Introduction

India’s agricultural landscape has long been shaped by the resilience of small and marginal farmers who form the backbone of the nation’s food security. However, fragmented land holdings, limited access to resources, and market vulnerabilities have often constrained their growth. Recognizing the need for a structured approach to empower farmers, the government has introduced several initiatives over the years to enhance their economic stability and bargaining power.

- In this pursuit, the Central Sector Scheme for the Formation and Promotion of 10,000 Farmer Producer Organizations (FPOs) emerges as a landmark effort to organize farmers into collective entities, fostering economies of scale, institutional support, and enhanced market access. Launched on February 29, 2020, under the leadership of Prime Minister Narendra Modi, this initiative signifies a paradigm shift in Indian agriculture, bridging the gap between small-scale producers and competitive markets.

- With a substantial budget outlay of ₹6,865 crore till 2027-28, the scheme envisions financial empowerment, resource optimization, and collective growth. By leveraging cooperative strength and digital integration, it aims to transform traditional farming into a sustainable, market-driven, and income-oriented enterprise. The establishment of 10,000 FPOs across India, including the recently launched 10,000th FPO in Khagaria, Bihar, is a testament to the government’s commitment to revolutionizing agriculture and uplifting rural livelihoods.

Understanding Farmer Producer Organizations (FPOs)

- A Farmer Producer Organization (FPO) is a legally registered collective entity formed by farmers to leverage economies of scale in production and marketing. These organizations are incorporated under either Part IXA of the Companies Act or the Co-operative Societies Act of respective states. The Small Farmers' Agribusiness Consortium (SFAC), under the Ministry of Agriculture and Farmers’ Welfare, is the nodal agency responsible for promoting and supporting FPOs.

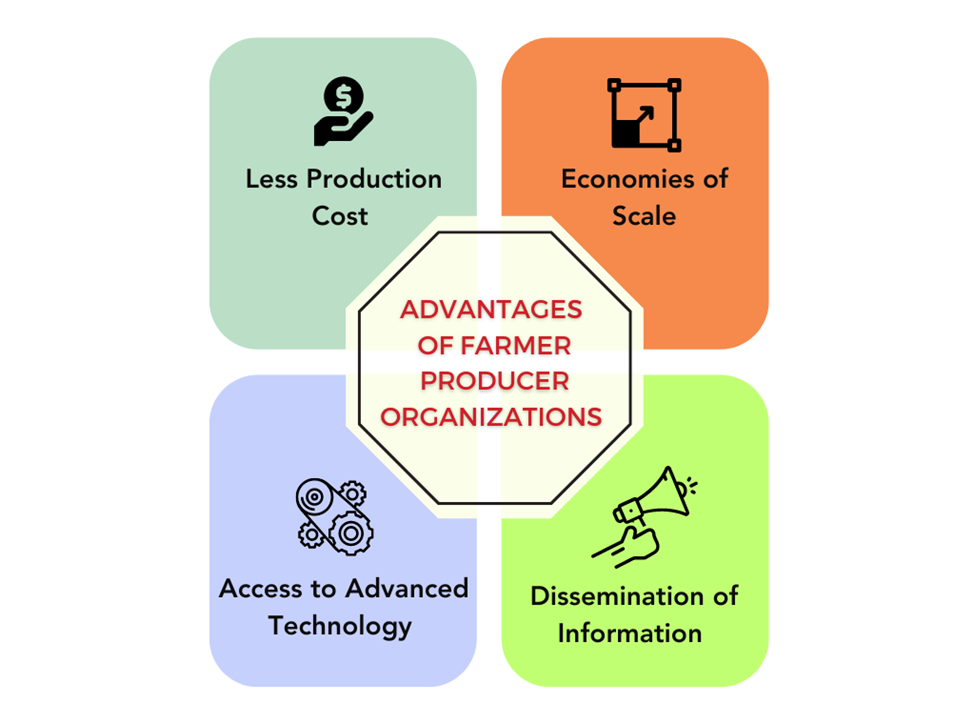

- The key objective of FPOs is to address the challenges faced by small and marginal farmers, such as limited access to quality inputs, credit, and profitable markets. By forming FPOs, farmers gain collective strength, enabling them to procure agricultural inputs at wholesale rates, access institutional credit, and secure better prices for their produce. This leads to lower production costs, improved productivity, and increased income.

Objectives and Need for FPOs

The primary objectives of the scheme are:

1. Creating a Supportive Ecosystem – Establishing 10,000 FPOs to promote sustainable, income-oriented farming and ensure the socio-economic well-being of farmers.

