Context-

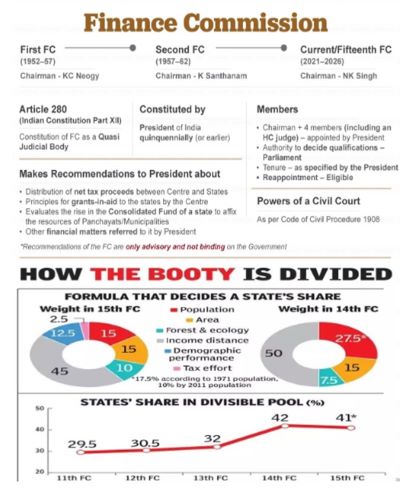

The devolution of Union tax revenue to States is an ongoing topic of discussion in both political and economic spheres. The Finance Commission (FC) determines the horizontal distribution formula for States' share in Union tax revenue every five years. Despite repeated reviews, the focus remains on equity over efficiency. This focus on intragenerational equity, which aims to redistribute tax revenue among States, often leads to intergenerational inequity within States. TExperts argue for the inclusion of intergenerational equity as a factor in India's horizontal distribution formula for tax devolution.

Intergenerational Fiscal Equity

Intergenerational equity is the principle of providing equal opportunities and outcomes to every generation, ensuring that the actions of current generations do not burden future generations. In public finance, it implies that each generation pays for the public services it receives without imposing debt on future generations. Governments can raise revenue through taxes or borrowing. If tax revenue equals current expenditure, current taxpayers pay for the services they receive. However, if expenditure is financed through borrowing, future generations will face higher taxes to repay the debt and interest, leading to intergenerational inequity.

Principles of Intergenerational Equity

Intergenerational equity is based on the ethical principle that no generation should impose undue financial burdens on future generations. This principle is crucial for sustainable development and long-term fiscal stability. When governments prioritize short-term gains through borrowing, they risk creating substantial financial obligations for future taxpayers, undermining the principles of fairness and justice across generations.

Ricardian Equivalence Theory

The Ricardian Equivalence Theory suggests that when governments borrow to finance current expenditure, households increase savings to enable future generations to pay higher taxes while maintaining constant aggregate demand. However, this theory does not hold in India's federal context. In developed States, households pay taxes that are not entirely used within their States, leading to more borrowing or curtailed expenditure. In contrast, households in developing States pay less tax than the value of their public services, supplemented by higher financial transfers from the Union government.

Implications for Fiscal Policy

Intergenerational equity has significant implications for fiscal policy. Policymakers must consider the long-term impacts of their decisions, ensuring that fiscal policies do not lead to unsustainable debt levels. This requires a balance between current spending and future obligations, promoting fiscal responsibility and prudent financial management. Integrating intergenerational equity into the tax devolution formula can encourage States to adopt more sustainable fiscal practices.

Intragenerational Equity

Intragenerational equity focuses on the fair distribution of resources and opportunities within a single generation. This concept is crucial in ensuring that all individuals, regardless of their socio-economic status, have access to essential services and opportunities for development. In the context of tax devolution, intragenerational equity aims to redistribute resources among States to promote balanced regional development.

High-Income vs. Low-Income States

For a broader perspective, consider major States divided into high-income (Tamil Nadu, Kerala, Karnataka, Maharashtra, Gujarat, Haryana) and low-income (Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan, Odisha, Jharkhand) categories. During the 14th FC period (2015-20):

● High-Income States: These States financed 59.3% of their revenue expenditure with their own tax revenue, while low-income States financed only 35.9%. The Revenue Expenditure to GSDP ratio was 10.9% for high-income States, compared to 18.3% for low-income States.

● Low-Income States: These States received 57.7% of their revenue expenditure from Union financial transfers, whereas high-income States received only 27.6%. This significant disparity highlights the challenges in achieving both intragenerational and intergenerational equity.

