Introduction:

Critical minerals are vital for technological advancements, sustainable development, and national security, forming the backbone of industries like renewable energy, electronics, and defense. Despite its substantial mineral wealth, India heavily relies on imports, exposing strategic vulnerabilities, particularly due to global supply chain dominance by nations like China.

India's challenges stem from limited exploration technology, inadequate processing infrastructure, and policy shortcomings, hindering its ability to utilize domestic resources effectively. Overcoming these obstacles requires innovative extraction methods, private sector engagement, international collaborations, and sustainable practices like recycling.

Building a robust critical minerals ecosystem is essential for India to secure economic resilience, reduce dependency, and establish itself as a key player in the global resource economy.

Challenges Faced by India:

India’s dependency on imported critical minerals stems from several challenges:

1. Limited Exploration Technology: India lacks the advanced exploration technology needed to tap into its vast mineral resources effectively. Many critical minerals are found in deep-seated deposits, which require high-tech methods for extraction.

2. Inadequate Processing Infrastructure: India struggles with underdeveloped mineral processing facilities. Despite possessing reserves like lithium in Jammu and Kashmir, India lacks the infrastructure to extract and process these minerals.

3. Policy Shortcomings: The absence of strong policies and financial incentives to promote private sector involvement in mining and mineral processing further exacerbates the country’s reliance on imports.

China’s Dominance in Critical Minerals:

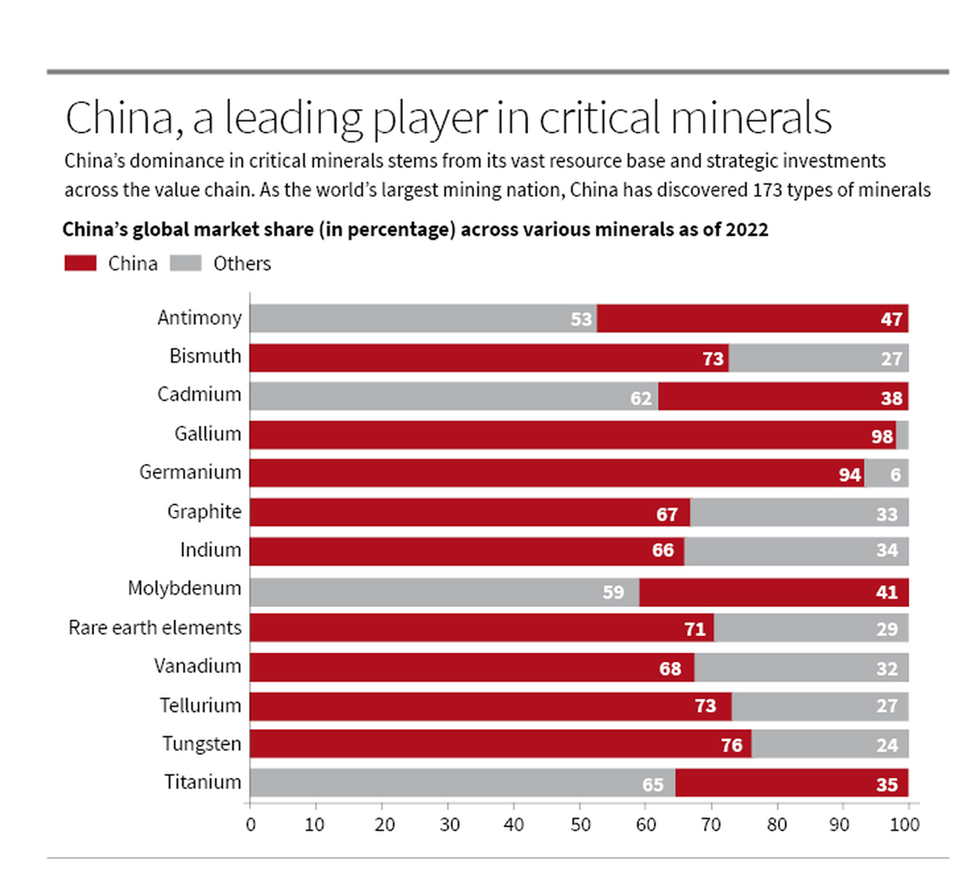

China has cemented its position as the dominant player in the global critical mineral market. This dominance is the result of a well-planned strategy, including robust infrastructure, strategic investments, and global expansion.

1. Resource Base and Exploration: China is the world’s largest mining nation, having discovered 173 minerals, including energy minerals like coal and uranium, metallic minerals like lithium and cobalt, and non-metallic minerals like silicon and graphite. In 2022, China allocated $19.4 billion for mineral exploration, resulting in the discovery of 132 new deposits, including significant reserves of lithium and nickel.

