Context:

The Fiscal Year (FY) 2024- 25 Union Budget has sent out a strong message under the new administration — there remains an unequivocal focus on stability (fiscal) and continuity (of sustainable growth impulses) amidst a new chiselled focus on providing growth a more inclusive character in India.

Addressing the Weaker Building Blocks

Strengthening Foundational Sectors of the Economy

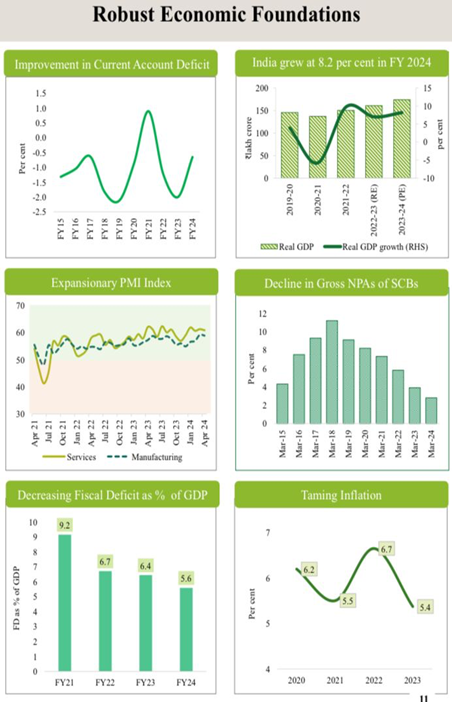

Despite an impressive 8.2% GDP (Gross Domestic Product) growth in FY24, which highlights the economy's resilience, the growth was uneven. While luxury goods and high-end consumption saw robust demand, wages remained stagnant, and inflation continued to impact lower-income groups. The fiscal deficit stood at 5.6% of GDP in FY24, higher than pre-COVID-19 levels, but it provided necessary growth stimulus through capital spending, given the subdued private capital expenditure.

In response, the FY25 Budget introduces measures to strengthen the foundational sectors of the economy, focusing on improving employment quality, bolstering agriculture, and integrating micro, small, and medium enterprises (MSMEs) into India’s manufacturing sector. These initiatives aim to pave the way towards achieving a 'Viksit Bharat' by 2047.

Issues with Official GDP Estimates

Recent provisional estimates show a real GDP growth of 8.2% for 2023-24 and a nominal growth of 9.6%, implying an annual inflation rate of only 1.4%. However, the combined Consumer Price Index indicates a retail inflation rate of 5.4%, highlighting discrepancies in GDP estimates. The economy's actual growth rate appears slower than official estimates suggest. The Economic Survey notes a lack of dynamism in private consumption and investment.

The Budget assumes that reducing the fiscal deficit and providing supply-side incentives will spur a virtuous investment cycle led by private corporations. The deep corporate tax cut in 2019 did little to boost capital expenditure in the non-financial private sector. The Budget’s continued reliance on wage subsidies and skill development to address unemployment reflects a dogmatic approach that remains disconnected from economic realities.

Focus on Agriculture

The Budget places a strong emphasis on agriculture, a critical priority. It aims to promote self-reliance in pulses and oilseeds, invest in agricultural research to address climate change challenges, develop large-scale vegetable production clusters, and enhance Digital Public Infrastructure (DPI) for farmers. These steps are designed to support farmers and ensure continued provision of foodgrains under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), which has been extended for five years.

Employment Generation

Supply-Side Incentives for Employment

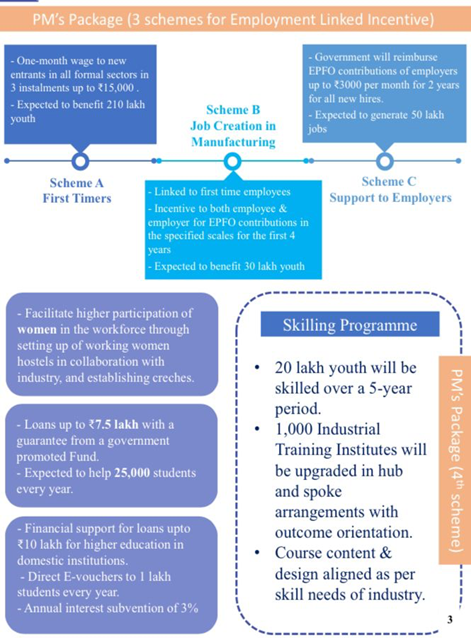

The Finance Minister has introduced three ‘employment-linked incentive’ schemes to address the employment challenge:

● Wage Subsidy for First-Time Employees: Provides the first month's wage to all first-time employees registered with the Employees' Provident Fund Organisation (EPFO), up to a ceiling of ₹15,000.

