Context:

During the 8th edition of the India Mobile Congress (IMC) 2024, Prime Minister Narendra Modi highlighted India's significant transformation into a smartphone manufacturing hub. He traced the growth from having only two mobile manufacturing units in 2014 to over 200 units today. This transformation is a key part of India’s push toward self-reliance and global competitiveness in the mobile and electronics sector.

Key Highlights:

1. Smartphone Manufacturing Growth:

o In 2014, India relied heavily on mobile phone imports, but today, the country manufactures six times more phones than it did before.

o This growth is largely driven by initiatives such as the Make in India campaign, which was designed to boost domestic production and reduce dependency on imports.

2. Increased Global Attention:

o India is now seen as a major mobile phone exporter. Currently, 14% of iPhones are manufactured in India, and tech giants like Apple and Google are increasing their production presence in the country.

o India is emerging as a key location for global tech companies, especially as businesses look to diversify production away from China due to geopolitical factors.

3. Ambitious Future Goals:

o PM Modi announced plans to move towards producing a fully Made-in-India phone, including developing a domestic semiconductor ecosystem to manufacture chips locally.

o This initiative aligns with the country’s broader vision to become a leader not only in mobile manufacturing but also in high-tech components like semiconductors.

4. Semiconductor Sector Growth:

o Though India’s semiconductor manufacturing is still at an early stage, the government has set an ambitious goal to grow the electronics sector from $155 billion today to $500 billion by 2030.

o While Taiwan remains the largest global chipmaker, India seeks to collaborate with countries like the US to accelerate its semiconductor development.

Support Measures:

India’s mobile manufacturing success can be attributed to various support measures introduced by the government:

- The Production Linked Incentive (PLI) Scheme and tariff incentives have attracted both domestic and foreign companies to establish a presence in India.

- These initiatives encourage local manufacturing, boost exports, and provide a strong foundation for the country’s future ambitions in high-tech production.

Major Growth Drivers of the Telecom Sector:

1. Digital India Initiative: Launched in 2015, this government initiative aims to create a digitally empowered society, significantly increasing demand for internet services. Internet subscribers surged from 881 million in March 2023 to 954 million by March 2024, with projects like BharatNet enhancing rural connectivity.

2. Affordable Smartphone Penetration: The rise of low-cost smartphones has fueled growth, with 146 million devices shipped in 2023. Initiatives like Google's Android One and government support for local manufacturing have expanded the customer base, especially in tier 2 and tier 3 cities.

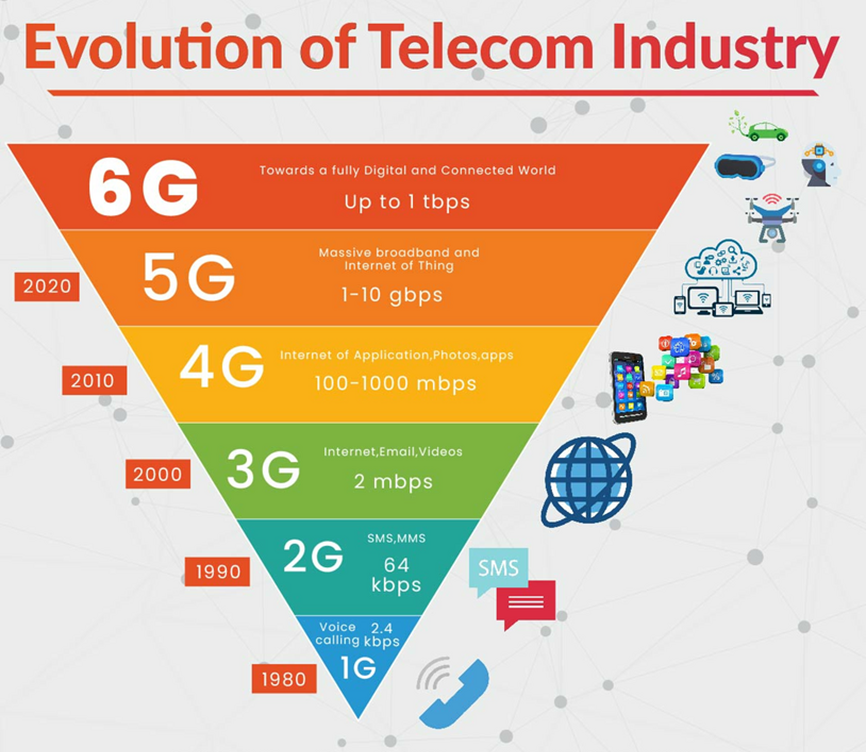

3. 5G Revolution: The rollout of 5G services, initiated in October 2022, has transformed the telecom landscape. As of December 2023, 5G reached around 100 million users across 738 districts, unlocking new opportunities in IoT and smart cities. India is projected to have 920 million unique mobile subscribers by 2025.