2. Processing and Refining Capabilities: China’s dominance is most evident in its control over processing and refining:

o 87% of global rare earth processing.

o 58% of the world’s lithium processing.

o 68% of silicon processing, crucial for semiconductors and solar panels.

3. Global Reach and Investments: China has invested heavily in overseas mining projects, particularly in Africa, Latin America, and Australia. This expansion has bolstered its global refining and processing dominance, making it the backbone of critical mineral supply chains.

4. Strategic Export Controls: China has strategically used export controls to exert geopolitical influence. Notable instances include:

o Rare Earth Embargo (2010): China restricted rare earth exports to Japan, disrupting global supply chains.

o Gallium and Germanium Restrictions (2023): Export controls were imposed on critical minerals used in semiconductors and electronics.

o Rare Earth Technology Ban (2023): China banned the export of rare earth extraction technologies, consolidating its monopoly in the sector.

|

Critical Minerals: Strategic Resources for Modern Economies Critical minerals are integral to modern technological advancements, economic growth, and national security. They are indispensable in industries like:

India’s Critical Mineral Landscape: India has identified 30 critical minerals vital for its technological and economic future, including lithium, graphite, cobalt, rare earth elements (REEs), and titanium. 1. Graphite: o Reserves: 9 million tonnes (43% in Arunachal Pradesh). o Leading Producer: Tamil Nadu (63%). 2. Lithium: o Discovered in Jammu & Kashmir and Rajasthan. 3. Ilmenite (Titanium): o Global Share: 11%. o Leading Producer: Odisha (60%). 4. Phosphorus: o Reserves: Rajasthan (31%) and Madhya Pradesh (19%). 5. Potash: o Reserves: 2.4 billion tonnes in Rajasthan (91%). 6. Rare Earth Elements (REEs): o Reserves: 11.93 million tonnes of monazite in Andhra Pradesh, Kerala, Tamil Nadu, and Odisha. 7. Platinum Group Elements (PGEs): o Reserves: 15.7 tonnes in Odisha and Karnataka. Rare Earth Critical Minerals in India: India holds the fifth-largest reserves of rare earth elements in the world, nearly double that of Australia. The reserves primarily consist of Light REEs (Lanthanum, Cerium, Neodymium, Praseodymium, and Samarium). However, Heavy REEs (Dysprosium, Terbium, Europium) are not found in extractable quantities in India. India’s Dependency on China: India's critical mineral imports from China are significant. The dependency rates for key minerals between 2019 and 2024 include:

|

Structural Challenges in India:

India's heavy reliance on imports results from several structural issues:

1. Exploration Risks: Many critical minerals are deep-seated, requiring advanced extraction technology and high-risk investments.

2. Processing Deficits: The lack of developed infrastructure to process these minerals, such as extracting lithium from clay deposits, compounds the problem.

3. Policy Gaps: Inadequate policies and financial incentives discourage private sector investment in the mining and processing sector.

India’s Strategic Response:

India has initiated several strategies to reduce dependency on imports and strengthen its critical mineral supply chain:

1. Overseas Asset Acquisition: Through KABIL (Khanij Bidesh India Limited), India has acquired mineral assets in Australia, Argentina, and other resource-rich nations to diversify supply sources.

2. International Partnerships: India has joined global initiatives like the Minerals Security Partnership and Critical Raw Materials Club to secure diversified mineral supply chains.

3. Research and Development: Institutions like the Geological Survey of India (GSI) and the Council for Scientific and Industrial Research (CSIR) are investing in advanced exploration and processing technologies to boost domestic capabilities.

4. Promoting Recycling: India is exploring recycling as a sustainable alternative to primary mineral extraction, particularly for EV batteries, which could help reduce import dependency.

Challenges and the Path Ahead:

India’s journey toward reducing critical mineral dependency involves:

1. Technological Advancements: Developing technologies for extracting minerals from complex geological formations.

2. Private Sector Participation: Encouraging private investment through tax incentives, subsidies, and policy reforms.

3. Strategic Reserves: Establishing strategic reserves of critical minerals to buffer against supply chain disruptions.

4. Strengthening Domestic Supply Chains: Building a strong ecosystem for mining, processing, and refining minerals.

Conclusion:

India’s reliance on critical minerals, especially from China, presents a strategic vulnerability. While the government has taken steps to secure mineral assets, diversify supply chains, and promote recycling, achieving mineral independence requires sustained effort. Strong policy frameworks, technological innovations, and international partnerships will be crucial in building a resilient critical mineral ecosystem. India must navigate the path to self-reliance in critical minerals to secure its future in an increasingly resource-dependent and competitive world.

|

Main question: India is endowed with significant mineral resources, yet it remains heavily dependent on imports for critical minerals. Discuss the structural challenges in India’s mining and processing sector that contribute to this dependency, and propose solutions to overcome these challenges. |