Relevance: GS-3: Issues related to Direct and Indirect Farm Subsidies and Minimum Support Prices; Public Distribution System - Objectives, Functioning, Limitations, Revamping; Issues of Buffer Stocks and Food Security; Technology Missions; Economics of Animal-Rearing.

Key Phrases : Western sanctions, Domestic consumption, Diversification, Buffer stock, Task group, APEDA (Agricultural and Processed Food Products Export Development Authority),World Trade Organisation.

Why in News?

- Russia and Ukraine account for about 25% of the world's wheat exports. However, Russia's invasion of Ukraine and the subsequent Western sanctions against Moscow have curtailed their wheat supplies drastically. As a result, many countries which were sourcing wheat mainly from these two nations are now in dire need of alternatives.

Status of Export for India:

While Russia and Ukraine exported 183 and 91 million tonnes (MT) of wheat, respectively, between 2017 and 2021, India exported a miniscule fraction of its output, or just 12.6 MT in the period.

- India, which had the second-highest wheat supply (including production, existing stocks and imports) in this period — 613 million tonnes — exported only 2% of this, with about 80% used for domestic consumption, and the rest stored.

- In contrast, other leading exporters could sell big chunks of their supply. For instance, the U.S. exported 31% of its 404 MT of supply in the 2017-2021 period. Canada exported 60.5% of its 186 MT, while Australia exported 57% of its supply of 146 MT.

Global Market:

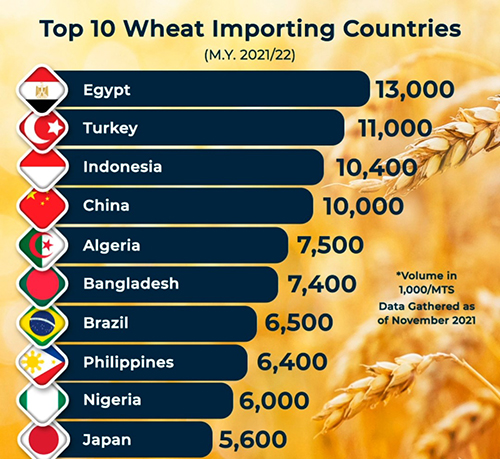

- Many countries in Africa, West Asia and Southeast Asia rely

heavily on Russian and Ukrainian wheat.

- African nations such as Sudan (80% reliance), Tanzania (64%), Libya (53%), Tunisia (52%), and West Asian countries including Lebanon (77% dependency), Yemen (50%) and U.A.E. (42%) are also highly dependent on supplies from the two neighbours now at war.

- Egypt, the biggest importer of wheat, sources 93% of its needs from the East European neighbours.

- Indonesia, the second-largest importer, has a 30% dependency on these two nations.

Opportunity for India:

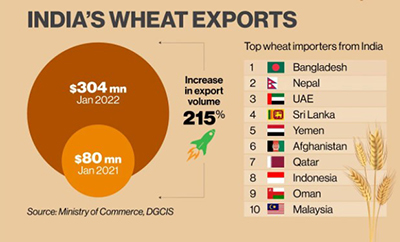

India, the largest wheat producer after China, is reported to be eyeing the void. The government plans to allow increased exports to cash in on the higher price of wheat in the international market.

- Diversification of export: India is now focussing on exporting wheat to many of these above nations like Egypt, Turkey, Nigeria, Algeria, Middle East, Indonesia.

- Creation of task group: To give impetus to the export promotion of wheat as well as to bring focus on the challenges and bottlenecks faced in production and export, APEDA has created a task group

- Catalyzing opportunity: With India's wheat harvesting season (March to May) coinciding with the supply crunch, a bumper crop expected again this year, and a significant amount of buffer stocks, food security campaigners agree that India is well-poised to step in and fill the void.

Agri Export Policy

Keeping in mind the significant Indian agriculture holds, the Government of India introduced Agri Export Policy in 2018.

- To double agricultural exports from present ~US$ 30+ Billion to ~US$ 60+ Billion by 2022 and reach US$ 100 Billion in the next few years thereafter, with a stable trade policy regime.

- To diversify our export basket, destinations and boost high value and value added agricultural exports including focus on perishables.

- To promote novel, indigenous, organic, ethnic, traditional and non-traditional Agri products exports.

- To provide an institutional mechanism for pursuing market access, tackling barriers and deal with sanitary and phytosanitary issues.

- To strive to double India’s share in world agri exports by integrating with global value chain at the earliest.

- Enable farmers to benefit from export opportunities in overseas markets.

Concerns:

- Food security campaigners however, emphasise the need to prioritise

local prices and ensure adequate supplies for domestic consumption before

deciding on the quantum of exports.

- The Global Hunger Index (GHI) 2021 report has put India in the 101st position out of 116 countries. India has slipped from its 94th position in GHI 2020 placing her behind neighbors like Pakistan, Bangladesh, and Nepal.

- The contentious issue of exporting wheat from the FCI stocks adds

another dimension to this issue. If India does so, some developed nations

may raise objections at the World Trade Organisation.

- Already, in March, India was accused of exporting rice from its stocks. India had replied that its rice exports were not from stocks set aside under the public stock holding programmes.

Way ahead:

- Ensuring the stability of prices in India and availability of grain for internal consumption should be of utmost priority to the Indian government while ensuring that farmers are adequately compensated.

- Ensuring food availability: This would require continuing with the PDS [public distribution system], Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) and also expanding the net to bring in more people who are currently excluded.

- Boosting farmers income: Since there are no export restrictions, farmers can also get the advantage of higher prices by selling the surplus to private traders for exports.

Peace clause adopted in W.T.O. 's Bali Ministerial in 2014 does not prevent India from exporting food grains. With the buffer stocks at hand, India should increase its wheat exports in order to stabilise global prices to the extent that it can.

Source: The Hindu

Mains Question:

Q. The Ukraine-Russia war has generated an export vacuum in agriculture commodities. Explain how India can galvanize this opportunity? [250 words].