Date: 17/10/2022

Relevance: GS-2: Global groupings and agreements affecting India’s Interests, Effect of policies and politics of developed and developing countries on India’s Interests, important International Fora

Key Phrases: OPEC+, Strategic Petroleum Reserves, Crude Oil Imports, INDO-US, Brent Crude, Increase In The Oil Import Bill, Loss Of Forex

Why in News?

- The Organization of the Petroleum Exporting Countries (OPEC+) which includes Saudi Arabia and Russia has recently announced that it would cut oil production by two million barrels a day.

- This has created a state of panic in the market given the current geopolitical situation as this is the largest cut since the beginning of the Covid-19 pandemic

- Brent Crude, the international benchmark, was up 28 cents or 0.3%, at $92.08 a barrel after the cut was announced.

What are the reasons for slashing oil production?

- Oil prices skyrocketed after Russia’s invasion of Ukraine in February, and have since begun to reduce over the past few months, before dropping sharply to under $90 in September due to fears of a recession in Europe and reduced demands from China because of its lockdown measures.

- The reductions would boost prices and will be extremely beneficial for the Middle Eastern member states, to whom Europe has turned for oil after imposing sanctions against Russia since it invaded Ukraine.

- OPEC+ members are concerned that a weakening global economy would reduce the demand for oil, and the cuts are seen as a way to protect profits.

- Increased oil prices, which first occurred during the invasion of Ukraine, have helped Saudi Arabia, one of the founding members of OPEC, become one of the world’s fastest-growing economies.

- Moreover, there is a possibility that Moscow is influencing OPEC, to make it more expensive for the West to extend energy sanctions on Russia.

Do you know?

What is OPEC+?

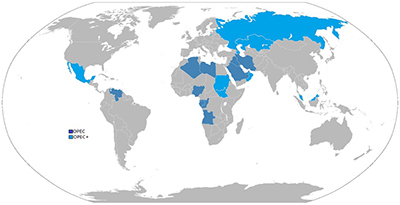

- Established in 1960 by founding members Iran, Iraq, Kuwait, Saudi Arabia and Venezuela, OPEC has since expanded and now has 13 member states which include Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan.

- With the addition of another 11 allied major oil-producing countries that include Russia, the grouping is known as OPEC+.

- The objective of the organisation is to coordinate and unify the petroleum policies of its Member Countries and ensure the stabilisation of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for those investing in the petroleum industry.

- Previously controlled by western-dominated multinational oil companies known as the “Seven Sisters,” OPEC sought to give the oil-producing nations greater influence over the global petroleum market.

- They account for roughly 40 per cent of the world’s crude oil and 80 per cent of the globe’s oil reserves, according to estimates from 2018.

- They usually meet every month to determine how much oil the member states will produce.

- However, it is alleged that OPEC behaves like a cartel, determining the supply of oil and influencing its price in the world market.

What would be the potential impact of oil production?

- The move is likely to be highly detrimental to the US, which has repeatedly asked the organisation to increase oil production.

- Slashes in reduction and subsequently increased oil prices can be particularly dangerous to the UK, which is trying to reduce inflation rates before the upcoming midterm elections in November as to the extent that prices rise, it will make it that much more challenging for Europe to proceed with its sanctions on Russian oil.

Impact on developing nations:

- For the developing countries, it is a double blow as they would need to think about whether to handle high food prices or fuel prices, as even food prices are high which has put inflationary pressure on economies.

- They will need to handle both and there will be demand destruction in food as well as fuel and a drop in demand will impact producers.

Challenges for India:

- India imports more than 80 percent of its oil requirements to meet the oil demand and thus, this will lead to an increase in the oil import bill and loss of forex on account of the rise in prices.

- The rise in import bills will not only lead to inflation and a rise in the Current Account Deficit (CAD) and fiscal deficit but will also lead to further weakening of the rupee against the dollar hurting stock market sentiments.

- For every $10 per barrel increase in the price of the Indian crude oil basket, the CAD could widen by $14-$15 billion or 0.4% of GDP.

- Another challenge ahead would include an increase in subsidy burden as India provides oil subsidy on retail prices to protect the consumers.

Will the price rise lead to India sourcing more Russian crude?

- Most of the Indian refineries can process only limited quantum of Russian oil because of the crude quality and thus, Indian refiners are mainly dependent on West Asia for the supply.

What needs to be done?

- While the transition towards other sources of energy and increasing the fossil fuel output is an ongoing process, India due to its sheer consumer base can bargain on price, if it remains consistent in its approach and does not buckle under international pressure as it did during the Iran sanctions.

- In the short term, India can pursue the increase in electric vehicles and should try to avoid fuel subsidies or tax reductions and instead protect low-income consumers in other ways.

- The cap on oil prices (as discussed by G7) is possible, but it will have major unintended consequences.

- India needs to think about how it secures the benefits of the price cap and how to redistribute those to consumers.

- A middle path which hurts neither the producer nor the consumer is the ideal situation.

Conclusion:

- At present, five million barrels of petroleum are being consumed in India every day and it is also increasing by three per cent, which is higher than the global average of around one percent. Therefore, OPEC+ has to be mindful of consumers like India and China.

- India’s sheer demand size gives it a voice in the global market and if consumers like India and China combine forces, then it would become difficult for producers to play on the price.

Source: The Hindu BL

Mains Question:

Q. What are the potential impacts of slashing oil production by OPEC+? What should be the way forward for India in order to protect the economy and its consumers from inflationary pressures? (250 words).