Context-

The Unified Payments Interface (UPI), launched in 2016 by the National Payments Corporation of India (NPCI) under the Ministry of Electronics and Information Technology, has revolutionized digital payments in India. UPI has seamlessly integrated itself into the daily financial activities of millions of Indians, reshaping how transactions are conducted.

The UPI Phenomenon: Growth and Infrastructure

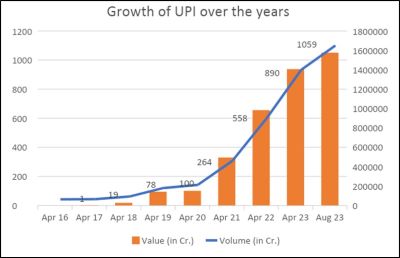

UPI's growth trajectory is nothing short of extraordinary. From processing 0.8 billion transactions in January 2018 to over 14.4 billion in July 2024, UPI now handles nearly 80 percent of India's digital payments. This rapid adoption can be attributed to its seamless integration with India's banking infrastructure and the widespread use of mobile internet.

Key Infrastructure Components of UPI:

1. Mobile Internet Penetration: The widespread adoption of mobile broadband has been a crucial factor in UPI’s success. Affordable smartphones have enabled 424 million users as of July 2024 to access digital payment platforms like UPI, contributing to its mass adoption across urban and rural areas.

2. Banking Integration: UPI's integration with India's formal banking system has been pivotal to its success. The JAM trinity—Jan Dhan accounts, Aadhaar, and Mobile connectivity—has played a significant role in extending financial services to approximately 900 million Indians as of June 2024. This integration has helped bring millions into the formal financial system, supporting economic growth and financial inclusion.

3. Aadhaar and UPI Linkage: UPI's linkage with Aadhaar, India’s digital identity system that covers 1.3 billion people, ensures secure and reliable transactions. This has been fundamental in building user trust, which is essential for the widespread adoption of digital payment platforms.

Trust: The Foundation of UPI’s Success

Trust is a cornerstone of UPI's success, bolstered by two key factors:

1. Government Endorsement: UPI’s endorsement by the Indian government as part of the Digital India initiative has lent it credibility and legitimacy. The wide adoption of government-backed initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) further demonstrates the trust placed in UPI, integrating it with financial inclusion programs and enhancing its reach among the masses.

2. Robust Security Framework: UPI's integration with Aadhaar provides a strong security framework, ensuring secure transactions and reliable identity authentication. Additionally, UPI offers real-time transaction updates and an easy dispute resolution process, fostering a transparent and trustworthy environment for users.

UPI’s Impact on India’s Economy

UPI has significantly impacted India's economy by streamlining financial transactions and driving financial inclusion and GDP growth. UPI has played a crucial role in integrating over 300 million individuals into the formal financial system. Notably, the number of new bank accounts opened under PMJDY increased by approximately 50 percent between 2018 and 2024, coinciding with the rapid rise in UPI adoption.

A key finding is that a 1 percent increase in UPI transaction volume is correlated with a 0.03 percent rise in GDP growth, underscoring UPI’s significant role in economic expansion. The correlation is strong (R² = 0.75), indicating that UPI adoption is a reliable indicator of India's GDP growth pattern over the past seven years. Additionally, UPI has positively impacted credit accessibility, especially in rural areas and among the urban poor. Microloan disbursements increased by 100 percent from 2018 to 2023, further highlighting the correlation between UPI transaction volume and microloan disbursements.

Global Aspirations: UPI as a Tool for Soft Power

India's ambition to export UPI to other countries represents a strategic move to enhance its positioning as a trusted development partner in digital finance. UPI's domestic success has piqued interest from countries like Japan, UAE, France, and Maldives, as they pursue financial modernization. By promoting UPI globally, India is engaging in technological diplomacy. Successfully implementing UPI in other markets could establish India as a leader in providing scalable and secure digital payment solutions.

UPI’s global proliferation would not only highlight India’s technological capabilities but also enhance its cultural and economic influence. A notable example of this is the visit of External Affairs Minister Dr. S. Jaishankar to Male on August 9, 2024, where he received a warm welcome from the President of Maldives, Mohamed Muizzu. Subsequently, on August 10, 2024, India and Maldives signed an agreement to introduce UPI in the archipelago nation, marking a significant step in India’s technological diplomacy.

Despite its successes, UPI faces several challenges that need to be addressed for its continued growth and global expansion:

1. Data Privacy and Security: With the increasing volume of transactions, concerns around data protection and cybersecurity are becoming more pronounced. To maintain user trust, robust measures must be implemented to safeguard personal and financial information.

2. Regional Disparities: Although UPI has seen widespread adoption, significant regional disparities remain due to variations in internet penetration and financial literacy. Bridging these gaps is essential for achieving broader financial inclusion across India.

3. Integration with Traditional Payment Systems: UPI has not yet fully replaced traditional payment methods like credit cards and cheques. Understanding how UPI can coexist with these systems without creating friction is a critical challenge. UPI’s near-zero cost for users allows it to compete with established players like MasterCard and Visa, which currently have high Price-to-Book ratios (around 56), reflecting high consumer and shareholder confidence.

UPI is more than just a payment platform; in it is a testament to India’s capacity for innovation and its potential to lead in the global digital economy. While challenges remain, particularly around data privacy and the complexities of exporting UPI to other markets, UPI’s success story is still unfolding. As India explores extending UPI’s reach beyond its borders, this platform could become a cornerstone of India’s technological diplomacy and a powerful tool for expanding its imprint on the world stage.

For the world to embrace UPI, a key challenge for Indian policymakers is to promote it as a case study in Indian training establishments and management institutions. By doing so, India can effectively showcase its innovation in digital payments and bolster UPI's global adoption, positioning itself as a leader in the fintech space.

|

Probable Questions for UPSC Mains Exam-

|

Source- ORF