Relevance: GS-3: Infrastructure: Energy, Ports, Roads, Airports, Railways, etc.

Key Phrases: Indian Railways (IR), Operating Ratio (OR), Bulk and Non-Bulk Goods, Comptroller and Accountant General report, Dedicated Freight Corridors, Railway freight transport, Eastern DFC, Western DFC.

Context:

- The deteriorating financial health of Indian Railways (IR) is reflected in the high Operating Ratio (OR), which means that working expenses are higher than traffic earnings.

- A high ratio indicates poor ability to generate surplus and thereby a requirement for budgetary support.

Bulk and Non-Bulk Goods

- Bulk goods refer to goods that are not containerised and are directly moved through a vessel in large quantities, as opposed to non-bulk goods that are often packaged.

- Some examples of bulk commodities include oil, coal, mineral ores, and grains.

- Non-bulk goods comprise a broad array of products such as consumer goods, edible oils, paper products, automotive supplies, milk, and other agricultural products.

Key findings of CAG’s report:

- The Comptroller and Accountant General’s (CAG’s) report shows IR’s OR was 114 percent for 2019-20 against the budgeted 98 percent.

- CAG reports take more than a year to come out and if we discount the Covid years of 2020-21 and 2021-22, this report does reflect the situation pretty accurately.

- The report commented that the declared OR of 98 percent camouflaged the reality by excluding pension payments. At the same time, with IR’s Capex mounting to ₹2.45-lakh crore in this year’s budget which has gone up five times since 2014, the long-term debts of IR have now topped ₹3-lakh crore.

Dedicated Freight Corridors(DFC)

- These are freight-only railway lines to move goods between industrial heartlands in the North and ports on the Eastern and Western coasts.

- The DFC consists of two arms.

- Eastern DFC:

- It is a 1,839-km line that starts from Sahnewal (Ludhiana) in Punjab and ends at Dankuni in West Bengal.

- It is being majorly funded by the World Bank.

- Western DFC:

- It is around a 1,500-km line that starts from Dadri in Uttar Pradesh to JNPT in Mumbai, touching all major ports along the way.

- It is being majorly funded by Japan International Cooperation Agency.

Main objectives of Indian Railways’ Dedicated Freight Corridor Project:

- Decongestion of the existing Indian Railways network

- Increasing the average speed of freight trains from the existing speed of 25 km per hour to a speed of 70 km per hour

- Running Heavy Haul trains (higher axle load of 25/32.5 Tonne) as well as an overall load of 13,000 Tonne

- Facilitating the operations of longer (1.5 km) as well as double-stack container trains

- Linking existing ports and industrial areas for faster movement of freight

- Energy efficient as well as eco-friendly rail transport system

- Increasing share of transportation through rail and minimizing the logistic cost of transportation

Challenges in railway freight transport:

- Imbalanced capacity distribution:

- Seven main routes contribute to 60 percent of freight traffic yet constitute only 16 percent of India’s railway route network. These routes are often overutilised and are not designed to handle high traffic density.

- Overutilisation:

- About two-thirds of India’s railway lines are already above 100 percent utilisation when 80 percent capacity utilisation is considered ideal.

- Track sharing:

- Passenger and freight trains share the same tracks, and passenger trains often receive higher priority, increasing lead times for rail-based freight transport and reducing reliability

- Lower speeds:

- Freight trains in India carry smaller loads and usually travel at lower speeds than global standards. This increases lead times of goods and reduce the capacity of the network.

- Lack of arrangement to aggregate smaller loads:

- Currently a shipper has to contract a full train to move freight. There are no standardised processes to aggregate smaller loads for contracting individual or partial wagons. It is for this reason that non-bulk commodities such as consumer goods, electronics, automobiles, etc., are being transported through trucks.

Need a shift to carry freight:

- CAG also commented on IR’s over-dependence on coal movement, being 49 percent of its commodity basket, and that any shift in bulk commodities pattern due to market conditions or technology could significantly affect its freight earnings.

- There is urgent need for some imaginative changes in the way IR carries freight.