2. Enhancing Productivity – Encouraging efficient and cost-effective resource use to maximize farm output and returns.

3. Ensuring Financial and Institutional Support – Providing handholding assistance for five years, covering aspects such as management, input procurement, processing, market linkages, and technology adoption.

4. Building Agricultural Entrepreneurship – Offering capacity-building programs to develop farmers' skills, ensuring long-term economic viability and self-sufficiency of FPOs.

Challenges Faced by Small Farmers

Small, marginal, and landless farmers struggle with:

- Limited access to technology, quality seeds, fertilizers, and pesticides

- Inadequate institutional credit and high dependence on informal lenders

- Low market bargaining power due to small-scale production

- Lack of infrastructure for storage, processing, and transportation

By organizing farmers into FPOs, the scheme helps overcome these challenges, ensuring better market access, financial stability, and technological support.

Financial and Institutional Support under the Scheme

To ensure the sustainability of FPOs, the government provides financial and credit assistance, including:

- ₹18 lakh per FPO as management cost support for three years.

- Matching equity grant of ₹2,000 per farmer-member, with a maximum limit of ₹15 lakh per FPO.

- Credit guarantee facility of up to ₹2 crore per FPO, ensuring easier access to institutional loans.

Multi-Ministerial Convergence for FPO Support

Several ministries and agencies collaborate to strengthen FPOs:

1. Ministry of Agriculture & Farmers Welfare – Assists FPOs in obtaining licenses for seeds, fertilizers, and pesticides and facilitates linkages with institutional buyers through e-NAM, ONDC, and Agri Input Companies.

2. Ministry of Food Processing – Offers credit-linked capital subsidy (35% of project cost) and financial grants (50%) for branding and marketing.

3. Ministry of Micro, Small & Medium Enterprises (MSME) – Provides funding, equity grants, credit guarantees, capacity-building training, and market linkages.

4. Ministry of Fisheries, Animal Husbandry, and Dairying – Implements schemes like Supporting Dairy Cooperatives and Farmer Producer Organizations, with an allocation of ₹500 crore (2021-26). It also supports the formation of 100 Fodder Plus FPOs through NDDB.

5. APEDA (Agricultural & Processed Food Products Export Development Authority) – Assists APEDA-registered FPOs in export promotion and financial support under the SFURTI scheme.

6. Spices Board – Implements the SPICED scheme to promote the production and export of quality spices, enhance post-harvest improvements, and build farmer capacities.

Services and Activities Undertaken by FPOs

FPOs play a crucial role in reducing costs and increasing farmers’ income by offering:

1. Supply of Quality Inputs – Seeds, fertilizers, pesticides, and other inputs at lower wholesale rates.

2. Custom Hiring Services – Rental services for tractors, irrigation systems, and other agricultural machinery.

3. Value Addition and Processing – Cleaning, sorting, grading, and packaging to enhance product value.

4. Storage and Transportation – Reducing post-harvest losses through affordable storage and logistics.

5. Income-Generating Activities – Engaging in beekeeping, mushroom cultivation, and seed production.

6. Market Aggregation – Bulk selling of farm produce to ensure better price realization.

7. Market Information and Logistics Support – Enabling farmers to make informed decisions about market trends, pricing, and transportation.

Key Initiatives under the FPO Scheme

· Credit Guarantee Fund (CGF): A dedicated Credit Guarantee Fund (CGF) has been established to help FPOs access institutional credit without excessive collateral requirements. This fund enables FPOs to secure loans for working capital, marketing, and infrastructure development.

· ONDC Platform for Digital Market Access: More than 5,000 FPOs have been onboarded onto the Open Network for Digital Commerce (ONDC), allowing them to sell produce directly to consumers across the country, ensuring fair pricing and eliminating middlemen.

· Conversion of 10,000 FPOs into Common Service Centres (CSCs): An MoU between CSC SPV and the Ministry of Agriculture & Farmers Welfare has been signed to convert FPOs into CSCs, enabling them to offer digital services, financial transactions, and employment opportunities in rural areas.

Conclusion

The formation of 10,000 FPOs is a transformative step toward Atmanirbhar Krishi (self-reliant agriculture). By enhancing market access, improving income security, and reducing dependence on middlemen, FPOs have empowered millions of small and marginal farmers, including women and weaker sections.

| Main question: Discuss the potential of FPOs in promoting agricultural entrepreneurship among farmers. How do capacity-building programs under the FPO scheme contribute to developing farmers' skills and ensuring the economic viability of FPOs? |