Relevance: GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Key phrases: PM Fasal Bima Yojana, Premium cover, claim delay, voluntary for farmer, State subsidy premium, Beed Model.

Why in News?

- Maharashtra, one of the major States to participate in the Pradhan Mantri Fasal Bima Yojana (PMFBY) with more than 1 crore farmer applications every year might opt out of the scheme. The State government is considering launching its own crop insurance scheme for farmers as per their demand.

Background:

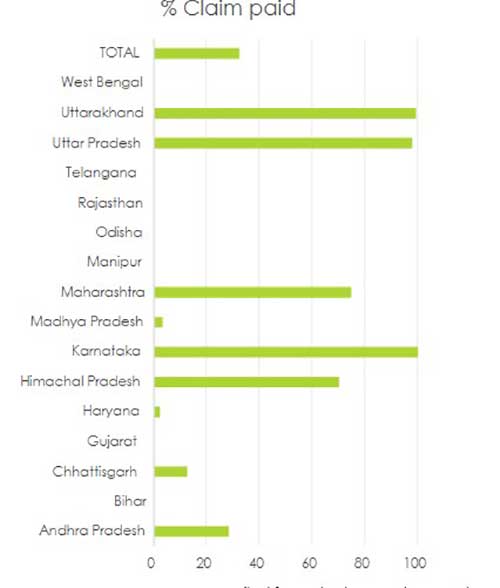

- Since PMFBY was launched in 2016, Punjab never joined the scheme while Bihar and West Bengal withdrew from it in 2018 and 2019 respectively while Andhra Pradesh, Gujarat, Telangana and Jharkhand have not implemented the Scheme in 2020.

- Now, Maharashtra one of the major States to participate in the Pradhan Mantri Fasal Bima Yojana (PMFBY) with more than 1 crore farmer applications every year might opt out of the scheme.

- In Maharashtra’s Beed cluster, farmers are up against the State government and insurance companies for not settling earlier claims, while the latter have decided to stay out of bids for this region for the current season.

- It is in the nature of the insurance business for entities to make money when crop failures are low and vice-versa. Over the last three years, insurance companies have collectively paid claims amounting to about 85 per cent of the premium collected.

PM Fasal Bima Yojana

- Pradhan Mantri Fasal Bima Yojana (PMFBY) scheme was launched in India by Ministry of Agriculture & Farmers welfare, New Delhi from Kharif 2016 season onwards..

- It provides a comprehensive insurance cover against failure of the crop thus helping in stabilising the income of the farmers.

- All food & oilseed crops and annual commercial/horticultural crops for which past yield data is available.

- The prescribed premium is 2% to be paid by farmers for all Kharif crops and 1.5% for all rabi crops. In the case of annual commercial and horticultural crops, the premium is 5%.

- From Kharif 2020, the scheme was made voluntary and the farmers were given an option to opt out of crop insurance by submitting a written request to the bank.

- Under the PMFBY, there would be no upper limit on government subsidy provided by centre and state governments. “Even if the balance premium (after farmers’ contribution) is 90%, it will be borne by the government

Why the state government is opting out?

It is true that due to high actuarial rates in several clusters, the states found that a substantial part of their agriculture budget was going to pay premium subsidies. In several states, the claims have exceeded the gross premium. Like Haryana, Madhya Pradesh, Odisha and Tamil Nadu the claims were more than the premium. But yet, it is true that in several states the claims were less than the premium. Several other states have also decided to discontinue this centrally sponsored scheme, in which the states had to pay 50% of premium subsidy.

- State has strongly objected to a provision in the PMFBY which says the existing loanee farmers who do not want to get covered under the Scheme have the option of opting-out from the Schemes by submitting requisite declaration to loan sanctioning bank branches any time during the year but at least seven days prior to the cut-off date for enrolment of farmers for the respective season. All those loanee farmers who do not submit the declaration would be essentially covered and premium is deducted, as per the current PMFBY rules.

- Bihar and Jharkhand have started their own crop insurance schemes under which farmers do not have to pay any premium and they are eligible for crop insurance upto 2 hectares, if shortfall in yield is more than 20% of threshold yield. The insurance scheme in West Bengal is modelled on PMFBY and the companies are selected through a tender. The state does not take any premium subsidy from the Centre.

- The financial constraints of the state governments and low claim ratio during normal seasons are the major reasons for non-implementation of the Scheme by these States. Though most of the withdrawing States are implementing their own Scheme.

- States (Bihar, West Bengal and Andhra Pradesh, Telangana, Jharkhand and now Gujarat) has opt out of the scheme and launched their own versions. They told that if farmers are dissatisfied with both the level of compensation and delays in settlement, insurance companies have shown no interest in bidding for clusters that are prone to crop loss, so what the benefit of this Scheme is.

Why delay in claim payments?

- The Union Ministry of Agriculture in December last year told Rajya Sabha settlement of a few claims in some States got delayed due to reasons like delayed transmission of yield data and late release of their share in premium subsidy by some State governments to insurance companies.

- The delays were also attributed to yield-related disputes between insurance companies and States, non-receipt of account details of some farmers for transfer of claims to the bank account of eligible farmers, and National Electronic Fund Transfer (NEFT) related issues.

Way forward:

- If the farmer is not enthused by crop insurance despite the 95-98 per cent subsidy on premium, it means that the product needs improvement. Farmers deserve a better choice of insurance products to meet the specifics of each crop or region. For this, insurance companies should be offered more freedom to operate.

- For now, the Beed ‘model’, can emerge as a way out of the current mess.

- The guidelines issued by the Centre in February 2020 have sought to address the above criticisms.

- From Kharif 2020, the scheme was made voluntary and the farmers were given an option to opt out of crop insurance by submitting a written request to the bank.

- Secondly, like the Modified National Agricultural Insurance Scheme (MNAIS), introduced by UPA II in 2010-11, the government capped the Central government’s liability in the premium at 30% for unirrigated areas and crops and 25% for irrigated areas or crops.

- Apart from this, a lot more needs to be done in bringing about a behavioural change regarding the cost of insurance being a necessary input and not a money-back investment.

Beed ‘model’

Under the model, the insurance company provided a

cover of 110% of the premium collected, with caveats. If the

compensation exceeded the cover provided, the state government would pay the

bridge amount. If the compensation was less than the premium collected, the

insurance company would keep 20% of the amount as handling charges

and reimburse the rest to the state government.

In a normal season where farmers report minimal losses, the state government

is expected to get back money that can form a corpus to fund the scheme for

the following year. However, the state government would have to bear the

financial liability in case of losses due to extreme weather events.

Some Example of State schemes:

Andhra Pradesh has started Dr. YSR Free Crop Insurance Scheme, while Bihar has launched Bihar Rajya Fasal Sahayata Yojana. Gujarat has its own Mukhyamantri Sahay Yojana while West Bengal is implementing Bangla Shashya Bima. Jharkhand has its own Fasal Rahat Yojana.

Source: The Hindu BL

Mains Question:

Q. Maharashtra, one of the major States to participate in the Pradhan Mantri Fasal Bima Yojana (PMFBY) with more than 1 crore farmer applications every year might opt out of the scheme, In light of the statement discuss the reasons behind states’ decision? What should be the measures to tackle this issues? Critically analyse.