GS-3 Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment; Government Budgeting.

Key Phrases: Public debt, debt to GDP, FRBM Act, Weaker public finance, Nominal economic growth, primary deficit, fiscal austerity, public expenditure, tax buoyancy, monetisation of assets.

Why in News?

- The Indian government's debt is estimated to be at 62 per cent of the gross domestic product (GDP) as of March 31, 2022, the Finance Ministry informed the Lok Sabha in the ongoing winter session.

More in News

- One of the more persistent economic burdens that the pandemic leaves behind is the high level of public debt.

- The collapse in economic activity during the worst months of the pandemic forced the government to borrow more to run its essential services, provide some support to the poor, and build infrastructure in the absence of robust private-sector investment.

- Public debt as a proportion of India’s gross domestic product (GDP) as a result, shot up by 15 percentage points in a year to 89.8%.

- Public debt is expected to decline only gradually, from the current

89.8% to 85.7% at the end of 2025-26, according to estimates of the 15th

Finance Commission.

- That will still be 25 percentage points higher than what the committee to review the Fiscal Responsibility and Budget Management Act had recommended in 2017.

Global Comparison:

- Most countries have seen their public debt shoot up because of a decline in revenues as well as an increase in spending after the pandemic struck, so India is not an exception.

- The combined debt of the Union government and states is a massive 26

percentage points higher than the average of emerging-market and

middle-income countries, which was 64.3%.

- It is also 20 percentage points higher than its Asian peers.

- Much of this gap is not just because of what happened in the first two years of the pandemic, but also because India entered the crisis with weaker public finances than most comparable economies.

Steps to bring down their public debt:

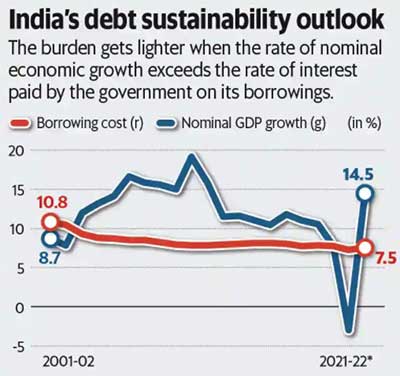

- The burden of public debt will get lighter when the rate of nominal

economic growth is much higher than the rate of interest that the government

pays on its debt; the need for a sharp reduction in its primary deficit is

relatively small.

- On the other hand, the government will have to aggressively bring down its primary deficit, or even aim for a primary surplus, in case nominal economic growth is weak and/or there is a jump in interest rates.

- Hence, the need to go for fiscal austerity is lower when the economy is growing rapidly and the government is paying low rates of interest on its public debt.

- India managed to bring down its ratio of public debt to GDP by 18 percentage points between 2002-03 to 2010-2011 because of its splendid growth acceleration; the Union government reported a primary surplus in only two of those nine years.

- The gap between interest rates and nominal GDP growth narrowed after that, as nominal economic growth came down sharply because of a combination of slower real growth as well as lower inflation.

The charts here show the India story since the turn of the century in terms of the rate of interest on government borrowings (r), the rate of nominal economic growth (g) , and the difference between the two (r-g).

What’s in Future?

- Estimates suggest that the burden of public debt—and hence the interest costs of the government—will continue to be high by historical standards till at least the middle of this decade.

- However, there is no reason to be worried about the sustainability of

Indian public debt as long as economic growth is on track.

- The International Monetary Fund says that the debt-stabilizing primary deficit for India is 2.9% of GDP, which is lower than the current elevated level because of the pandemic but in line with the average level over the medium term.

- This has important implications for Indian macroeconomic policy:

- As the monetary policy of the Reserve Bank of India pivots back towards inflation control, and thus gives less importance to supporting the fiscal operations of the government, interest rates will begin to inch up.

- The primary deficit will only gradually come down to sustainable levels in the next three years.

Government Deficits:

- Fiscal deficit is the difference between the total expenditure of the government and its total income.

- Primary Deficit is the difference between fiscal deficit and

interest payments.

- Primary Deficit = Fiscal Deficit (Total expenditure – Total income of the government) – Interest payments (of previous borrowings)

- When the primary deficit is zero, the fiscal deficit becomes equal to the interest payment. This means that the government has resorted to borrowings just to pay off the interest payments.

Steps Taken by Government:

- As per the government, Centre’s debt is predominantly held in domestic

currency and it is capable of repaying it.

- Foreign-currency government debt makes only 6% of total debt compared with 33% median for peers.

- Further steps taken include:

- Increasing the buoyancy of tax revenue through improved compliance,

- Mobilisation of resources through monetisation of assets,

- Improving efficiency and effectiveness of public expenditure.

- Government has also made headway on India’s potential inclusion in global bond indexes, which could be positive from a credit perspective, as it would open up alternative sources of financing for the government and free up domestic lending.

Way Forward:

- A lot will then depend on the Indian growth trajectory in terms of bringing down the ratio of public debt to GDP, without imposing premature austerity or hindering inflation control via fiscal dominance over monetary policy.

- Hence, there is now good reason for the Union to make economic growth the focal point of the new budget to rein in the burgeoning public debt.

Source: Live Mint

Mains Question:

Q. Indian economic recovery though has gathered strength but some long shadows over the economic outlook still remains. Comment.