India’s pharmaceutical and medical devices sectors are central to the country’s healthcare system and are increasingly contributing to the global supply chain. With robust government support, a steady inflow of foreign direct investment (FDI), and transformative Production Linked Incentive (PLI) schemes, these sectors are poised for sustained growth and innovation.

The Department of Pharmaceuticals, under the Ministry of Chemicals and Fertilizers, is the primary authority overseeing these sectors. Its goal is to ensure affordable access to quality medicines and to position India as a global pharmaceutical leader. India has earned the reputation of being the ‘Pharmacy of the World’ by manufacturing affordable and high-quality medicines, particularly branded generics. The nation also plays a key role in vaccine supply, consistently serving as UNICEF’s largest supplier, meeting significant proportions of the global demand for vaccines like DPT, BCG, and measles.

In this context, India’s pharmaceuticals and medical devices sector has seen a FDI inflow to the tune of 11,888 crore rupees from April to December in the financial year ended on March 31, 2025. Apart from this, 13 FDI proposals worth 7,246.40 crore rupees for brownfield projects during 2024-25 have been approved, taking the total FDI to 19,134.4 crore rupees, according to figures compiled by the Department of Pharmaceuticals.

Production Linked Incentive (PLI) Schemes

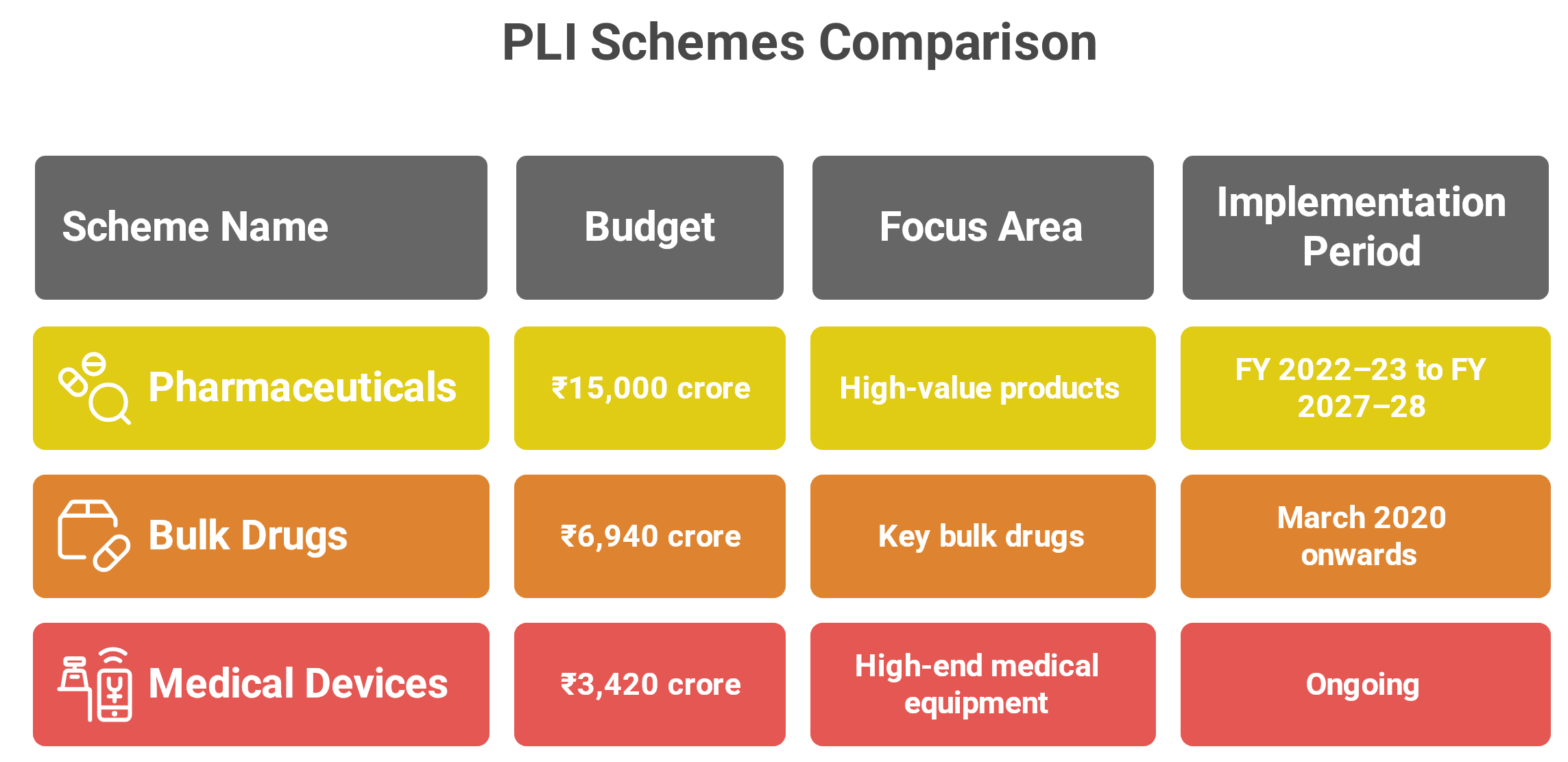

Introduced in 2020, the PLI schemes aim to enhance domestic manufacturing, reduce dependency on imports, and encourage exports. The Department of Pharmaceuticals has launched three major PLI schemes:

