Context:

The government is looking to expand the scope of its electric vehicle (EV) policy, announced in March, to include a retrospective effect, which endeavours to prompt global players to localise production and invest in the domestic ecosystem, and will now extend benefits to entities who have already made their investments. The revised policy is expected to be formally announced in August.

Towards Change: Government's EV Policy

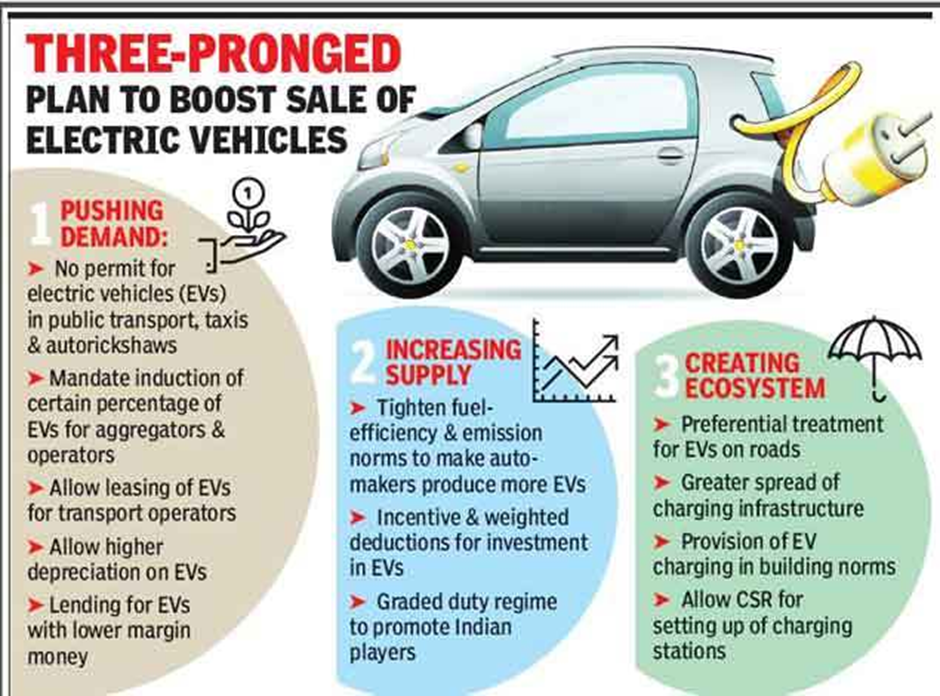

- Focus of the Government's EV Policy : The policy announced in March aimed to provide Indian consumers with access to the latest technology and strengthen the EV ecosystem by encouraging healthy competition among EV players. This was to be achieved by attaining higher volumes of production, economies of scale, and lower production costs. The overall goal was to improve the economics of electric vehicles for Indian consumers while maintaining commercial viability for the ecosystem.

- Policy Mandate : The policy also mandated that half of the value addition in overall manufacturing be done domestically within five years. To maintain commercial viability and retain a foothold in the Indian market, the import duty on EVs as completely built units (CBUs) with a minimum cost, insurance, and freight (CIF) value of $35,000 was reduced from 70%-100% to 15%.

- Potential for Global Leadership : The policy document highlighted that India, being the third-largest automotive market in the world, could potentially lead the global transition from internal combustion engine (ICE) vehicles to decarbonised electric counterparts. The policy recognised that import substitution for EVs would require a layered and sustained approach. To this end, the policy provided mechanisms for manufacturers to address the affordability paradigm essential for Indian consumers.

Electric Vehicle Industry in India: Growth Targets

- Market Potential and Policy Goals : India aims to be the third-largest automotive market by 2030. To address unsustainable fuel-intensive mobility, policymakers are targeting 100% electrification with a "Shared, Connected, and Electric" mobility strategy.

