupted global oil markets, affecting prices and supplies, especially in Europe and Asia, which rely heavily on Saudi oil.

● UAE’s Trade and Ports: The UAE, known for its strategic maritime hubs like DP World, also experienced fallout from the Red Sea crisis. The UAE Minister of Economy acknowledged in early 2024 the need for alternative trade routes to ensure stable supply chains. DP World recorded a 59 percent drop in net profit in the first half of the year due to the crisis.

● Qatar’s LNG Exports: As the world’s second-largest exporter of LNG, Qatar was forced to reroute its shipments via the Cape of Good Hope, extending travel times by nine days. This adjustment has led to delays and increased costs for its European clients, further complicating the global energy market.

Yemen and the Economic Disruption

● Humanitarian Crisis in Yemen: The ongoing civil war in Yemen, compounded by the Red Sea crisis, has worsened the country’s humanitarian and economic conditions. While regions controlled by the internationally recognized government of Yemen are expected to bear the brunt of the economic downturn, areas controlled by the Houthis may be less affected. Nevertheless, the World Bank anticipates a 0.8 to 2.7 percent dip in the overall economic growth of the Middle East and North Africa (MENA) region for 2024.

● Disruption in Telecommunications: A sabotage of underwater telecommunications cables in February 2024 disrupted 25 percent of the telecommunications traffic in the West Asia and North African (WANA) region. While the Houthis denied responsibility, the incident significantly affected nations like Ghana and Nigeria, prompting calls for international protection of critical undersea infrastructure.

● Redundant Israeli Ports: The Eilat Port in Israel has been inactive for eight months, with no revenue generation since the start of the conflict in November 2023. This port handles bulk cargo, including car imports, especially from China, which accounts for 70 percent of Israel’s electric vehicle sales. The economic setback extends to other Israeli ports like Ashdod and Haifa, which have also experienced significant revenue losses.

India’s Strategic and Economic Concerns

- India’s Maritime Trade: India depends on the Red Sea for approximately 80 percent of its trade with Europe. The ongoing crisis has jeopardized this crucial route, leading to a sharp increase in shipping costs and delays.

- Governmental Response: During a visit to Iran in January 2024, External Affairs Minister S. Jaishankar highlighted the critical nature of maritime safety for India’s economy and energy security. The Indian Ministry of Finance’s February 2024 economic review emphasized the need for diversified trade routes, warning that rising oil prices could affect economic growth.

- Impact on Exports: India’s seafood exports dropped by 5.39 percent due to diminished demand in Western markets, where consumers faced higher prices because of shipping disruptions. Additionally, Indian petroleum exports to Europe decreased from 425,000 barrels per day in December 2023 to around 250,000–300,000 barrels by mid-2024.

● Bunkering and Navy Operations: Despite the challenges, India has seen a 65 percent increase in bunkering at its ports as ships reroute through the Cape of Good Hope. Regular domestic refinery supplies have helped make Indian ports an attractive stop for refueling.

● Indian Navy’s Role: The Indian Navy has played a key role in safeguarding shipping lanes in the Gulf of Aden, conducting anti-piracy operations, and responding to distress calls from ships in the region. India's maritime strategy underscores the importance of securing sea lines of communication in the Western Indian Ocean, ensuring that vital trade routes remain open.

The Red Sea crisis has had far-reaching economic and geopolitical consequences, not only for countries bordering the Red Sea but also for global commerce and maritime trade. Egypt, Saudi Arabia, and other nations in the Horn of Africa have experienced sharp revenue declines due to disrupted shipping routes. The crisis has also led to rerouted shipping, increased costs, and delays, with significant implications for global oil and LNG supplies.

India’s economy has been particularly affected, given its reliance on the Red Sea for trade with Europe. As the conflict between Israel and Hamas shows no signs of abating, the Red Sea will likely remain a critical flashpoint with ongoing consequences for regional stability and global trade.

|

Probable Questions for UPSC Mains Exam- 1. Discuss the economic impact of the Red Sea crisis on global maritime trade, focusing on its effects on Egypt, Saudi Arabia, and India. (10 Marks, 150 Words) 2. How has the Red Sea crisis affected India’s trade and energy security, and what role can India's naval strategy play in mitigating these challenges? (15 Marks, 250 Words) |

Source- IDSA