-

PLI Scheme for Pharmaceuticals

(₹15,000 crore): Launched in 2021 for implementation from FY 2022–23 to FY 2027–28, this scheme supports 55 selected companies manufacturing high-value products such as complex generics, biopharmaceuticals, patented drugs, APIs, and medicines for lifestyle diseases including cancer and diabetes. -

PLI Scheme for Bulk Drugs

(₹6,940 crore): Initiated in March 2020, this scheme promotes domestic production of 41 key bulk drugs. As of December 2024, 48 projects were selected, of which 34 have begun operations, covering the production of 25 bulk drugs. The total investment realized was ₹4,253.92 crore, exceeding the initial target of ₹3,938.57 crore. Notable examples include Penicillin G in Andhra Pradesh (₹1,910 crore investments, ₹2,700 crore import substitution) and Clavulanic Acid in Himachal Pradesh (₹450 crore investments, ₹600 crore substitution value). -

PLI Scheme for Medical Devices

(₹ 3,420 crore): This initiative encourages the domestic manufacture of high-end equipment such as radiology devices, cancer treatment technologies, and implants. Beneficiaries receive 5% incentives on incremental sales for five years.

Key Supporting Initiatives

1. Medical Devices Sector

India’s medical devices industry spans electro-medical equipment, surgical tools, diagnostic reagents, implants, and disposables. As a capital- and technology-intensive field, it requires continuous innovation and skilled personnel. Government intervention is vital to build domestic capacity, improve quality standards, and boost exports.

2. Promotion of Bulk Drug Parks

To lower manufacturing costs and ensure self-reliance, the government approved the Bulk Drug Parks Scheme in 2020. Three parks—located in Gujarat, Himachal Pradesh, and Andhra Pradesh—are being developed with financial support of up to ₹1,000 crore per park or 70% of the total project cost (90% in hilly/Northeastern states). The overall outlay is ₹3,000 crore, valid until FY 2025–26.

3. Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP)

This initiative focuses on providing affordable medicines through a wide network of Jan Aushadhi Kendras. As of April 2025, 15,479 such outlets operate across India. These centres promote generic drugs and challenge the misconception that only costly medicines are effective. Doctors in public healthcare are encouraged to prescribe generics, enhancing public trust in affordable healthcare solutions.

Strengthening of Pharmaceuticals Industry (SPI) Scheme

With an outlay of ₹500 crore, the SPI Scheme supports micro, small, and medium enterprises (MSMEs) in upgrading their infrastructure and regulatory compliance. Valid from FY 2021–22 to FY 2025–26, the scheme has three primary goals:

- Upgrading Regulatory Standards: It provides reimbursement-based support for facilities aiming to meet Revised Schedule M and WHO-GMP certifications.

- Infrastructure Development: Funding is extended for building common cluster facilities such as testing laboratories, training centres, and research hubs.

- Promoting Knowledge Exchange: The scheme supports policy research, database development, and collaboration among academia, industry, and policymakers.

Enabling Reforms: Patent Law and R&D

India’s pharmaceutical growth story is deeply rooted in its patent policies. The 1970 Patent Act excluded product patents for pharmaceuticals, enabling domestic firms to engage in reverse engineering and manufacture cost-effective alternatives. This legal stance facilitated the rise of India’s generic drug industry.

After the WTO’s TRIPS agreement came into force in 1995, India amended its laws to allow product patents in pharmaceuticals, effective from 2005. Since then, R&D priorities have shifted—while the early 2000s saw 60–65% of budgets allocated to process and reverse engineering, post-2005 focus has increasingly shifted to original innovation, now accounting for 30–35% of R&D investment.

Challenges Ahead

- Intellectual Property Rights (IPR): The Draft Patents (Amendment) Rules, 2023, have sparked concerns about their potential impact on the availability of affordable generics.

- Quality Assurance: Ensuring uniform product quality across manufacturing and distribution networks remains a major concern.

- Regulatory Complexity: Adhering to evolving and often stringent regulatory frameworks poses a burden, especially on smaller firms.

- Talent Shortage: The growing demand for skilled professionals in R&D, quality control, and manufacturing is outpacing current supply.

Conclusion

India’s pharmaceutical and medical devices sectors are charting a path of sustained advancement, powered by government policy, international investment, and domestic innovation. Strategic schemes like PLI and SPI, along with infrastructure development and regulatory modernization, are reinforcing India’s standing as a global hub for pharmaceuticals and medical technologies.

| Main question: India is often called the "Pharmacy of the World" due to its strong generic drug industry and vaccine supply chain. In light of this, discuss the role of government initiatives and reforms in strengthening India’s pharmaceutical sector and enhancing its global competitiveness. |