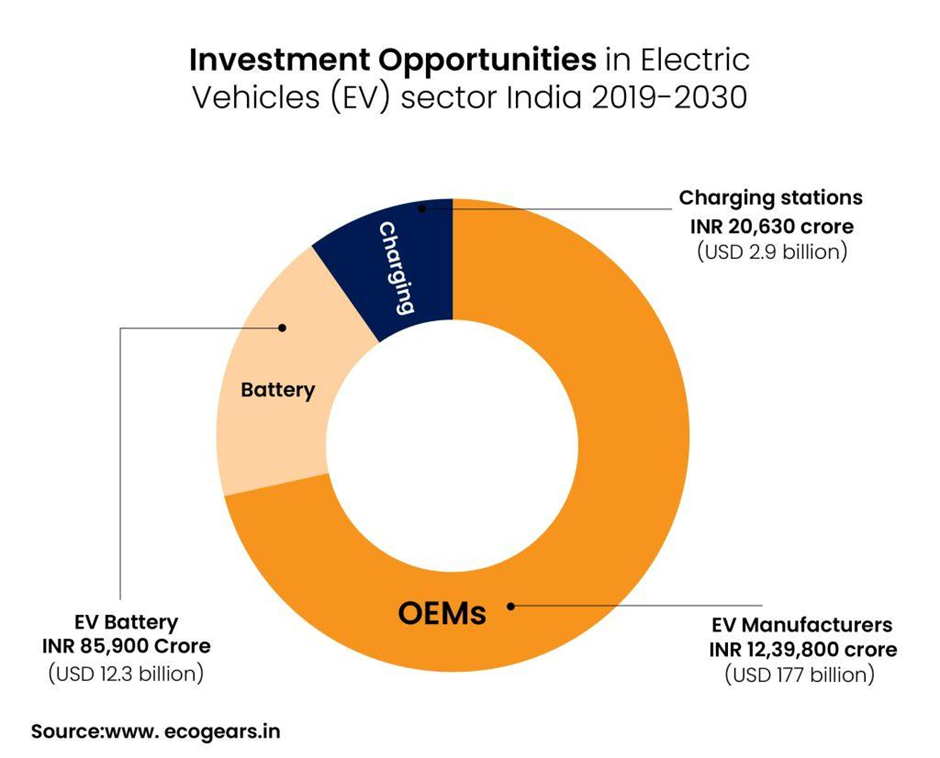

- Benefits of Transitioning to EVs : India can leverage its renewable energy resources and skilled workforce in technology and manufacturing. The EV market could reach US$206 billion by 2030, requiring over US$180 billion in investments. In 2021, the industry attracted US$6 billion, drawing interest from private equity and venture capital investors.

- Market Growth Projections : The Indian EV market is projected to grow at a CAGR of 36% until 2026, with the battery market growing at 30%. By 2030, the industry could create 10 million direct and 50 million indirect jobs. The EV financing market is projected to be worth US$50 billion by 2030, according to Niti Aayog.

Why does the Ecosystem Need Investment and Intervention?

- Need for Investment and Intervention : A Niti Aayog report in 2022 argued that purchasing a vehicle is a major investment decision for most Indian consumers. Therefore, it was essential to ensure viable economics for owning, maintaining, and running an EV—the total cost of ownership. The report suggested that a sharper decline in costs would accelerate the EV adoption timeline. The report also pointed to India's structural unit cost disadvantages in producing select cell components, such as CAM NMC (8-10%) and electrolyte (2-3%).

Additionally, certain cell components, like separators, copper foil, and anode active material (AAM), require significant capital investment—about $200-500 million for a 20-30 GWh plant. The commission recommended creating an enabling ecosystem to attract large-scale capital investment compared to other geographies.

- Addressing After-Sales Service and Scalability : The Bain & Company India EV Report (2023) observed that after-sales service was a significant pain point for EV customers, particularly in the two-wheeler segment. The report raised concerns about the scalability of business models where OEMs (Original equipment manufacturer) partnered with standalone breakdown service providers (such as Ampere with ReadyAssist). The report also highlighted the need for significant investor support to realise the $100 billion-plus EV opportunity in India. Investors need to evaluate potential assets based on sustainable competitive advantages, go-to-market and distribution capabilities, customer feedback and brand perception, talent and culture, and manufacturing and supply chain strategy.

- Importance of Local Manufacturing and Technology Transfer : The need for policies to ensure that foreign direct investment (FDI) focuses on building local manufacturing capabilities and technology transfer. The goal should be to strengthen domestic players in creating capabilities for critical components and to integrate foreign automakers with domestic suppliers' networks. This approach would enable India to establish itself as a core player in the global supply manufacturing chain rather than remaining a peripheral player.

- Comparison with Global Policies : The EV policy announced in March shares similar priorities with those in the U.S., China, and Europe, where incentives are given on a case-by-case basis to different companies for setting up capacity for EV value chain manufacturing. These incentives include land and infrastructure, capital subsidies, financing support, fiscal incentives, and subsidised utilities. However, the International Energy Agency (IEA)'s Global EV Outlook for 2024 pointed out that electric cars remain 10% to 50% more expensive than combustion engine equivalents in Europe and the U.S., depending on the country and car segment. Notably, Europe and the U.S. meet 20% and 30% of their EV battery demands through imports, highlighting the necessity for integrated production lines.

Conclusion

The Indian government's plan to expand its EV policy to include retrospective benefits aims to incentivize both current and future investments in the domestic EV ecosystem. By encouraging localisation of EV production, boosting technology adoption, and enhancing competitiveness in the Indian EV market, the revised policy is expected to stimulate investment in manufacturing capacity, reduce costs, and accelerate the adoption of electric vehicles in India.

|

Probable Questions for UPSC Mains

|

Source: The Hindu