Relevance: GS-3: Science and Technology- developments and their applications and effects in everyday life.

Key Phrases: World Bank, Financial Inclusion, favourable operating, Global Findex database,

Context:

- Around the world, high inflation, slow economic growth and food shortages are hurting the poor the most. To overcome this the World Bank is committed to expanding financial inclusion through digitalization.

Background:

- Coming on top of the unequal effects of covid, today’s multiple crises have already caused dramatic reversals in development and led to a substantial increase in global poverty.

- On the positive side, the covid crisis spurred unprecedented change, especially in industries with a large digital component.

- This digital revolution has catalysed increases in access to and use of financial services in developing economies, transforming how people make and receive payments, borrow and save.

What does the survey say?

- Changes are strikingly evident in the latest edition of the Global Findex database, compiled from a survey of more than 125,000 adults in 123 economies, covering use of financial services throughout 2021.

- The survey found that 71% of adults in developing economies now have a formal financial account compared to 42% in the first edition a decade ago.

- In addition, the difference in the share of men and women in developing economies who own an account has fallen for the first time.

- The share of adults in developing economies who make or receive digital payments grew from 35% in 2014 to 57% in 2021.

- In Sub-Saharan Africa, 39% of mobile money account holders now use their accounts to save.

- And more than one-third of people in low- and middle-income countries who paid a utility bill from an account did so for the first time after the start of the covid pandemic.

Why there is a need for digitalization?

- Easier, cheaper and safer for people: Digital transformation makes it easier, cheaper and safer for people to receive wages from employers, send remittances to family members, and pay for goods and services.

- Handle high-volume: Mobile money accounts can better handle high-volume, small-denomination transactions, which help users to access financial services and save in order to cope better with crises.

- More Privacy: Individual accounts also give women more privacy, security and control over their money.

- Powerful anti-corruption tool: The digital revolution also serves as a powerful anti-corruption tool, because it helps to increase transparency as money flows from a government’s budget to public agencies to citizens.

- Increase formal-sector employment: The digital revolution offers a chance to increase formal-sector employment without making compliance excessively burdensome.

- Broaden the revenue base: At a time of tighter government budget constraints, digital payments can help broaden the revenue base by reducing tax evasion.

Challenges Involved:

- Lack of Change Management Strategy.

- Complex Software & Technology.

- Driving Adoption of New Tools & Processes.

- Continuous Evolution of Customer Needs.

- Lack of a Digital Transformation Strategy.

- Lack of Proper IT Skills.

- Security Concerns.

- Budget Constraints.

Note:-

- There were 467.0 million social media users in India in January 2022.

- India is the second largest online marketplace in the world after China.

- Financial Inclusion: Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.

Ways to Enhance Digitalization:

- Role of Governments and the private sector.

- They need to create a favourable operating and policy environment.

- Enabling the interoperability of systems allows for payments across different types of financial institutions and between mobile money service providers.

- Improving access to finance depends much more on the mobile-phone system than on the physical banking system.

- Affordable internet access: Cheap and functional mobile phones and affordable internet access are prerequisites for expanding digital finance.

- Step-by-Step tutorial : Interactive walkthroughs and user flows that take new users on a step-by-step tutorial of how to use different features

- Promotion: Another high priority should be to promote the digitalization of payments.

Government initiatives to boost digitalization:

- Bharat Net Program

- The objective of this project is to provide accessible broadband services to citizens and institutions in rural and remote areas with the participation of states and private sector.

- Under the BharatNet project, more than 2.5 lakh gram panchayats are to be provided high speed broadband through optical fiber at affordable rates. It aims to set broadband speeds from 2 to 20 Mbps.

- National Digital Literacy Mission

- The National Digital Literacy Mission had been launched with the objective of making at least one person digitally literate in every household in India by the year 2020.

- The project aims to help technically illiterate adults to find their place in a rapidly digitalizing world.

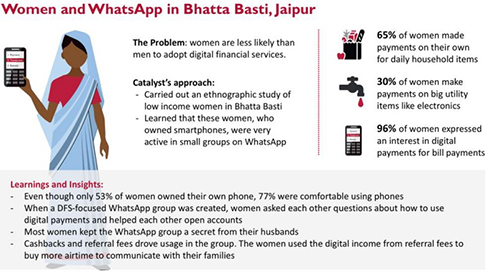

Case Study:

Source: usaid-gov

Conclusion:

- Policymakers will need to make additional efforts to include underserved groups. The gender gap in financial access has narrowed, but it still exists.

- For the many millions of people who still lack an account, we need to find creative ways to connect them to the financial system, build economic resilience and reap the benefits of inclusion.

Sources: Live-Mint

Mains Question:

Q. Briefly discuss how digital adoption is fast bringing financial inclusion within reach. (150 words).