Context-

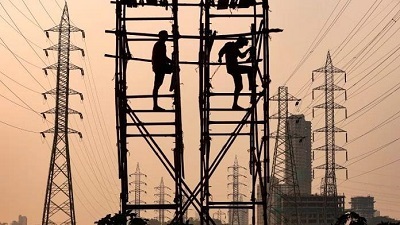

Government reported on the introduction of an amendment to India’s power export rules. Purported to hedge against political risks in Bangladesh, it allows Indian power exporters to reroute their output to Indian grids if there is a delay in payments from partner countries. Adani Power’s plant in Godda (Jharkhand) supplies its entire generated power to Bangladesh.

What is the Godda project?

- The Jharkhand-subsidiary of Adani Power supplies 1,496-megawatt net capacity power to Bangladesh from the ultra super-critical thermal power plant in Godda. This is facilitated under a Power Purchase Agreement (PPA) entered with the Bangladesh Power Development Board (BPDB) in November 2017 for a period of 25 years.

- The Godda plant is India’s first transnational power project that supplies all the power generated to another nation. In a statement on July 15 last year, Adani Power stated that the electricity supplied from Godda will have a positive impact on the neighbour’s power situation by replacing costly power generated using liquid fuel. It elaborated that the transition would help reduce the average cost of power purchased.

- As per the Bangladesh Power Development Board’s (BPDB) annual report for 2022-23, the total installed generation capacity of the country was 24,911 MW in June 2023. Of this, 2,656 MW was imported from India (more than 10% of overall) with the Godda plant contributing 1,496 MW (about 6% of overall).

- On the policy prerogative for power export, India’s Ministry of Power illustrating the guidelines for power export in 2016 said the exchange of electricity across South Asia would promote “economic growth and improve the quality of life for all the nations”.

Why was the project criticised?

- Thermal power plants rely on coal as their primary fuel source. However, the use of coal from the Carmichael mine in Australia to generate electricity for Bangladesh has faced scrutiny. A 2018 analysis by the Institute for Energy Economics and Financial Analysis (IEEFA) concluded that the PPA allowed Adani Power to pass on the elevated costs of importing and transporting coal to Bangladesh.

- In February 2023, the Bangladesh Power Development Board (BPDB) formally requested a PPA revision, citing an exorbitant coal price of $400 per metric ton. The BPDB argued that this price was excessive compared to the $250 per metric ton paid for coal at other thermal plants. Additionally, concerns were raised about the high capacity and maintenance charges imposed by Adani Power, regardless of electricity generation. These charges were deemed significantly above industry standards.

Why does Bangladesh need imports?

- The answer is underutilisation. t Bangladesh has made notable progress in expanding electricity access, especially in rural areas. However, notwithstanding the increase in electricity generation, India’s South Asian neighbour continues to experience fuel and gas supply constraints, thus, contributing to the underutilisation of its power plants.

- In fact, in July 2022, Bangladesh had sought support from the International Monetary Fund (IMF) to cushion itself against a financial shock originating from volatile energy prices after Russian actions in Ukraine. This was after the country experienced blackouts, sometimes up to 13 hours a day, as utilities struggled to source enough diesel and gas to meet demand.

- Separately, Bangladesh-based activist specialising in matters relating to power and climate change, also pointed to total power generation capacity as on June 30 this year being 28,098 MW, of which the highest power generation was scaled at 16,477 MW an unutilised idle capacity of about 11,621 MW.

Where do we stand now?

- It states that the regulatory change endows greater flexibility to power exporters by permitting them access to the domestic market and reducing the dependency on external markets. He explains that it mitigates risks associated with instability or economic challenges in neighbouring countries.

- Further, activist explained that delay in payments have been a standard phenomenon. It explained that a comprehensive internal review process begins once a bill is submitted to the BPDB. The BPDB carefully examines the bill, verifying coal prices against the open market and scrutinizing other listed expenses. Any discrepancies identified are communicated back to the company for necessary adjustments.

- It indicated that while a complete supply cut-off would initially cause disruptions lasting two to three days due to its sudden nature, the long-term impact on Bangladesh would be minimal.

Conclusion

The introduction of an amendment to India’s power export rules, Purported to hedge against political risks in Bangladesh, it allows Indian power exporters to reroute their output to Indian grids if there is a delay in payments from partner countries.

|

Probable Questions for UPSC Mains Exam- 1. What are the potential geopolitical and economic implications of India's amended power export rules on its relationship with Bangladesh, considering the ongoing disputes over the Godda power project? (10 Marks, 150 words) 2. How does the underutilization of power generation capacity in Bangladesh impact the dynamics of power trade between India and Bangladesh, and what are the potential solutions to address this issue? (15 Marks, 250 words) |

Source- The Hindu