Date : 06/06/2023

Relevance – GS Paper 3 - Indian Economy - Trade and other economic activities

Key Words – Merchandise export, Inflation, Russia-Ukrain Confict, UNCTAD, WTO

Context –

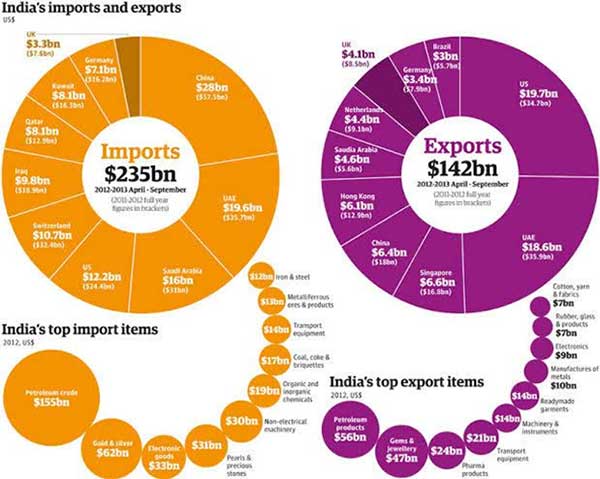

Mired in a slowing economy, inflationary setting and tighter monetary controls worldover, India’s merchandise exports shrunk 12.7% on a year-on-year (YoY) basis to $34.66 billion in April — a six-month low. Imports fell sharper by 14% to $49.90 billion during the same period.

Have a look on India's trade story –

What are the current underlying trends in global trade?

- The essential headwinds observed with respect to global trade are weaker economic activities worldwide, inflation and tightening of monetary policies, disrupted supply chains because of the Russia-Ukraine conflict and financial instability because of the collapse of several financial institutions in advanced economies.

- The ongoing conflict in Eastern Europe continues to have a bearing on the prices of energy, food and commodities. As observed by the World Trade Organization (WTO), though food and energy prices receded from their post conflict peaks by the fourth quarter last year, “they remained high by historical standards and continued to erode real incomes and import demand” during the mentioned period.

- The impact of energy prices was strongest during the winter months in Europe as Russia was among the largest suppliers of energy to Europe before it was sanctioned. Europe responded to the loss of gas shipments from Russia by shifting to other suppliers, including the U.S., Qatar, Norway and Algeria. This potentially increased LNG prices elsewhere such as Japan, where the prices doubled between January last year to February this year.

- The collapse of financial institutions — such as of the crypto exchange FTX (November 2022) alongside three banks in the U.S. since March (the Silicon Valley Bank, Signature Bank and First Republic Bank), and the loss of confidence in Credit Suisse added to the troubled scenario. As the United Nations Conference on Trade and Development (UNCTAD) in its latest update (in April) concluded, the events raised “the spectre of financial contagion in an already slowing economy”.

What are we witnessing?

- The EU is India’s third largest trading partner after the U.S. and China. The European Economic Forecast (published in February) held that the region would “narrowly escape the recession” that took shape around September.

- As for the U.S., in May, Fed Chair said that inflation had “somewhat” moderated since the middle of the last year. Nonetheless, inflation pressures continued to run high with expectations of it receding to 2% having a “long way to go”.

- The JP Morgan Global Manufacturing Purchasing Managers’ Index (PMI), compiled by S&P, registered 49.6 in May — unchanged for the third consecutive month and indicating a marginal deterioration of business conditions. The indicator is used to assess manufacturing business conditions.

How are these activities are related to trade –

- To put it simply, in a period of economic slowdown, international trade, both exports and imports, falls sharply as overall demand for goods and services stand reduced.

- There is an aversion for discretionary spending which particularly weighs on some imports and postponable expenditures. It is in this light that the exports of engineering goods, gems and jewellery, chemicals, and readymade garments and plastics, along with petroleum products contracted or grew at a slower pace in 2023.

- Similarly, inflation, the uneven rise in prices especially of essentials such as food and energy erodes the purchasing power of an individual. Additionally, inflation also affects the flow of capital to a developing country. Important to note, the share of exports of goods and services combined in GDP stood at 21.4% in FY 2021-22.

The way forward –

- Ministry of commerce said “Global demand is not looking good from markets like the EU and the US. For the next two-three months, the demand scenario doesn’t look very optimistic,”, adding that the government will initiate inter-ministerial talks to find ways to diversify and sustain the exports momentum.

- Many economist told that a global slowdown, especially in the U.S. which is our major trading partner would have implications on demand for our merchandise exports. High base effect may also reflect on growth numbers.

- However, services exports will hold the fort. Imports may remain low as commodity prices and INR value stabilise. However, quicker recovery may add pressure on import demand.”

- A cyclical correction should not be seen as a slowdown. Lower imports have been because of stable oil prices, reducing our imports bills.”

Probable Questions for Mains Examination –

- Question 1 – What are the essential headwinds observed with respect to global trade? How is the Russia-Ukraine conflict affecting trade in the international market? ( 10 Marks, 150 Words )

- Question 2 – Why has there been an overall decline in the demand for goods and services? How has the collapse of financial institutions affected trade? Give Your answer with appropriate examples. ( 15 Marks, 250 Words)

Source – The Hindu