Context

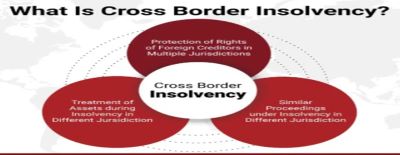

The implementation of cross-border insolvency laws is crucial for international trade. Incorporating these regimes into a country’s legal framework is seen as a key feature of effective insolvency laws. In addition to offering legal certainty, they enhance the stability of trading entities engaged in cross-border activities, ultimately benefiting investments and global commerce.

Overview

Currently, approximately 59 countries, including the United States, the United Kingdom, Japan, and South Korea, have adopted and integrated the UNCItral model law on cross Border Insolvency into their legal frameworks. India also adopted the Model Law on Cross-Border Insolvency on May 17, 2022.

Implementing the Model Law

- The discussion around the adoption of harmonized laws for cross-border insolvency has been ongoing. Since the late 1990s, the UN Commission on International Trade Law (UNCITRAL) has worked to promote its Model Law, which is built on four key pillars: access, recognition, cooperation, and coordination, among various nations.

- Several countries, including India, have acknowledged its potential benefits, as noted by the Bankruptcy Law Reform Committee while drafting the Insolvency and Bankruptcy Code (IBC) in 2016, as well as in the Indian government's Economic Survey of 2022.

- However, progress in adopting the Model Law has been sluggish. According to UNCITRAL, only 60 countries have embraced it. Moreover, its implementation has varied significantly, as nations have customized it to suit their needs, often including clauses for reciprocity and public policy exceptions.

- India, in particular, has yet to implement the Model Law despite multiple committee recommendations. Recent reports suggest that a decision on this matter has been postponed once again. While the Union Budget expressed support for enhancing the IBC’s efficiency through technological advancements and improved judicial infrastructure, it did not address the Model Law adoption. Currently, India relies on limited provisions that allow for bilateral agreements on a case-by-case basis for cross-border insolvencies, which are often viewed as inadequate and ad hoc.

- At the same time, India has been actively entering into Free Trade Agreements (FTAs), Comprehensive Economic Cooperation Agreements (CECAs), Comprehensive Economic Partnership Agreements (CEPAs), and similar pacts. According to the Commerce Ministry, India has signed agreements with over 54 countries. FTAs are defined as arrangements aimed at reducing or eliminating tariff and non-tariff barriers on significant trade, covering areas like intellectual property rights and investments. In contrast, CECAs and CEPAs are more comprehensive agreements that encompass goods, services, and investments, including broader aspects such as trade facilitation and cooperation. Thus, it is essential to explore how these agreements address the issue of insolvency.

Insolvency Provisions

- Despite the increasing number of FTAs and CEPAs and their significance for trade, these agreements often lack detailed cross-border insolvency provisions. While FTAs have a more limited scope, CEPAs and CECAs are considered "more ambitious," addressing deeper regulatory trade aspects (Commerce Ministry). However, in their current form, most agreements include only general dispute resolution or trade remedy clauses. Although FTAs facilitate trade, which raises the need for cross-border insolvency laws, such laws are essential for international trade and should be integrated into these agreements while awaiting the adoption of any harmonized law.

- Regarding the Model Law, while it is well-recognized, its effectiveness as an optimal solution for diverse economic and legal systems remains debated. Some scholars suggest that international treaties, frameworks, and protocols can be customized to address specific cases effectively, complementing the existing legal framework.

- India has signed four new FTAs from 2021 to 2024 and is pursuing similar agreements with various nations (Economic Survey, 2024). Therefore, until the Model Law is adopted, there is no reason why FTAs cannot include insolvency provisions. These agreements could incorporate complementary cross-border provisions. Currently, while FTAs address disputes, intellectual property rights, and even sustainability, they largely overlook insolvency. If CECAs and CEPAs are designed to explore deeper regulatory aspects, why shouldn’t they encompass insolvency issues?

- This gap is not only evident in bilateral and regional agreements but also in key World Trade Organization reports, which fail to explicitly discuss cross-border insolvency while addressing factors that influence the future of trade. Thus, it is crucial to integrate the importance of insolvency laws into the discourse on global trade through both multilateral and bilateral channels. Specifically, FTAs are incomplete without addressing cross-border insolvency.

- There needs to be a deeper understanding of the critical role that sound insolvency laws play in international trade. FTAs (and similar agreements) should include mechanisms to manage the consequences of insolvency for trading entities. This would enhance the effectiveness of FTAs being negotiated by India and could inform the government’s agenda in developing standard operating procedures (SOPs) for these agreements. While the practical feasibility of linking insolvency issues with FTAs is best evaluated by the Commerce Ministry, the Insolvency and Bankruptcy Board, and legal experts, addressing these challenges promptly will yield significant benefits for India’s trade.

Conclusion

the implementation of cross-border insolvency laws is essential for fostering international trade and ensuring the stability of trading entities. While significant progress has been made globally, including India's adoption of the UNCITRAL Model Law, the integration of comprehensive insolvency provisions into Free Trade Agreements and other international agreements remains inadequate. To enhance the effectiveness of these agreements, it is crucial to address the gaps in insolvency regulations and recognize their importance in trade discussions. By doing so, India can strengthen its trade framework and better prepare for the complexities of cross-border insolvencies, ultimately benefiting its economic landscape and international relations.

|

Probable questions for UPSC mains examinations

|

Source: The Hindu