Relevance: GS-3: Indian Economy and issues relating to Planning, Mobilisation of Resources, Growth, Development and Employment; Inclusive Growth and issues arising from it;

Key Phrases: Micro, Small and Medium Enterprises Development Act, 2006 (MSME Act), Cluster based approach, Dwarfism of MSMEs, TReDS (Trade Receivables Discounting System), Germany’s Mittelstand Program, Government eMarketplace (GeM Portal),

Why in news?

- Post COVID world order has seen significant growth in Digitization and Digital onboarding of several offline products and services.

- But, MSMEs and small offline retailers are facing issues in compliance with GST registration.

- Budget 2021-22 has allocated INR 2 lakh Cr. as credit for MSMEs

What are MSMEs?

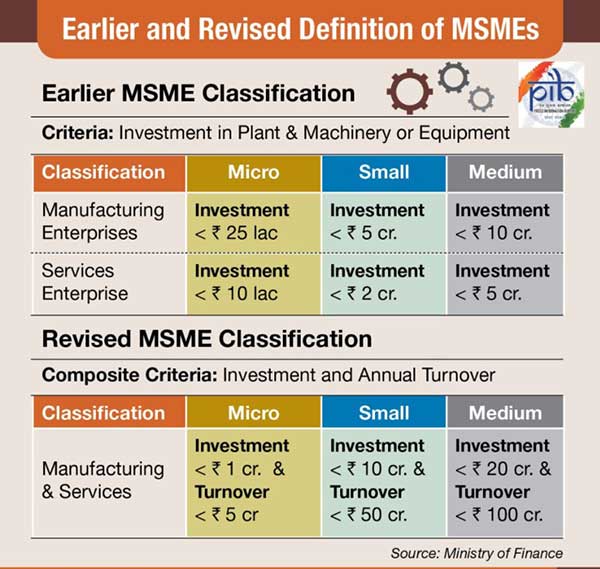

- MSMEs are Micro, Small and Medium Enterprises, defined on the basis of the scale of production or investment. They form an integral constituent of Manufacturing sector and an important part of Service sector.

- Micro, Small and Medium Enterprises Development Act, 2006 (MSME Act) governs their working

Importance of MSMEs

- Economic Contribution

- 30% of India’s gross domestic product (GDP)

- Whereas for China (60%) and Germany (55%)

- Brings in Foreign Exchange - constitute more than 40% of exports and will be instrumental in reducing Current Account Deficit

- 45% of Manufacturing Output

- 30% of India’s gross domestic product (GDP)

- Developmental Contribution

- 2nd largest employment provider after Agriculture, as it provides employment to about 120 Mn People in India

- Inclusive growth is promoted through MSMEs as they are more evenly distributed around the geographic expanse of India

- Social Contribution

- They employ vulnerable communities and women in large quantities and ensure they remain integral to inclusive growth story of India

- Innovation Contribution

- Fuels entrepreneurial spirit and scientific temperament in people.

Issues faced by MSMEs

- Access to Capital

- As most of the small MSMEs are forced to resort to borrow from NBFCs and MFIs which charge high interest on borrowed amount

- The formal credit available to this sector is ₹16 trillion. The viable credit gap is ₹20 trillion against a total demand of ₹36 trillion

- Lack of formalisation

- Only 1 out 6 MSMEs were registered on GST portal (December 2020 data)

- Almost 86% of the manufacturing MSMEs operating in the country are unregistered

- Regulatory Cholesterol (as mentioned in Economic Survey 2018-19)

- Environmental Clearances, Labour Clearances and other Governmental approvals puts regulatory burden denting their profits both monetarily and due to diversion of human resources

- Current GST Rules

- Provide that any offline seller with annual turnover under ₹40 lakh and engaged in intra-state sales must obtain GST registration to sell online.

- Offline sellers under ₹1.5 crore annual turnover with intra-state sales cannot continue with simplified GST compliance processes under the composite GST scheme if they want to sell online.