4. Rise of Digital Payments: The shift to digital payments has driven telecom growth, with UPI transactions increasing from 920 million in FY 2017-18 to 8.375 billion in FY 2022-23. Telecom companies are leveraging this trend by offering specialized data plans for financial services.

5. Over-the-Top (OTT) Content Boom: The growth of OTT platforms has led to a surge in data consumption. The Indian OTT streaming industry is projected to grow to USD 13-15 billion in the next decade, with telecom operators bundling OTT subscriptions to enhance customer acquisition.

6. Remote Work and Education: The pandemic accelerated the adoption of remote work and online education, resulting in a 30-40% increase in data consumption. Telecom companies upgraded network capacities and introduced specialized plans to meet this sustained demand for high-speed internet.

Major Challenges in the Telecom Sector:

1. Financial Stress: The telecom industry is burdened by significant debt, totaling around ₹6.4 lakh crore as of March 31, 2023. High spectrum costs, intense competition, and substantial infrastructure investments contribute to this financial strain, with Vodafone Idea alone owing ₹2.1 lakh crore, hampering capital expenditure and delaying 5G rollouts.

2. AGR Dispute: The Supreme Court's 2019 ruling expanded the definition of Adjusted Gross Revenue (AGR) to include non-telecom revenues, leading to cumulative liabilities of ₹1.69 lakh crore for telecom companies. This ongoing financial burden continues to strain operators' balance sheets, despite government moratoriums and options to convert dues into equity.

3. Infrastructure Gaps: There is a significant urban-rural divide in telecom infrastructure, with urban tele-density at 133.81% compared to only 57.71% in rural areas as of March 2023. Challenges such as difficult terrain and inconsistent power supply hinder network expansion and quality in rural regions.

4. Spectrum Pricing: High spectrum prices are a major obstacle for operators. The government raised ₹1.5 lakh crore from the 2022 5G spectrum auction, but operators argue that these costs impede network expansion and quality improvements, potentially slowing technology adoption.

5. Quality of Service: Persistent issues with quality of service, including high call drop rates and low connection success rates, lead to customer dissatisfaction and increased churn, negatively affecting revenues.

6. Cybersecurity Threats: The expansion of India's digital landscape has led to a surge in cybersecurity threats, with over 1.39 million incidents recorded in 2022. Telecom networks are prime targets for attacks, resulting in financial losses and eroding customer trust.

7. Regulatory Challenges: The sector grapples with a complex regulatory environment, characterized by frequent policy changes and operational uncertainties. The unresolved definition of Over-The-Top (OTT) services and their regulatory obligations poses significant challenges for long-term planning and investment.

Government Initiatives and Recommendations:

The government has launched several initiatives to address the sector's challenges, including the Prime Minister Wi-Fi Access Network Interface (PM-WANI) and the Bharat Net Project. The Telecommunications Act 2023 focuses on optimal spectrum utilization and better governance in the telecom sector.

To revamp India's telecom sector, the following measures are recommended:

- Rationalizing Spectrum Pricing: Implement a balanced pricing model to alleviate financial burdens on telecom companies.

- Infrastructure Sharing Incentives: Encourage active infrastructure sharing through tax rebates and a centralized database of shareable assets.

- Rural Connectivity Fund: Establish a dedicated fund for rural infrastructure development, leveraging public-private partnerships.

- Regulatory Sandbox for Innovation: Create a flexible framework for telecom and tech companies to test innovative services.

- Skill Development Initiative: Partner with universities to address talent gaps in emerging technologies like 5G and IoT.

- Green Telecom Policy: Promote sustainable practices and renewable energy usage within the sector.

Conclusion:

India's telecom sector is at a pivotal moment, necessitating comprehensive reforms to tackle financial challenges, regulatory complexities, and infrastructure gaps. By rationalizing spectrum pricing, fostering infrastructure sharing, and promoting innovation, the sector can unlock its full potential. Government initiatives like the Telecommunications Act 2023, coupled with a focus on sustainability and rural connectivity, will ensure that the telecom sector contributes effectively to India's digital transformation journey.

|

Probable questions for UPSC Mains exam: Evaluate the role of affordable smartphones and internet penetration in driving India’s digital economy. How have these factors contributed to India’s rise as a global leader in digital payments and telecommunications? |