● Manufacturing Sector Wage Subsidy: Offers wage subsidies for first-time employees in the manufacturing sector, with payments made partially to the employer and partially to the employee.

● Incentives for Additional Jobs: Reimburses ₹3,000 per month for EPFO employer contributions for two years for employers providing additional jobs.

Additionally, 1,000 Industrial Training Institutes (ITIs) are to be upgraded with a total outlay of ₹60,000 crore over five years, shared between the Union government, State governments, and Corporate Social Responsibility (CSR) funds. A 12-month ‘Prime Minister’s Internship’ scheme has also been announced, offering a monthly allowance of ₹5,000 and a one-time assistance of ₹6,000 for youth aged 21 to 24.

Schemes for Skill Development

The Budget outlines a robust approach to employment generation, particularly for the youth. A new scheme offering incentives to both employers and new employees has been introduced, with an allocation of ₹10,000 crore through the Ministry of Labour. Additional schemes, including those for internships and skill development in collaboration with state governments and industries, are also part of the plan. These measures reflect the tripartite compact proposed by the Economic Survey to meet the rising aspirations of Indian youth.

Housing and Infrastructure Investments

Significant increases in housing allocations are evident in the FY25 Budget. The urban Pradhan Mantri Awas Yojana (PMAY) saw a 37% increase in funds, while the rural counterpart received a 70% boost. This marks a notable expansion in the government’s housing agenda. The Production Linked Incentive (PLI) Scheme received a 75% increase in funding, particularly for the auto sector. Additionally, sectoral customs duties have been adjusted to support domestic manufacturing and enhance local value addition.

Fiscal Discipline and Future Outlook

● Reduce Fiscal Deficit: The FY25 Budget has reduced the fiscal deficit target to 4.9% of GDP from the interim Budget’s 5.1% estimate. The 70 basis points consolidation planned for FY24 remains intact, setting the stage for a 4.6% deficit target in FY26. This continued fiscal consolidation aims to maintain the trust of economic stakeholders and prepare the groundwork for a potential sovereign rating upgrade.

● Address MSMEs’ Fiscal Constraints: To alleviate financing constraints faced by MSMEs, the Budget promises collateral-free term loans for machinery and equipment and allows banks to develop in-house credit assessments to ensure continued lending during economic stress.

● Addressing Job- Creation Challenges: On the employment front, expectations are high for the private sector to address job creation challenges. The ‘Prime Minister’s Package for Employment and Skilling’ includes government-sponsored internships, incentives for Employees' Provident Fund Organisation (EPFO) enrollments, and skill-development programs, with an allocation of ₹2 lakh crore over five years, largely depends on industry response and requires private sector contributions from Corporate Social Responsibility (CSR) funds.

● Balanced Approach: The unchanged capex target of ₹11.1 trillion, along with the strategic use of the Reserve Bank of India's record high dividend of ₹2.1 trillion, underscores a balanced approach to welfare spending and fiscal deficit reduction.

Conclusion

The FY25 Union Budget emphasises the government's commitment to maintaining fiscal discipline while implementing measures to stimulate growth. By addressing key areas such as agriculture, employment, housing, and MSMEs, the Budget aims to foster a more inclusive growth trajectory for India. With its adherence to fiscal stability and strategic investments, the Budget prepares India for greater integration into global bond indices and positions the country for future economic advancements.

|

Probable Questions for UPSC Mains 1. Evaluate the effectiveness of the FY25 Union Budget's focus on employment generation through supply-side incentives. Discuss the potential challenges and limitations of relying on wage subsidies and skill development programs as primary tools for addressing unemployment in India. Analyse the historical performance of similar schemes and their impact on long-term job creation. (10 Marks, 150 Words) 2. Critically assess the FY25 Union Budget’s approach towards fiscal stability and growth continuity in the context of the economic realities highlighted by recent GDP estimates and inflation data. How does the Budget’s emphasis on infrastructure investments, housing, and MSME support align with the goals of fiscal discipline and sustainable development? Analyze the potential outcomes of these measures on India’s economic stability and growth trajectory. (15 Marks, 250 Words) |

Source: The Hindu