Date : 05/07/2023

Relevance – GS Paper 3 – Indian Economy and issues relating to Planning, Mobilization of Resources

Keywords – GST Council, Rationalization of Tax Rates, Additional Taxable Commodities, Indirect tax

Context –

The Goods and Services Tax (GST), introduced on July 1, 2017, marked a significant milestone in India's indirect taxation system. This article discusses the key aspects of GST, its purpose, achievements, and the challenges it still faces.

Overview of Goods and Services Tax (GST):

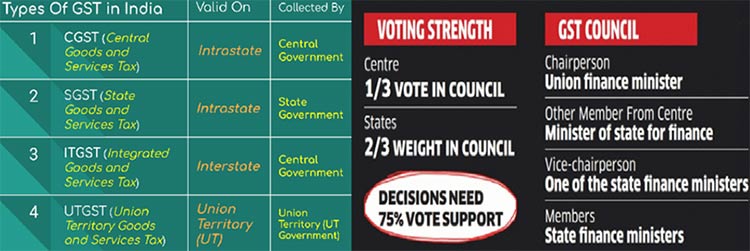

GST is an indirect tax implemented through the 101st Amendment to the Indian Constitution. It applies to manufacturers, sellers of goods, and service providers. The tax is categorized into five slabs - 0%, 5%, 12%, 18%, and 28%.

The Role of GST Council:

The GST Council, established under Article 279A of the Indian Constitution, serves as the apex committee responsible for recommending modifications, reconciliations, and exemptions related to GST. It plays a crucial role in shaping the GST laws and regulations.

Need for GST:

India's previous tax system included multiple indirect taxes at different stages of the supply chain, leading to complexity and fragmentation. This resulted in tax cascading and an increased tax burden on goods and services. GST aims to simplify the tax structure by replacing multiple indirect taxes with a uniform tax system.

Achievements of GST:

- Revenue Collection: Despite lower buoyancy exhibited by indirect taxes, GST has achieved an average growth rate of 3% in gross GST revenue from 2018-19 to 2022-23, surpassing the nominal GDP growth rate of 9.8%. Monthly collections have consistently exceeded 1.6 lakh crore since the inception of GST.

- Seamless Market and Digitized Compliance: GST has facilitated the creation of a seamless national market, transforming India's tax landscape and fostering economic growth. The digitization of processes, from registration to return filing, has streamlined compliance for businesses and paved the way for other indirect tax reforms.

- Empowering the Manufacturing Sector: By eliminating tax cascading, GST has significantly reduced manufacturing costs and contributed to the growth of the manufacturing sector.

Persistent Challenges:

- Complexities in Return Forms and Tax Rates: Ambiguities surrounding return forms and the classification of certain goods and services continue to lead to disputes and uncertainty.

- Combating Tax Fraud: Measures have been implemented to ensure compliance and tackle fraudulent practices, but tax fraud remains a persistent challenge that requires ongoing attention.

Areas for Attention:

- Inclusion of Additional Taxable Commodities: Petroleum crude, high-speed diesel, petrol, natural gas, aviation turbine fuel, and alcohol meant for human consumption should be brought under the purview of GST.

- Incorporating Other Levies: Consideration should be given to including other levies such as electricity duty and stamp duty in the GST framework.

- Clarifying Taxation of New-Age Activities: Clear guidelines are needed for the taxation of online gaming activities and transactions involving cryptocurrencies.

- Rationalization of Tax Rates: There is a need to review and potentially revise the tax rate slabs to simplify the system and enhance compliance.

Conclusion:

The implementation of GST has been a significant success, revolutionizing India's economy, promoting digitization, and streamlining the tax structure. However, challenges persist, and further reforms and clarifications are required to optimize the potential of GST in the years ahead.

Probable Questions for Mains Examination –

- Discuss the achievements of Goods and Services Tax (GST) in India over the past six years, highlighting its impact on revenue collection, the manufacturing sector, and the creation of a seamless national market. Also, examine the challenges that still persist in the implementation of GST. (10 Marks, 150 Words)

- In the context of Goods and Services Tax (GST) in India, analyze the significance of the GST Council in shaping the GST framework and its role in recommending modifications, reconciliations, and exemptions related to GST. Discuss the areas that require attention for further improvement of the GST system, such as rationalization of tax rates, inclusion of additional taxable commodities, and clarifying taxation of new-age activities. (15 Marks, 250 Words)

Source – Indian Express