Date : 07/08/2023

Relevance: GS Paper 3- Economy

Keywords: Purchasing Managers' Index (PMI), Multipolar World, Foreign Direct Investment (FDI),

Context-

In a recent report, Morgan Stanley highlighted the economic prospects of India and China. The broking firm upgraded India's rating to "overweight" while downgrading China to "underweight." The report indicates that India's low GDP per capita of $2,500 presents significant growth opportunities, positioning the country at the start of a potential long-wave boom.

India's GDP per Capita and Growth Potential:

India's GDP per capita stands at $2,500, offering a massive runway for growth. This low figure suggests ample room for economic expansion, outperforming other emerging markets. Fund managers and market experts see India's economic potential as highly promising.

China's Slowing Growth:

With a GDP per capita of $12,700, China appears to be witnessing a slowdown in its growth trajectory. The report suggests that the country's boom period might be coming to an end.

Household Debt-to-GDP Ratio:

India maintains a healthy household debt-to-GDP ratio of only 19 percent, while China's ratio is relatively higher at 48 percent. This indicator reflects the economic health of the respective countries.

Resilient Economic Indicators in India:

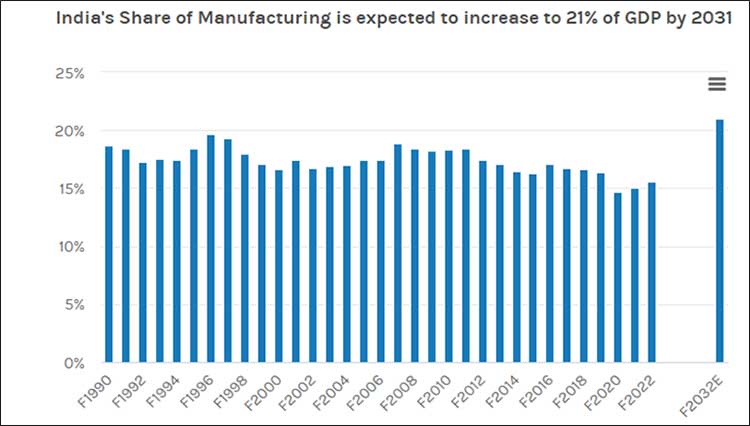

India's manufacturing and services Purchasing Managers' Index (PMI) have shown consistent rallies following the easing of Covid restrictions. This resilience sets India apart from China, where PMIs have rapidly declined.

Morgan Stanley's Rating Upgrades and Downgrades:

Morgan Stanley upgraded India's rating from "equal weight" to "overweight" and simultaneously downgraded China to "underweight." This shift in ratings signifies the firm's positive outlook on India's economic prospects.

Over the past decade, India has undergone a series of supply-side policy reforms, including infrastructure development, formalization of the economy through GST and IndiaStack, and changes in real estate regulations. Additionally, social transfers have been digitized, making them more efficient and leakproof. India's corporate sector has witnessed a decline in leverage due to the implementation a new bankruptcy law. The country also adopted flexible inflation targeting to maintain price stability and support growth.

India's Growing Influence in a Multipolar World:

India is rapidly gaining prominence on the global geopolitical stage, leveraging its position in a multipolar world. It is a member of the Quad political framework, along with the US, Australia, and Japan, which further enhances its authoritative voice.

Inward Foreign Direct Investment (FDI) in India:

India benefits from a surge in inward FDI, particularly from countries like the US, Taiwan, and Japan. These firms are attracted to India's large domestic market and improved export infrastructure, including more efficient ports, roads, and electricity supply.

Challenges for China in a Multipolar World:

China faces new challenges amidst multipolar world pressures, especially from the US. President Joe Biden plans to sign an executive order limiting critical US technology investments in China, focusing on semiconductors, artificial intelligence, and quantum computing.

Positive Economic Indicators in India:

India's macro indicators remain resilient, with the economy on track to achieve a 6.2 percent GDP growth forecast. The 12-month forward EPS (earnings per share) is also trending higher, supported by favorable demographics and improved labor productivity.

Moreover, India's income pyramid is expected to undergo a transition, with millions of people moving out of poverty and a significant increase in middle-income and rich households in the coming decade. Despite a mild challenge posed by government deficit consolidation, India's improving terms of trade are likely to offset the impact by reducing earnings lost to foreign firms compared to the previous period.

Downside Risks:

Despite the positive outlook, the report cautions against unexpected inflation surges and changes in monetary policies, which could pose downside risks for India's economy. Additionally, the potential impact of artificial intelligence on India's services exports and labor force requires careful monitoring.

Conclusion:

Morgan Stanley's report signals a bright economic future for India, citing its low GDP per capita as a catalyst for growth. Meanwhile, China's boom period appears to be slowing down, leading to the firm's downgrade of China's rating. India's economic resilience, growing influence in a multipolar world, and favorable demographics contribute to its edge in the global market. However, the country must remain vigilant about potential risks and challenges on the horizon.

Probable Questions for UPSC Main exam-

- How does India's low GDP per capita of $2,500 position the country at the beginning of a potential long-wave boom, as highlighted in the Morgan Stanley report? (10 Marks, 150 Words)

- Discuss the factors contributing to India's growing influence in a multipolar world and its attractiveness for inward Foreign Direct Investment (FDI) from countries like the US, Taiwan, and Japan. (15 Marks, 250 Words)

Source : The Indian Express