Date : 30/08/2023

Relevance – GS Paper 3 – Indian Economy

Keywords – PMJDY, Financial Inclusion, Rupay card, Women empowerment

Context

The Pradhan Mantri Jan-Dhan Yojana (PMJDY) has emerged as a beacon of financial inclusion in India, marking a significant milestone by completing 9 years of successful implementation. This visionary initiative has not only expanded banking access but has also redefined the economic landscape of the country, empowering millions through access to financial services, credit, and a secure financial future.

About Pradhan Mantri Jan-Dhan Yojana (PMJDY)

Introduced on August 15th, 2014, the PMJDY serves as the National Mission for Financial Inclusion, aiming to provide accessible financial services encompassing Banking, Savings & Deposit Accounts, Remittance, Credit, Insurance, and Pension, all in an economically viable manner.

Objectives:

- Ensure the affordability of financial products and services.

- Harness technology to enhance accessibility and reduce costs.

Understanding Financial Inclusion:

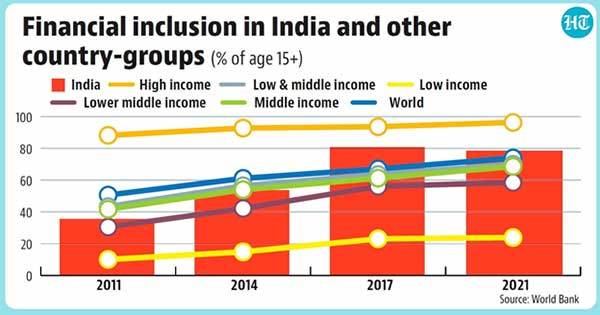

Financial inclusion, the core principle behind PMJDY, encompasses the provision of affordable and accessible financial services to vulnerable groups. Its importance in the context of India's development cannot be overstated. Central to achieving financial inclusion is granting individuals access to transaction accounts, thereby enabling secure storage, hassle-free payments, efficient transfers, and ultimately serving as a gateway to a broader spectrum of financial services.

What is financial inclusion?

Financial inclusion can be characterized as the systematic endeavor to secure access to financial services and appropriate credit, particularly for susceptible segments like marginalized communities and individuals with limited incomes, all while maintaining cost-effectiveness.

In a country as diverse as India, the integration of financial inclusion into the development framework holds paramount significance. Over the course of post-independence years, collaborative initiatives spanning across governments, regulatory bodies, and civil society entities have contributed to the expansion of financial inclusion coverage across the nation.

PMJDY: A Groundbreaking Initiative:

The Pradhan Mantri Jan-Dhan Yojana, aptly named the world's largest financial inclusion mission, has made remarkable strides, crossing the monumental milestone of 500 million accounts within a span of nine years since its inception.

Key Aspects of the PMJDY Scheme:

Extent of Participation

The PMJDY has accomplished several notable feats, shaping a more inclusive financial landscape in India. It has succeeded in providing banking access to individuals across rural and urban areas, effectively breaking down geographical barriers. Moreover, the scheme's accomplishment of surpassing the remarkable 500 million account mark stands as a testament to its efficacy in driving financial inclusion across the nation. Notably, these accounts have collectively accumulated deposits exceeding ₹2 lakh crore, underlining their significance in fostering a savings culture among the previously underserved.

Women Empowerment:

The PMJDY has played a pivotal role in promoting women's financial inclusion, resulting in substantial empowerment. Over 55% of the accounts under the scheme are held by women, signifying a significant step towards bridging the gender gap in financial access and control.

Focus on Rural & Semi-Urban Areas:

One of the defining features of the PMJDY is its extensive outreach in underserved regions. Approximately 67% of the accounts opened through the initiative belong to rural and semi-urban areas, underscoring the program's commitment to extending banking facilities to those who were traditionally excluded from the financial mainstream.

RuPay Cards:

The issuance of RuPay cards to account holders has been instrumental in extending insurance benefits. Around 340 million RuPay cards have been issued, each equipped with ₹2 lakh accident insurance coverage. This not only enhances the sense of financial security but also contributes to risk mitigation for individuals and their families.

Inclusion of Vulnerable Sections:

PMJDY's overarching objective of integrating financially vulnerable sections into the formal banking system has yielded commendable results. This initiative has not only uplifted marginalized communities but has also broadened the scope of financial services for those who previously had limited or no access.

Financial Benefits and Empowerment:

By enabling secure savings, efficient fund transfers, and access to credit facilities, the PMJDY has empowered individuals to manage their finances effectively. This has a cascading effect on their economic well-being and the overall economic growth of the nation.

Role in Welfare and Digital Platform:

The scheme's strategic integration with welfare initiatives has streamlined the distribution of benefits to the intended recipients. The PMJDY accounts have facilitated Direct Benefit Transfers (DBT) for a range of programs, including COVID-19 relief, PM-Kisan, MGNREGA, and insurance coverage. The Jan Dhan Darshak app further enhances accessibility to banking services, providing users with information about nearby banking touchpoints.

JAM Architecture and Formalization:

The PMJDY has synergized with the JAM (Jan-Dhan, Aadhaar, mobile) architecture, facilitating the direct transfer of government benefits to the intended beneficiaries. By formalizing the financial system, it has enabled marginalized individuals to bring their savings into the formal economy, provided avenues for remittances, and liberated them from the clutches of exploitative moneylenders.

Future Prospects and Conclusion:

The journey of the PMJDY continues, with a focus on expanding micro-insurance coverage for account holders. Efforts are being directed towards including eligible individuals in schemes like PMJJBY and PMSBY. This endeavor is bolstered by the establishment of acceptance infrastructure nationwide. Additionally, steps are being taken to enhance PMJDY account holders' access to micro-credit and micro-investment options such as flexi-recurring deposits.

In conclusion, the Pradhan Mantri Jan-Dhan Yojana has revolutionized financial inclusion in India over the past 9 years. Its multifaceted achievements, from extending banking access to rural and urban populations to empowering women and enabling welfare distribution, underscore its transformative impact. By promoting formal financial participation, providing avenues for economic empowerment, and aligning with the digital and welfare architecture, PMJDY has positioned India on a trajectory of inclusive growth and progress.

Probable Questions for UPSC Mains Exam

- Question 1: The Pradhan Mantri Jan-Dhan Yojana (PMJDY) has transformed financial inclusion in India. Explain its objectives and impact, emphasizing how the scheme has empowered vulnerable groups and reshaped the economic landscape. (10 marks,150 words)

- Question 2: How does the Pradhan Mantri Jan-Dhan Yojana (PMJDY) contribute to financial inclusion, particularly for marginalized communities and women? Analyze the scheme's role in leveraging digital technology and welfare integration for promoting inclusive growth. (15 marks, 250 words)

Source – PIB