OECD-UNDP Framework for SDG Aligned Finance launched

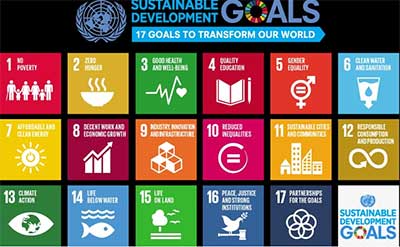

The Organisation for Economic Co-operation and Development (OECD) and the United Nations Development Programme (UNDP) launched a plan recently to help public and private actors identify and prioritise investments contributing to the Sustainable Development Goals (SDGs).

Requested by France’s G7 presidency last year, the framework was informed by an expert group of individuals across the public and private sectors. It builds upon existing principles and provides an ambitious yet feasible set of complementary measures, pertaining to policies, standards and tools, for both private actors and public authorities to deploy capital in ways that drive the greatest impact towards achieving SDGs without harming the intertwined goals.

Why SDG alignment matters ?

SDG alignment is indeed the first and necessary step to put finance to work for the prosperity, peace and wellbeing of people and planet, reduce global inequalities, and to secure the long-term value of assets otherwise challenged by recurrent systemic shocks linked to poor management of global public goods.

COVID-19 has made the case for alignment even stronger, waking us up to the costs of ignoring systemic risks, the interdependence of countries in their progress towards achieving the SDGs, and the interlinkages between the SDGs. As Covid-19 exposes, failure to meet one SDG will be of detriment to the others and will affect us all.

With an expected USD 700 billion drop in external finance to developing countries this year, the financing needed to meet the Global Goals is at risk of collapse, threatening decades of progress on poverty alleviation and sustainable development. But trillions of dollars available in the financial system could be better aligned with SDGs to curb this trend, considering that the financing gap to achieve the SDGs --around USD 2.5 trillion per year-- barely represents a small fraction of the global financial assets, including cash, bank deposits, bonds, stocks, etc.

“Over 379 trillion dollars of total assets are in the system held by banks, institutional investors and asset managers. Reallocating only 1.1% could be enough to fill the growing SDG financing gap. We need harmonised policies along the investment chain to make our savings and investment work better for people and the planet and build systemic resilience.