GS-3: Issues relating to planning, mobilization of resources, Government Budgeting

Key Phrases: GST, GST Rate Structures, Revenue Neutral Rate, GST Council

Why in News:

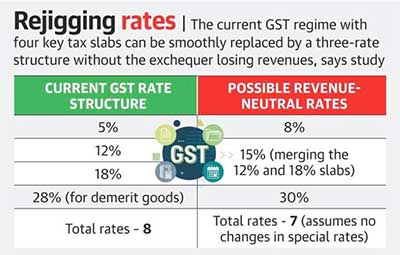

As per a recent study by National Institute of Public Finance and Policy (NIPFP), Government can rationalise the GST rate structure without losing revenues by rejigging the four major rates of 5%, 12%, 18% and 28% with a three-rate framework of 8%, 15% and 30%.

National Institute of Public Finance and Policy (NIPFP)

- It is an autonomous think tank backed by the Finance Ministry.

- Founded in 1976, the institute undertakes research, policy advocacy and capacity building in areas related to public economics.

- One of the major mandates of the institute is to assist the Central, State and Local governments in formulating and reforming public policies by providing an

Key Points:

Need for rationalisation?

- Multiple rate changes since the introduction of the GST regime in July 2017 have brought the effective GST rate to 11.6% from the original revenue neutral rate of 15.5%.

- If the GST rate structure prevailing at its onset in July 2017 was restored last year, additional GST revenues of nearly ₹1.25 lakh crore could have accrued in

2020-21.

- In its report tabled in Parliament earlier this year, the 15th Finance Commission also urged restoring the ‘rate neutrality of GST’, which was compromised by rate cuts.

- Idea for a three-tier structure of GST was also aired by chief economic adviser in the finance ministry, Krishnamurthy Subramanian in July this year.

- Merging the 12% and 18% GST rates into any tax rate lower than 18% may result in revenue loss.

- As a result, NIPFP proposes that the GST Council may consider a three-rate structure by adopting 8%, 15% and 30% for revenue neutrality.

• The nature of rate changes has also meant that over 40% of taxable turnover value now falls in the 18% tax slab, thus any move to dovetail that slab with a lower rate will trigger losses to the tax kitty that need to be offset by marginal hikes in other remaining major rates — 5% and 28%.

• NIPFP also noted that raising rates on ‘high-value low volume goods’ like precious stones and jewellery ‘may encourage unaccounted (undisclosed) transactions and therefore revenue leakages’.

The findings of the NIPFP, assume significance as the GST Council has tasked a Group of Ministers, headed by Karnataka CM Basavaraj S. Bommai, to propose a rationalisation of tax rates and a possible merger of different tax slabs by December to shore up revenues. Apart from above, NIPFP also suggested that the GST Council may consider placing some aggregate data in the public domain to help policy research as binding data limitations hinder meaningful research of the GST regime.

Way Forward:

Apart from rationalising the existing Tax Slabs, Experts suggests that rather than focusing on increasing the effective tax rate to increase revenues, the emphasis should be on further expanding the tax base by keeping levies moderate.

- Further, from a tax policy perspective, it's important to remove barriers like restrictions on claiming input credits.

- Moreover, application of GST should be based on price points, size of packing and capacity of the firms.

Conclusion:

Restructuring GST rates is a timely idea to improve revenues. It was important to sequence the transition to the new rate structure so as to minimise the costs associated with tax compliance, administration and economic distortions.

Source: The Hindu

Prelims Question:

Q. Consider the following Statements:

1. Good and Service Tax has subsumed all the indirect tax presently levied by Union Government.

2. At present, GST rates come under three slabs i.e., 5, 18 and 28.

3. The 28% rate is levied on demerit goods.

Which of the statements given above is/are Correct?

A. 1 and 2 only

B. 2and 3 only

C. 3 only

D. None of the above

Answer: C

Mains Question:

Q. Good and Service Tax regime though have helped in increasing Tax revenues, still need reforms. Comment.