Federal Finances Analysis

This analysis reveals three key aspects:

1. Revenue Financing: Low-income States finance a smaller portion of their expenditure with their own revenue and receive larger Union transfers. This dependence on Union transfers limits their fiscal autonomy and creates long-term sustainability concerns.

2. Expenditure and Transfers: High-income States finance a substantial portion of their expenditure with their own revenue but receive minimal Union transfers. This imbalance requires high-income States to maintain fiscal discipline while managing higher deficits.

3. Fiscal Deficits: High-income States incur a higher deficit (13.1%) compared to low-income States (6.4%), despite raising more revenue and curtailing expenditure. This situation indicates the need for a more balanced approach to fiscal transfers that considers both equity and efficiency.

Implications for Public Services

Citizens expect the public services provided to match their tax contributions. However, the current fiscal behaviour burdens high-income States with higher taxes, impacting both present and future generations. Balancing intragenerational and intergenerational equity is crucial for a fair distribution formula. This responsibility falls to the FC to address conflicting equity issues effectively.

Addressing Conflicting Equities

- Current Indicators and Their Limitations

The FC currently uses indicators such as per capita income, population, and area, which reflect States' demand for public services and available revenue. These indicators prioritize equity in Union financial transfers. Efficiency indicators like tax effort and fiscal discipline carry less weight, despite their importance in rewarding fiscal efficiency.

Equity variables are often proxy variables that do not reflect actual fiscal situations. Efficiency indicators, derived from State budgets, directly impact the Budget and fiscal behaviour. Therefore, including more fiscal variables in the tax devolution criterion is appropriate to influence States' fiscal behaviour positively.

- Legal and Fiscal Constraints

All States have a Fiscal Responsibility Act limiting deficits and public debt. However, reduced Union financial transfers can compel some States to breach these limits. The FC should assign greater weight to fiscal indicators and incentivize tax effort and expenditure efficiency through larger Union transfers. This approach would ensure intergenerational fiscal equity and sustainable debt management.

- Balancing Equity and Efficiency

Balancing equity and efficiency is a complex but necessary task for the FC. Equity ensures that all States have the resources needed to provide essential public services, while efficiency encourages States to use resources wisely and promote economic growth. A balanced approach that integrates both equity and efficiency can lead to more sustainable fiscal practices and equitable development across regions.

Proposals for a Balanced Approach

1. Enhanced Fiscal Indicators: Incorporate additional fiscal indicators such as tax effort, fiscal discipline, and debt management into the tax devolution formula. These indicators can provide a more accurate reflection of States' fiscal situations and promote responsible financial behaviour.

2. Incentivizing Efficiency: Assign greater weight to efficiency indicators in the distribution formula. This can incentivize States to improve their tax collection efforts, manage expenditures effectively, and reduce fiscal deficits.

3. Long-Term Planning: Encourage States to adopt long-term fiscal planning and sustainability measures. This can include setting clear targets for debt reduction, maintaining balanced budgets, and investing in sustainable development projects.

4. Periodic Reviews: Conduct periodic reviews of the tax devolution formula to ensure it remains responsive to changing economic conditions and fiscal needs. This can help maintain a dynamic and fair distribution system that adapts to evolving challenges.

Conclusion

The Finance Commission needs to reassess the indicators used to reward State fiscal efficiency. By incorporating intergenerational equity into the tax devolution formula, the FC can ensure a fairer distribution of resources that balances both current and future generations' needs. This shift would address the conflicting equities and promote sustainable fiscal practices across States. Balancing both intragenerational and intergenerational equity is crucial for a fair and efficient tax devolution system that supports long-term fiscal stability and equitable development.

|

Probable Questions for UPSC Mains Exam- 1. How can the integration of intergenerational equity into the tax devolution formula help promote sustainable fiscal practices and long-term economic stability among Indian States? (10 marks, 150 words) 2. What are the potential challenges and benefits of including additional fiscal indicators, such as tax effort and fiscal discipline, in the Finance Commission's criteria for distributing Union financial transfers to States? (15 marks, 250 words) |

Source- The Hindu