Do you know?

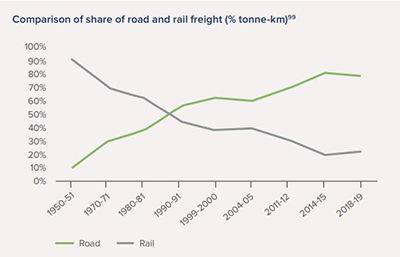

- Rail’s share in freight transportation in India has been declining since 1951.

- In 2020, it stood at merely 18 percent as compared to the road’s share of 71 percent.

Non-bulk cargo emphasis:

- The freight business is broadly divided into bulk and non-bulk cargo.

- IR’s focus has historically been on bulk commodities comprising coal, cement, fertilizer, petroleum products, food grains, and residual bulk raw materials required by industry.

- This approach has taken IR’s attention from a non-bulk business which is nearly half of the overall freight business today.

- While bulk freight has rail infrastructure at both origin and destination, or at least at the production point, the same is not true for non-bulk traffic.

- Non-bulk freight traffic comprises:

- packages of perishables,

- consumer goods that need time-bound,

- door-to-door service,

- needing low inventory,

- employing multimodal services.

- These features of non-bulk traffic do not exist in IR’s ecosystem and, therefore, this cargo is not amenable for carriage by rail.

- However, non-bulk cargo yield per million tonnes is far better, approximately ₹200 crores vis-à-vis ₹100 crores for bulk cargo.

- IR’s freight loading has increased roughly at the rate of 4 percent per year, from 1,000 million tonnes in 2012-13 to 1,418 million tonnes in 2021-22, albeit with an exceptional but unsustainable increase of 100 million tonnes last year.

- Non-bulk cargo also reduces un-remunerative empty running of freight trains as experienced with container trains which are charged on to and fro basis.

- RITES’ National Rail Plan study, commissioned in 2019-20, also indicates that IR’s growth must include transportation of non-bulk traffic.

Areas need to focus upon:

- IR can make significant inroads in the non-bulk space by

focussing on some special areas, viz:

- Domestic container services for light cargo with an equivalent dimension of double-stack dwarf containers

- Parcel business permitting high cube vans with superior containers viz. providing 10 cub m per tonne

- Higher height automobile wagons with Dedicated Freight Corridor (DFC) height of 5.1 m compared to present 4.3 m for all automobiles

- Roll-on-roll-off services with time-guarantee and competitive rates of container haulage benchmark

- Low-cost air-cooled vans for agriculture produce, including fisheries, dairy products, etc; and

- Multimodal logistics parks, envisaged as Gati Shakti terminals in the Union Budget

- Non-bulk cargo also needs wagon customization different from wagon standardization usually followed by the Railways.

Where to start from?

- A beginning would, however, need to be made by IR for establishing proof of concept for high-cube container services embracing dimensions of the dwarf double stack, wide-bodied roll-on-roll-off wagons, and high-cube parcel vans beating competition from the road.

- Once these services take off, such wagons can be brought under private investment.

- This process was followed in the case of automobile wagons and they have found a considerable market.

How can non-bulk freight be raised?

- This can be raised through steps in areas like:

- raising the average speed of freight trains to 50 kmph in the next 20 years;

- gradual reduction in freight charges by 30 percent to compete with the road;

- customised wagons with height at DFC level for light parcel cargo, automobiles, container segment, etc. and;

- lowering logistics costs by developing multimodal facilities.

Conclusion:

- As national freight activity grows about five-fold by 2050, India’s Non-bulk freight transport ecosystem has a critical role to play in supporting India’s ambitious priorities.

- Some of these include international competitiveness, job growth, urban and rural livelihoods, and clean air and environment.

- Non-bulk freight improvements can be developed around DFCs where time-guaranteed services can be introduced from FY23-24.

- The time to act on constructive measures is now, or else IR’s finances would keep slipping, rendering it dependent on government bail-out.

Source: The Hindu BL

Mains Question:

Q. It is high time Indian Railways focus on non-bulk freight as well. Justify the statement.