Context

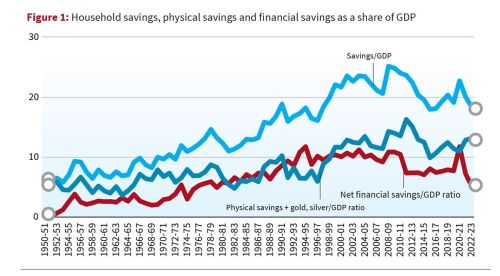

The recent decline in household savings has emerged as a focal point of economic discussions within India, sparking concerns about its implications for growth and economic stability. This decline is primarily attributed to a significant reduction in net financial savings, resulting in the household net financial savings to GDP ratio hitting a four-decade low. While there has been a marginal recovery in physical savings, the overall trend paints a worrisome picture for the economy.

Interpreting Lower Financial Savings

Understanding the reasons behind lower financial savings is crucial to grasp the dynamics at play. Net financial savings of households, the disparity between gross financial savings and borrowing, reflect changes in their financial assets over a period. These assets typically encompass bank deposits, currency, and various financial investments. The reduction in net financial savings can stem from multiple factors, each impacting the economy differently.

Firstly, households may opt to finance increased consumption expenditure by either borrowing more or depleting their financial savings. This stimulates aggregate demand and output, albeit with implications for debt levels. Secondly, higher tangible investment by households can also contribute to reduced financial savings, albeit to a limited extent. While this boosts aggregate demand through the investment channel, it simultaneously increases debt burdens. Lastly, fluctuations in interest rates can influence household savings by affecting interest payments. This, too, impacts net financial savings, either through increased borrowing or decreased financial asset holdings.

Implication of Higher Debt Burden

The rise in household debt burden introduces two primary concerns for the macroeconomy, namely debt repayment and its impact on consumption demand. Evaluating a household's debt sustainability hinges on factors such as the gap between interest rates and income growth. Failure to meet debt obligations not only strains household finances but also affects the broader financial sector, potentially leading to a cascade effect on the economy.

Moreover, higher household debt levels can dampen consumption demand in several ways. Firstly, increased leverage may signal higher default risk, prompting banks to tighten credit disbursement, thus constraining consumption. Secondly, higher debt translates to increased interest burdens, which can further curtail consumption expenditure, especially in environments of rising interest rates. These combined effects have tangible implications for economic stability and growth trajectory.

Macroeconomic Implications

The evolving trends in household balance sheets carry broader implications for the macroeconomic landscape. A shift towards financial assets signifies a degree of financialization within the economy, moving away from a production-centric model towards one driven by monetary exchanges. This transition has ramifications for economic stability, particularly concerning the precarious balance between growth and financial fragility.

Moreover, the increasing trend in both liability-to-income and debt-to-net worth ratios underscores the vulnerability of households within this evolving economic landscape. Policy responses aimed at combating inflation, such as raising interest rates, risk exacerbating household debt levels, potentially trapping them in a cycle of indebtedness. Consequently, this could exert downward pressure on consumption and aggregate demand, further complicating the macroeconomic outlook.

Conclusion

In conclusion, the decline in household savings and the concurrent rise in debt burden pose significant challenges to India's economic stability and growth prospects. Understanding the underlying dynamics driving these trends is essential for policymakers and economists alike. Efforts to address these challenges must strike a delicate balance between stimulating demand and ensuring financial stability. Failure to navigate these complexities could undermine efforts to achieve sustained economic growth and prosperity. Therefore, a nuanced approach that addresses both short-term demand concerns and long-term structural issues is imperative to steer the economy towards a path of resilience and prosperity.

|

Probable Questions for UPSC Mains Exam

|

Source – The Hindu