- Even where an SMEs turnover does not cross the threshold, it would be required to register itself under GST and fulfil all subsequent compliance requirements

- Access to Technology

- Technological Disruption brought forth by Industrial Revolution 4.0 (IR 4) with Artificial Intelligence (AI), Big Data, Robotics have remained distant from MSME due to challenges of skilled employees and financial constraints

- Lack of Marketing and Branding Support

- Which reduces competency of their products

- Information asymmetry regarding governmental support

- COVID-19 related challenges

- Disruption of Global Supply Chains have caused hurdles in procuring inputs for MSMEs

- COVID related restrictions in movement of labour hindered availability of human-resource

- Demand-side issues caused further delay in payment to MSMEs

which have raised questions on debt sustainability of this sector.

- Earlier, the former RBI Governor had raised concerns over viability of MUDRA loans and hinted at the looming Non Performing Asset (NPA) crisis.

- Credit Availability had reduced drastically due to cautious investors not investing in MSMEs since March 2020. Although this changed with subsequent steps taken as part of Atma Nirbhar Package

Measures taken to improve the MSMEs’ ecosystem

- Definition Change

- For timely payment and grievance redressal

- MSME Samadhan - for complaining against delayed payments beyond a time interval to Central Ministries/Departments/CPSEs/State Governments

- TReDS - sector had been facing constraints in obtaining adequate finance, particularly in terms of their ability to convert their trade receivables into liquid funds

- For Branding and Marketing

- National Manufacturing Competitiveness Programme (NMCP) : developing Global competitiveness of MSMEs by upgrading their processes, designs, technology and market access.

- For credit availability

- Udyami Mitra Portal - Launched by SIDBI for credit availability, will also provide handholding support to increase their competitiveness

- MUDRA scheme - collateral free loan to MSMEs in 3 categories

- Priority Sector Lending Tag - for increased credit support from formal financing sector

- For enhanced technological accessibility

- Credit Linked Capital Subsidy Scheme (CLCSS) to improve credit availability for investing in technology upgradation.

- Digital MSME Scheme - Cloud Computing is used to provide access to common as well as tailor-made IT infrastructure to MSMEs

- SFURTI Scheme - improving skills and technology usage by artisans and traditional industries; also organising them into clusters

- For increasing the demand of procurement from MSMEs

- MSME Sambandh - monitoring the implementation of the public procurement from MSMEs by Central Public Sector Enterprises (CPSEs)

- GeM Portal - to facilitate online procurement of common use Goods & Services required by various Central and State Government Departments / Organisations /Public Sector Undertakings ( PSUs) - there is a special preference for procurement from MSMEs

- For scaling up and formalisation of MSMEs

- PM Employment Generation Program - providing incentive to enterprises for formalising and recruiting more personnel by paying their share of EPF (Employees Provident Fund) contributions.

Way forward

- Increasing access to capital

- Recommendation of RBI panel headed by the former SEBI Chairman UK Sinha to increase collateral free loan to MSMEs to 20 Lakh should be implemented

- Developing Bond market for transparent and fair borrowing for MSMEs

- International and bilateral exchanges to increase the

competitiveness of MSME products

- Germany’s Mittelstand Program can help MSMEs to increase their competitiveness and benefit the national economy

- Creation of Independent regulators and single window clearances to reduce their compliance cost

- Changes in Present GST structure

- MSMEs should be liable for GST only at the threshold value, irrespective of whether they sell offline or online.

- Enabling GST parity between offline and online sellers with respect to registration would be logical and help in integrating small business owners in the country with the e-commerce ecosystem.

- Amending the rules to allow small offline sellers to sell online

(with intra-state restrictions) without needing a GST registration will

increase GST and income tax collections for the government, increase

control and transparency, and improve efficiency of tax collection.

- According to a report by Accenture and the Trust for Retailers and Retail Associates of India, digitising just 10% of India’s 13 million odd kirana stores has the potential of generating an estimated 3.2 million new jobs in the country

- differentiation of “essential” from “non-essential” products and services should be scrapped - as during COVID we saw what was non-essential for one entity was essential for the other

- Section 194-O, relating to TDS on payments made to e-commerce participants, should be axed. It does not help anyone and merely increases the compliance burden

Conclusion

- As per Economic Survey 2018-19, despite suffering from ‘dwarfism’ MSMEs remain integral players in providing employment and generating foreign income. But in order to achieve the target of a 5Tn $ economy, necessary governmental support and hand holding of MSMEs through enterprise facilitation centres will be required.

Source: The Hindu BL, Live Mint

Mains Question:

Q) Mention the needs and challenges faced by MSME in Post Covid India. Also mention a suitable way forward. (15 marker)